This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

05/08/2024

Will South Korea’s wine market bounce back?

IWSR analyses the outlook for South Korea's wine market

South Korea’s wine market was viewed by many as an important opportunity for the industry. After experiencing significant declines in recent years, should exporters start to look elsewhere instead?

South Korea’s wine market is in a phase of downward correction after enjoying exaggerated growth during the Covid-19 pandemic, but the longer-term prospects for still and sparkling wine in the country remain bright.

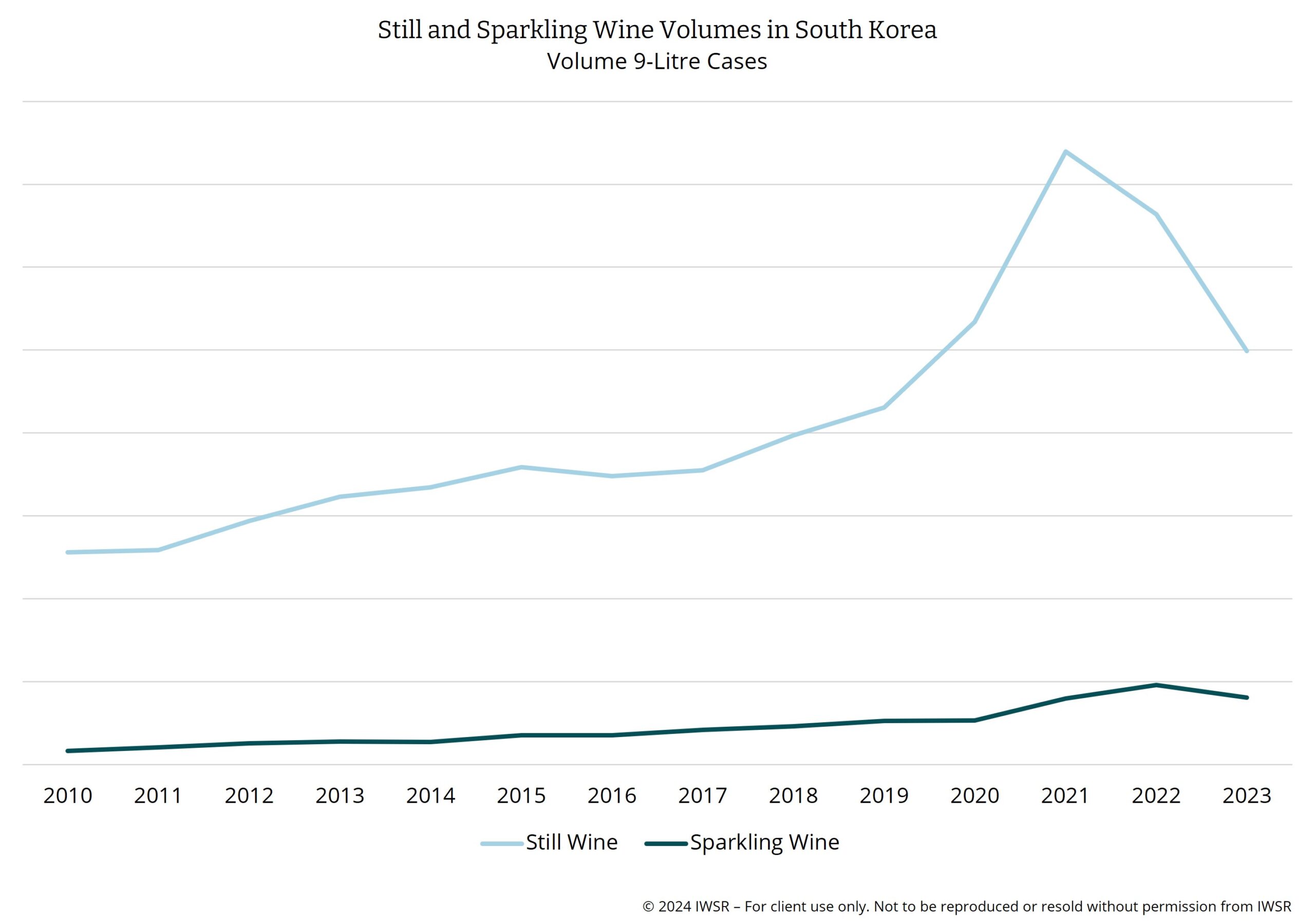

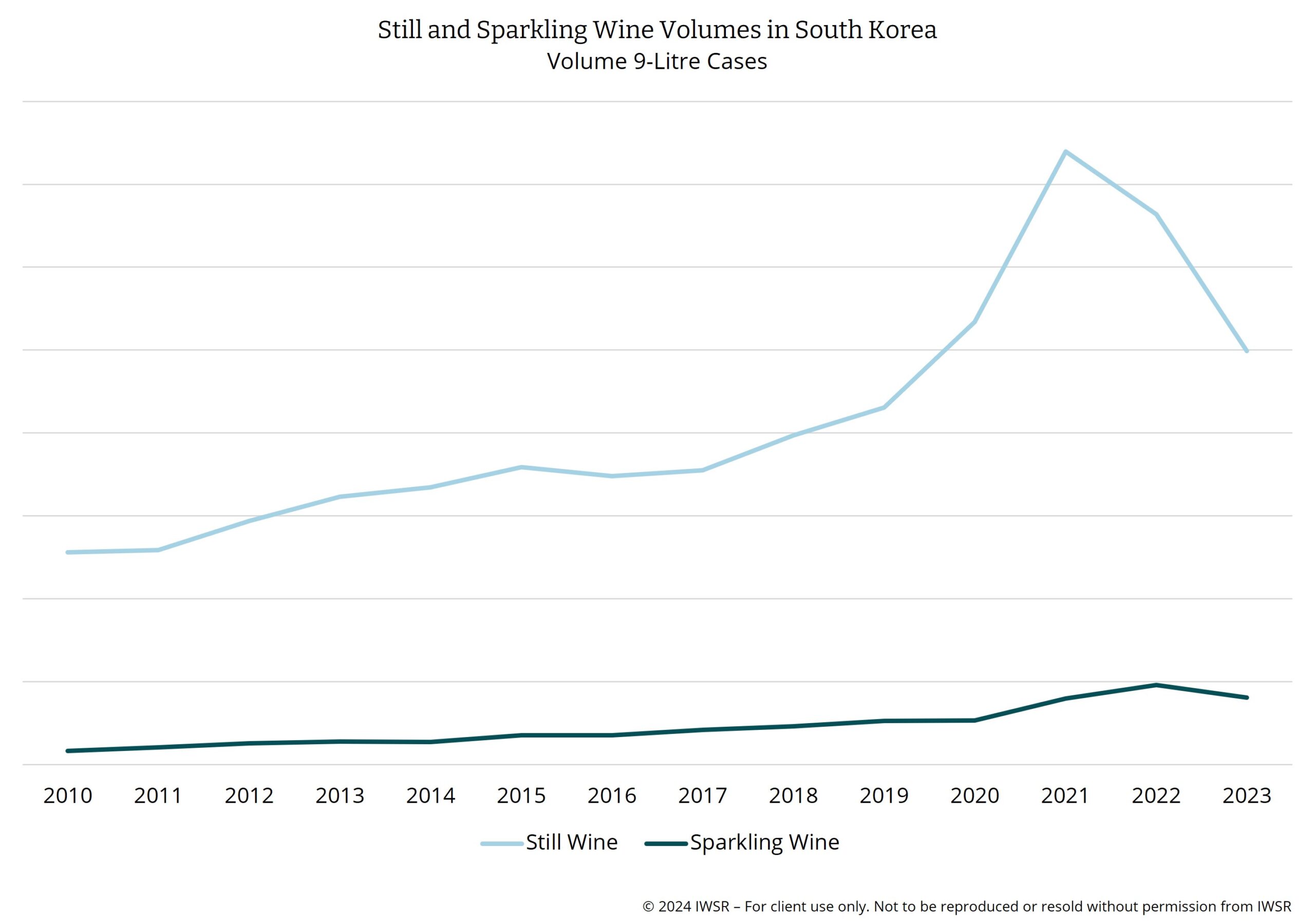

IWSR’s market data shows that still wine recorded its second consecutive year of substantial consumption declines in 2023, with volumes down by -25% (following a -10% decrease in 2022). Sparkling wine – which had surged up +21% in volume terms in 2022 – saw those gains all but wiped out with a -16% loss in 2023.

Nonetheless, both still and sparkling wine have experienced long-term growth in South Korea, whereas many global markets continue to see a long-term structural decline of wine volumes. Sparkling wine volumes more than doubled between 2016 and 2021. Meanwhile, in 2021 and 2022, South Korea’s still wine market was more than twice the size it was in 2008, with Chilean, French, and Italian wines driving much of this growth. However, after the volume declines of 2023, the country’s wine market is now only 50% bigger than it was in 2008.

Drivers for the volume decline

“Still wine’s post-pandemic decline continued in South Korea for a second year in 2023, with red, white and rosé all falling by between 15 and 30%,” said Jonathan Ho, Market Analyst, IWSR. “This was due to price increases and the market becoming saturated. Home consumption is the largest driver of volumes in the country, but this declined in frequency, resulting in lower overall consumption.”

The declines constitute a “reset” after wine volumes ascended to artificially high levels during the Covid-19 pandemic. Strict stay-at-home rules were a key driver for increased consumption, as well as factors such as relaxed ecommerce laws – which, when introduced in mid-2020, led to one in five South Korean wine drinkers placing orders online for click-and-collect (“Smart Order”). When stay-at-home regulations were eased in 2022, wine volumes were heavily impacted.

“There are reported to be elevated inventory levels sitting in warehouses during the second quarter of 2024,” says Ho. “Retailers are aggressively promoting in order to clear stock. Many wine regions, including Australia, have been looking to South Korea as an important emerging market, so this will have been a shock to many companies.”

Trends were less consistent in sparkling wine. Champagne volumes rose by +10% in 2023, according to IWSR market data, partially offsetting a -21% decline in other sparkling, as interest in Cava, Prosecco and other styles waned significantly amid high prices.

“The modern on-trade in South Korea has brought a surge in popularity for Champagne,” explains Ho. “High margins enable both the night-time entertainment operators and the brand owners to make significant investments in promotions. As consumers seek to flaunt their wealth when they go out, demand has noticeably increased.”

The overall wine category’s period of downward correction is expected to continue during 2024, although IWSR forecasts predict only marginal volume declines during the year. In the longer term, growth is expected to return, with still wine expected to grow at a CAGR of +5% between 2023 and 2028, and sparkling following suit with a +5% CAGR rise over the same timescale.

This brighter long-term prognosis reflects a market that remains at an early stage of development, where per capita wine consumption is still relatively low and there is substantial headroom for future growth.

Reasons for a brighter outlook

More highly involved wine drinkers enter the market

Data from IWSR’s consumer research division shows the number of semi-annual wine drinkers in South Korea has risen +14% between 2019 and 2024. The conversion rate of semi-annual to weekly wine drinkers has risen faster, increasing the number of weekly wine drinkers by 50% between 2019 and 2024.

Almost 30% of wine drinkers report consuming more wine than they did last year. This group is dominated by LDA Gen Z and Millennials (63% combined), who also tend to be the most involved in the market. As a result of their entry into the market, the proportion of highly involved wine drinkers has increased since 2019.

Positive consumer outlook

South Korean wine drinkers also have a positive outlook despite the country’s current economic woes.

In particular, younger adult consumers are going out more and buying more expensive wine. Up-trading was the most common reason given for this change. As a result, consumers report higher spending across occasions since 2019, although high inflation and rising costs in the past few years have played a part in this.

“Many consumers are interested in experimenting with wine, which is perceived as a sophisticated and fashionable,” says Ho.

Channel expansion

IWSR market analysts note that there are more wine shops opening, making it easier for people to buy wine locally. Ho adds: “Distribution is improving as we see senior employees of major wine importers leave to start their own businesses.”

“Wine is now also easily available in hypermarkets and convenience stores – and Millennials and LDA Gen Z consumers are likely to enter the category to take advantage of this greater choice, and reduced prices.”

The relaxation of ecommerce rules has also been good for wine since it allows new consumers to research and choose in a non-threatening environment – a significant factor when a large number of those trying wine for the first time are aged 19-24. Even now, with increased awareness, only 32% of wine drinkers feel ‘competent’ in their knowledge of grape-based wine.

Planning ahead

However, challenges remain. Still wine is still significantly more expensive than locally-made drinks such as soju, beer and rice wine. Wine can also be hard to find in traditional Korean restaurants, which are dominated by cheaper local alcohol.

“Complicated storage requirements can often deter traditional restaurants from selling wine,” points out Ho. “And red wine in particular can be difficult to pair with spicy Korean food.

In spite of this, wine is a category that is getting both broader and deeper in its penetration, yet one that still has huge potential, not least because per capita consumption remains low. Being able to convert even a small percentage of the country’s non-wine drinkers, or upselling the existing wine drinking population slightly, can drive significant value.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Wine | MARKET: Asia Pacific |