18/09/2024

Where next for premium gin?

IWSR analysis shows that the long-running premium gin trend may have reversed in key markets such as the UK and Spain, but pockets of opportunity still exist for higher-priced gin around the world.

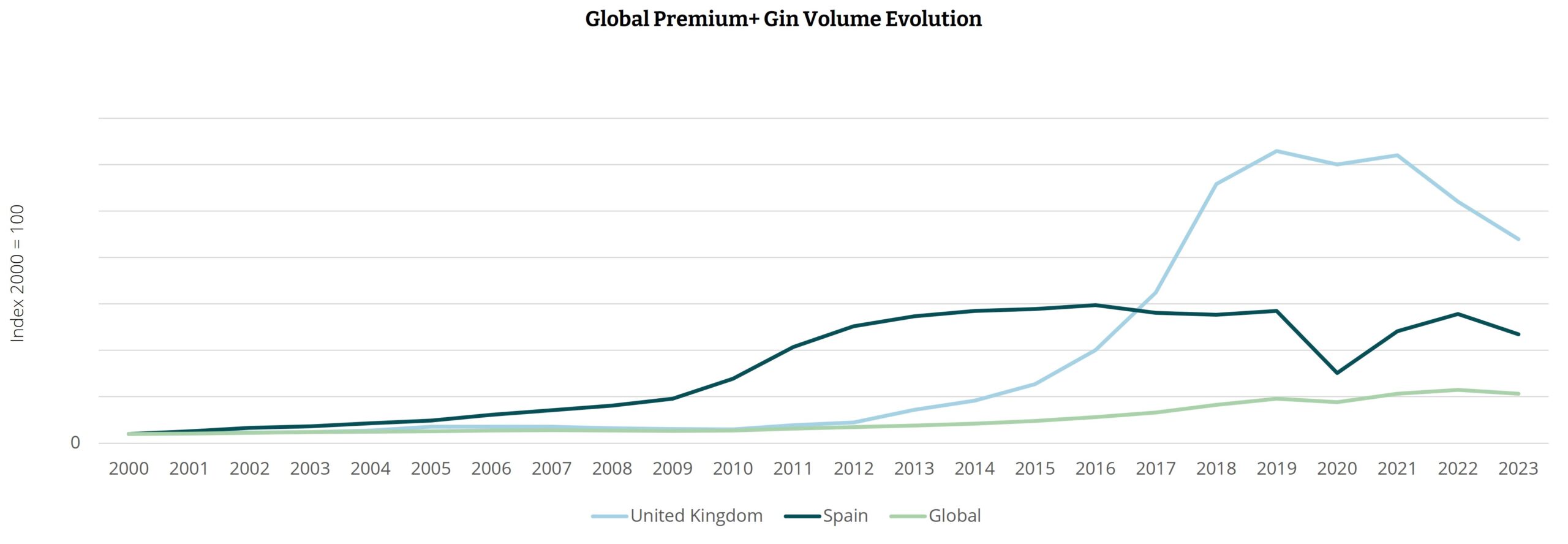

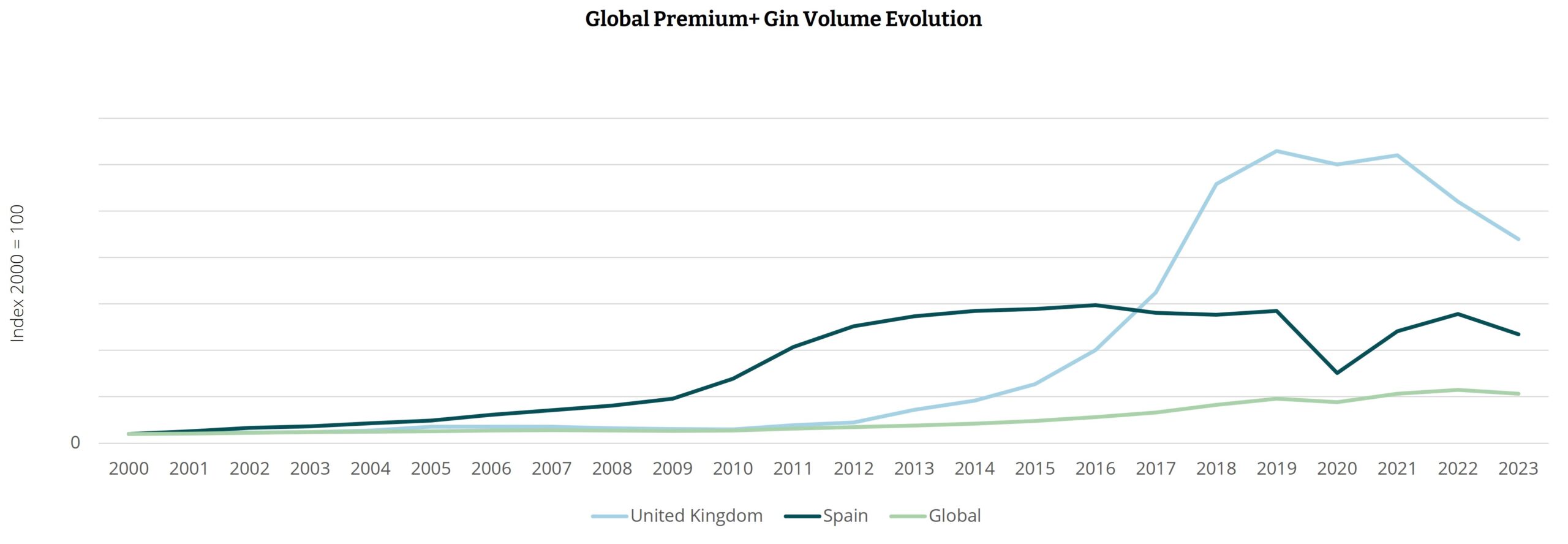

Premium gin’s impressive growth trajectory was instigated in Spain from 2008-09 and in the UK from 2013-14 – enjoying stratospheric gains in the case of the latter in the following years. Higher-priced gins were also given an extra boost during the Covid-19 pandemic, when many consumers had the time – and the disposable income – to explore the category.

In the UK especially, category growth in the years leading up to the pandemic was prolonged by interest in flavoured gins, observes Patrick Fisher, Senior Research Analyst at IWSR. “Much of the surge in gin sales in the UK over recent years can be attributed to the growth of flavoured gins, but these have now seen volumes plummet by nearly a half from their 2020 peak, when they accounted for more than 30% of the category,” he adds. “Sales of flavoured gins are now declining more than twice as fast as those of traditional gins.”

Premium-plus gin volumes in the UK peaked during the pandemic, and fell by -16% during 2023, according to IWSR market data. Further reductions are expected in the years ahead, with a forecast CAGR of -5% for premium-plus gin between 2023 and 2028.

Meanwhile, in Spain, premium-and-above gin sales mirrored the UK trend during 2023; volumes were down -16%, and are expected to decline further between 2023 and 2028, with a forecast CAGR of -5%.

“The extent of gin’s contraction in Spain during 2023, despite record tourist growth, was a clear indication that, not only in Spain but across most of Europe, the momentum for the gin and tonic is over,” says Dan Mettyear, Research Director, IWSR.

There are many explanations for premium-plus gin’s declines, including the “artificial” boost given by the pandemic and the disproportionate influence of flavoured gins, from which consumers can easily switch over to rival products, such as flavoured vodkas.

“Retail shelves and on-premise back-bars became really overcrowded with so many gins, and this inevitably led to a rationalisation of listings as demand began to soften,” says Mettyear.

“If you have too much proliferation – a little similar to the hard seltzer category in the US – then consumers may begin to feel that there are too many brands. You can end up overwhelming them by providing too much product in the marketplace – and then they back off.”

Gin also differs from brown spirits categories such as Scotch whisky and Cognac, in that there is no inherent age ladder to trade consumers up through the price points.

Taking a global perspective, IWSR market data indicates that premium-plus gin volumes rose at a CAGR of +3% between 2019 and 2023, but fell back by -7% during 2023. Forecasts, however, suggest CAGR growth of +1% between 2023 and 2028. Given the likely continued losses in the UK and Spain, where will this growth come from?

India: craft gin renaissance

One clear priority for brand owners is India. Premium-and-above gin volumes grew by +8% during 2023, and further gains are expected in the years ahead, with a 2023-28 CAGR of +5% as a mix of local and international brands vie for consumers’ attention.

“Gin has proven to be the ideal platform for local flavours and ingredients. Craft gins have emerged, with momentum sustained post-pandemic as well,” observes Jason Holway, Senior Research Consultant, IWSR.

“The category is now home to major international brands, a number of specialist producers and some large local players. There is ongoing innovation from brand owners and enthusiasm for cocktail culture among consumers.”

Japan: the G&T drives momentum

In Japan, gin is building on its existing familiarity with local consumers: the gin and tonic is one of the best-known long drinks in the country, enjoying huge popularity in izakayas.

The category’s momentum is particularly apparent in higher price tiers: although still small, premium-plus gin volumes surged up +31% during 2023, are expected to expand at a CAGR of +12% between 2023 and 2028.

“Interest in premium gins has taken off in the past couple of years, and local producers are now investing in the category,” says Piotr Poznanski, Research Director, IWSR. “Numerous shochu producers are also switching to gin, which should keep the category vibrant for years to come.”

The US: above-premium outperforms

Gin volumes in the premium price band declined by -5% in the US during 2023 – and this price tier is expected to remain relatively depressed in the years ahead, with a forecast 2023-28 CAGR of -1%.

However, overall premium-and-above gin volumes are expected to climb at a CAGR of +3% between 2023 and 2028, reflecting continued impressive gains for the super-premium and ultra-premium price tiers – expected to grow at CAGRs of +10% and +12% respectively over the same timescale.

Recently, the high-end gin market has garnered traction by targeting younger LDA demographics with an emphasis on boutique brands and innovative barrel finishes. This includes brands from around the world including Ireland, Japan and Mexico.

Brands are innovating with different flavour expressions as well. For example, Drumshanbo Gunpowder Irish Gin, part of the Palm Bay International portfolio, announced the launch of Brazilian Pineapple. The lineup also includes the Sardinian Citrus and California Orange flavours.

Brand owners are also investing in the segment. Spirit of Gallo, for example, is adding gin to its growing spirits portfolio with Mexico City-based Condesa Gin. Condesa is made in Mexico City and the name is inspired by one of the city’s most iconic neighbourhoods. Condesa is currently available in two expressions, Clasica and Prickly Pear & Orange Blossom.

The continued return of the on-trade also benefits high-end gin, especially in cocktails like the gin and tonic and negroni. The emergence of gin in RTDs is also attracting new consumers into the overall category.

Europe: pockets of growth

The gin boom may have subsided in many markets across Europe – for instance, Italy’s premium gin gains in 2023 are not expected to persist in the years ahead as consumers migrate to other categories including agave – but there are still pockets of potential growth in countries including France and Sweden.

Although downtrading is evident within the gin category in France, the market remains positive, driven by the cocktail scene and the popularity of locally made gins. French-produced gin tends to be less subject to downtrading, as consumers value its local credentials.

Gin displayed resilience in a lacklustre spirits market in France during 2023, when premium-plus gin volumes edged up by +1%. Solid gains are expected in the years ahead: IWSR forecasts indicate a +6% volume CAGR between 2023 and 2028, with bigger gains for super- and ultra-premium products.

Meanwhile, premium-and-above gin in Sweden represents a small but growing market. Robust gains between 2019 and 2023 (+14% volume CAGR) were brought to a halt by a difficult 2023 (volumes down -7%), but IWSR forecasts show renewed growth in the years ahead, with a 2023-28 volume CAGR of +2%. Locally produced craft gins are driving momentum for Sweden’s premium-and-above gin market.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Spirits | MARKET: All | TREND: Premiumisation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.