This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

30/10/2024

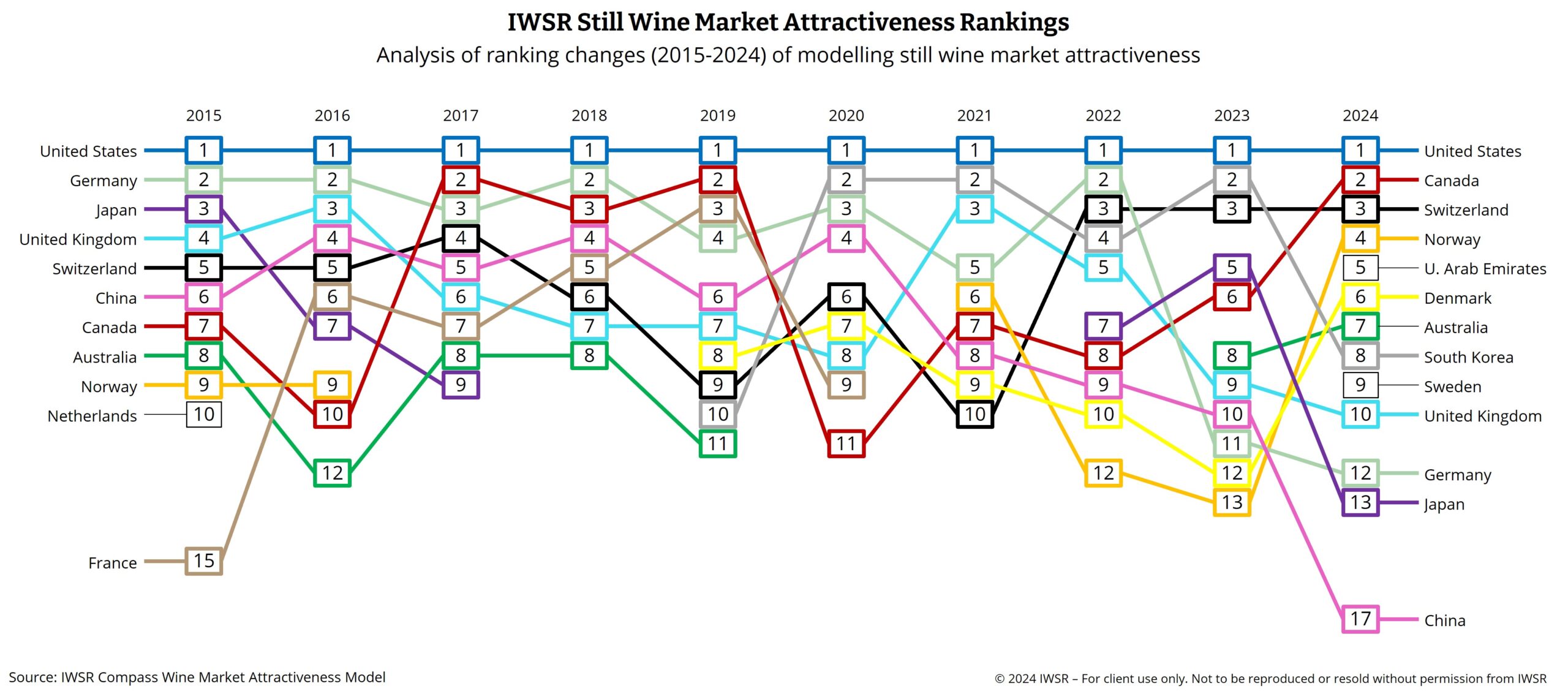

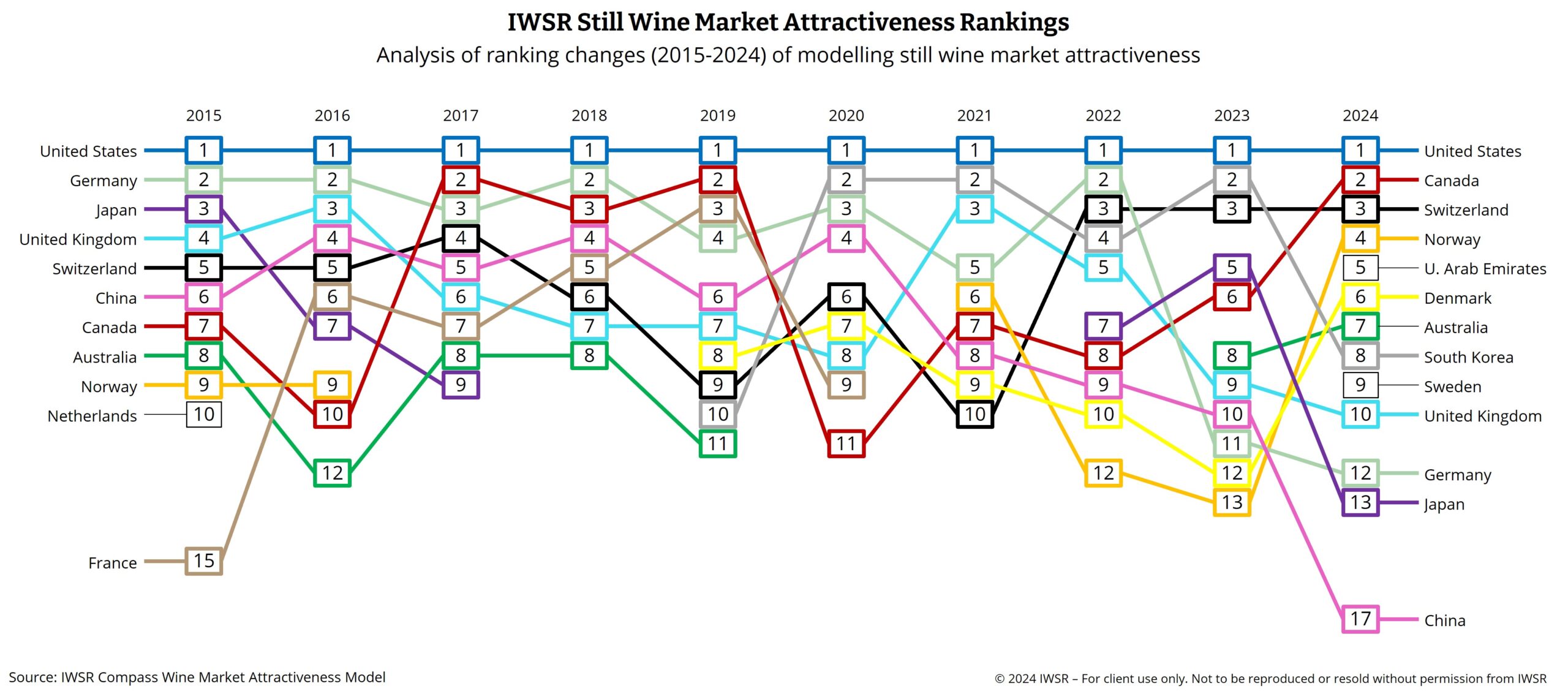

What can we learn from 10 years of IWSR’s wine market attractiveness rankings?

IWSR's longitudinal data for still wine market attractiveness highlights the impact of socio-economic and political factors, as well as shifts in consumer preferences, on the global wine landscape

This year marks a decade of IWSR wine market attractiveness tracking through its proprietary Compass model. As we take a look back at the past ten years, a number of key – and at times surprising – patterns begin to emerge.

The Compass model offers a snapshot of the relative attractiveness of global still and sparkling wine markets, with its methodology based on an extensive set of socio-economic and wine market measures.

Over the past ten years, the wine industry has faced a shifting market landscape:

- Lasting impacts of recent high inflation: For several years, rising inflation has been one of the key factors shaping the global alcoholic beverage and hospitality sectors. The impact of inflation – a fundamental reduction in household spending power – will continue to shape preferences, spending and demand for wine around the world.

- Pandemic impact on the on-trade is long-lasting: With rising operating costs and higher prices in the on-trade, the expected recovery has not materialised, particularly for nightclubs. However, the emergence of less formal, earlier evening drinking occasions have provided an opportunity for wine.

- Shifting drinking habits: Moderation, driven both by increasing health consciousness and the rising cost of living globally, has seen wine consumption continue to fall, particularly among younger consumers of legal drinking age. Moderated alcohol consumption is increasingly accepted socially, and the stigma around not drinking is starting to diminish in many markets.

- Trading environment influenced by politics: Tariffs and alcohol duty changes have shifted market dynamics. The introduction of a new UK alcohol duty in August 2023 has seen numerous brands opt to lower the ABV of their wines or launch new ‘mid-strength’ products. Meanwhile, China’s tariffs imposed on Australian wine lasted for over three years, coming to an end in March 2024.

Against this backdrop, there are a few key patterns emerging in terms of IWSR’s still wine market attractiveness rankings:

Dominance of the US: The US continues to lead the way for still wine opportunities, despite a slight decline in the number of regular wine drinkers in the country and a fall in wine volumes after decades of growth. High volumes make it the largest wine market in the world, with over a third of still wine sold at premium-and-above price points in the US in 2023. While volumes are forecast to decline slightly, the market share of premium wines is forecast to keep growing as more moderate-drinking consumers seek to drink less but better.

Cyclical patterns in Canada: The pandemic left a strong impact on Canada’s still wine market, with the market now back in number two position as population growth recovers following the Covid years. Premiumisation has also recovered to similar levels as the US, possibly linked to economic improvements and inflation falling relative to the hikes during the pandemic.

Switzerland consistently holds onto its #3 position: Consistently high GDP and GNI levels work in Switzerland’s favour, combined with the lowest levels of inflation of any of the European markets studied. The country has a relatively high per capita consumption of still wine and a consistent demand for imported wines priced at Premium-and-above price tiers.

Scandinavia resilient: Norway (#4), Denmark (#6) and Sweden (#9) have all moved up five places or more in the rankings. Rates of still wine consumption in these markets are falling, but at lower rates than many of the more mature markets in Europe.

Western Europe continues to decline: High inflation and living costs, although starting to moderate, continue to hold back the attractiveness of most European markets. The UK and Germany have both seen consecutive years of declines in the rankings. Relatively low levels of premiumisation impact the rankings for Germany, while high inflation, excise duty increases and the economic impact of Brexit have weighed on the UK.

APAC markets struggle: South Korea, which once held the number 2 ranking for still wine market attractiveness, saw a drop to 8th position this year. In many APAC markets, the rising cost of living, constrained household budgets, economic slowdown, and regulatory changes have led to consumers down-trading within beverage alcohol and reducing consumption. In South Korea, the premium still wine segment has seen acute declines as well. In Japan, RTD penetration is very high and is expected to continue to provide competition for the still wine market.

UAE a big mover and surprise entrant in the top 10: Although the United Arab Emirates remains a market largely dominated by beer and spirits, it is one of the major movers in the top 10. Wine consumption across the region has risen as the tourism industry grows and on-trade drinking habits shift. In the on-trade, restaurants are stocking wider varieties of fine wine offerings, driving high value growth and opportunities for premium products in the market. The continued influx of Western expatriates to the region has contributed to rising per capita consumption, too.

It’s important to note that IWSR’s Compass evaluation method is based on a hypothetically neutral investor with no legacy assets. In reality, most businesses already have some assets and relationships and will therefore internally need to adjust attractiveness to reflect their existing strategic position. For instance, attractiveness of certain markets will increase with regional proximity, existing presence and established routes to market. Therefore, the attractiveness model can be optimised by tailoring it to the specific dynamics of an individual business, region or country to enable the assessment of their greatest opportunities.

As we look ahead to 2025, we expect the still wine market to have to contend with:

- Continued impact of high cost-of-living and inflation: while increases are starting to taper in many Western markets, the cost-of-living remains high, and prices have been starting to rise in Japan and other key APAC countries.

- Consolidation of new drinking habits as younger drinkers mature: moderated drinking continues to become more socially acceptable. This may present opportunities for more high-quality no/low products, and fuel premiumisation as people seek less-but-better options.

- Further disruption from international politics: this includes, for example, UK alcohol duty on wine, which is set to rise in Feb 2025; possible impact of US election; continued conflicts in the middle east and Ukraine.

IWSR’s Compass Model is designed to answer the question: which are the most attractive markets for wine right now? If you would like to know more about the Model’s underpinnings or adapt the model for your specific business needs/circumstances, please contact your IWSR account manager or email enquiries@theiwsr.com.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Wine | MARKET: All |