23/10/2024

Key US states for American whiskey are softening – why?

New data from IWSR US Navigator shows shifts in American whiskey's largest domestic markets

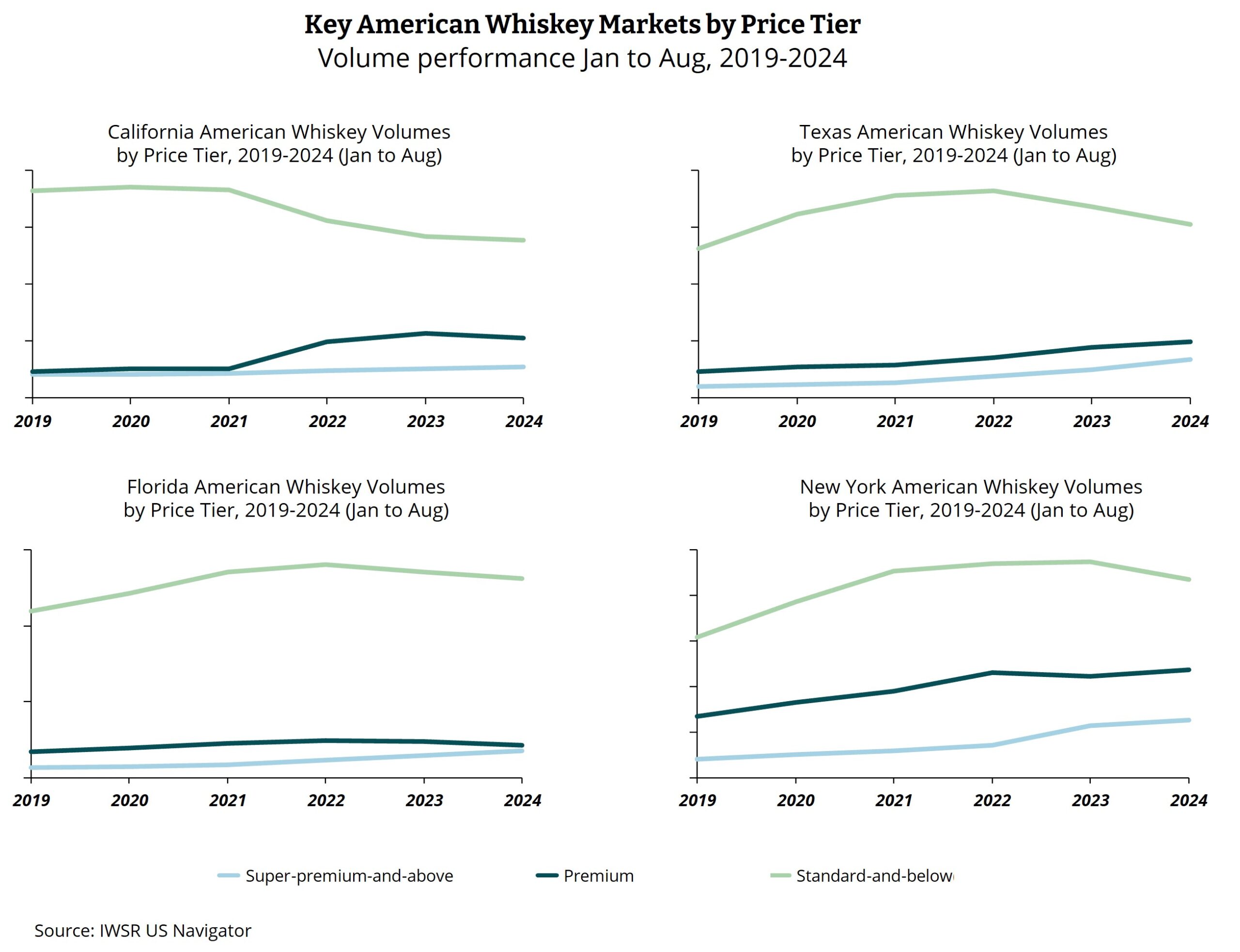

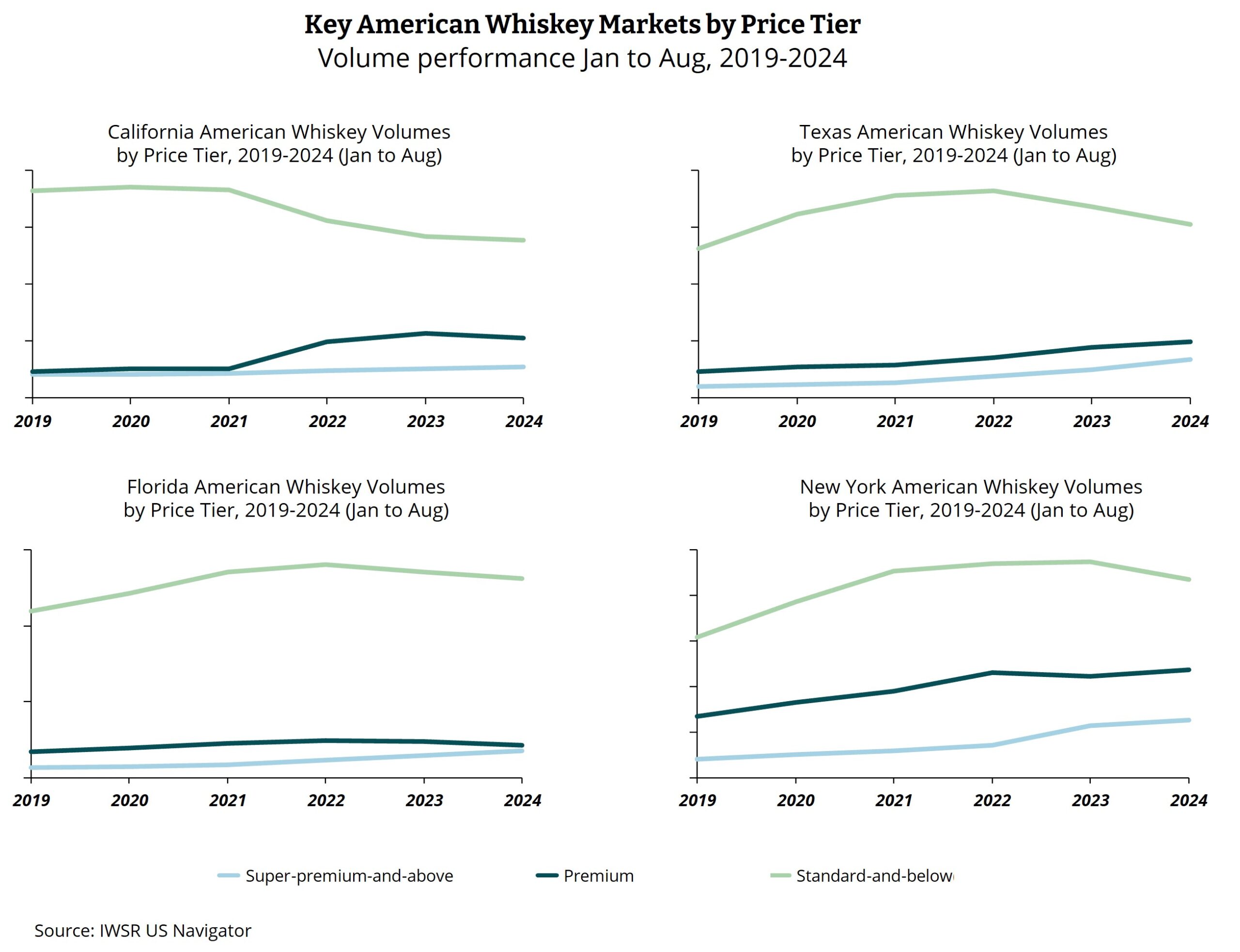

After years of robust growth in its home US market, American whiskey’s momentum has stalled in recent times as consumers feel the pinch of the cost-of-living crisis and squeezed disposable incomes. Signs of downtrading are appearing in some of American whiskey’s largest domestic markets.

This latest data comes from IWSR US Navigator, the industry’s only trusted source of monthly volume data for the total US beverage alcohol market — across wine, spirits, beer, cider, RTDs and no-alcohol — by price tier, for all 50 states going back to 2019, based on highly accurate local tax office data.

Nationwide trends show:

- American whiskey volumes in the US enjoyed years of strong growth, at +5% CAGR, 2019-2022.

- The category started struggling in 2023 when the growth rate tipped into negative territory (-1% volume decline, 2022-2023) and has since struggled further dropping to -2% YTD (Jan-Aug 2024)

How do trends change at the price tier level?

- This decline has been almost entirely driven by losses in the Standard-and-below (<$22.49 per 75cl bottle) price tier which accounted for 59% share of the category in 2023. Declines here have been substantial, with Standard American whiskey declining -4% YTD and Value American whiskey declining even more at –8% YTD.

- Losses at lower price tiers are somewhat offset by strong growth in Super-premium-and-above (SP+), which grew at 6% YTD. SP+ represents products above $30.50 a bottle. Growth in the Premium price tier has been flat, as it appears that trade down from higher price tiers into Premium is being offset either by trade down from Premium to lower price tiers or by consumers leaving the category entirely.

Which states are seeing softening demand?

Signs of softening demand appear across states that are in the top 10 largest domestic American Whiskey markets.

- States like New York, Texas, Pennsylvania and Illinois continue to see growth in Premium and SP+, albeit slowing, but have seen the strongest declines in Standard-and-below suggesting that premiumisation here remains bullish.

- By contrast, states like California, Florida and Kentucky have seen significant declines in Premium while the Standard-and-below price tiers have flattened, suggesting a bifurcation in the market where some consumers are continuing to trade up, while others are being forced to trade down further.

California and Texas are the two largest domestic markets for American whiskey (by volume).

What’s driving softening demand?

- Challenging prior-year comparisons for leading brands have made it difficult for the segment to post growth.

- A slight reduction in new American whiskey brands and variants entered the segment in 2023, reducing the scale of innovation.

- Lower levels of consumer demand are coinciding with increased production coming on stream as companies invest in the category. For example, a record 12.6m barrels of Bourbon were maturing in 2022, according to figures from the Kentucky Distillers Association, and production is not expected to slow in the near future.

What does this mean for the category?

- Distillers are contending with increasingly price-conscious consumers as well as rising production costs. This is creating challenges – particularly for distillers who cannot benefit from the economies of scale enjoyed by larger brand owners. We could see ongoing consolidation of the market.

- The current economic environment has consumers seeking out brands with a good price-to-value ratio. SP+ price tiers will be under increasing pressure over the next 12 months. Growth will likely be driven by robust innovation at the higher price point without eroding equity in the category.

- There will be a temptation to reduce prices in order to generate demand, but this can backfire if it is taken too far, and it eliminates the need or desire to pay SP+ prices.

- Innovation remains important. Current NPD trends focus, for example, on new production techniques to ‘finish’ the product, with the intention of being less reliant on the taste nuances obtained through additional ageing. Innovation is also focused on less established American whiskey blended variants; recent examples include SirDavis, launched by Beyoncé Knowles-Carter and Moët Hennessy, and a new Bourbon x Rye offering from Knob Creek.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Spirits | MARKET: North America | TREND: Premiumisation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.