This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

08/11/2024

Sparkling wine’s holiday spike in the US seems to be slowing

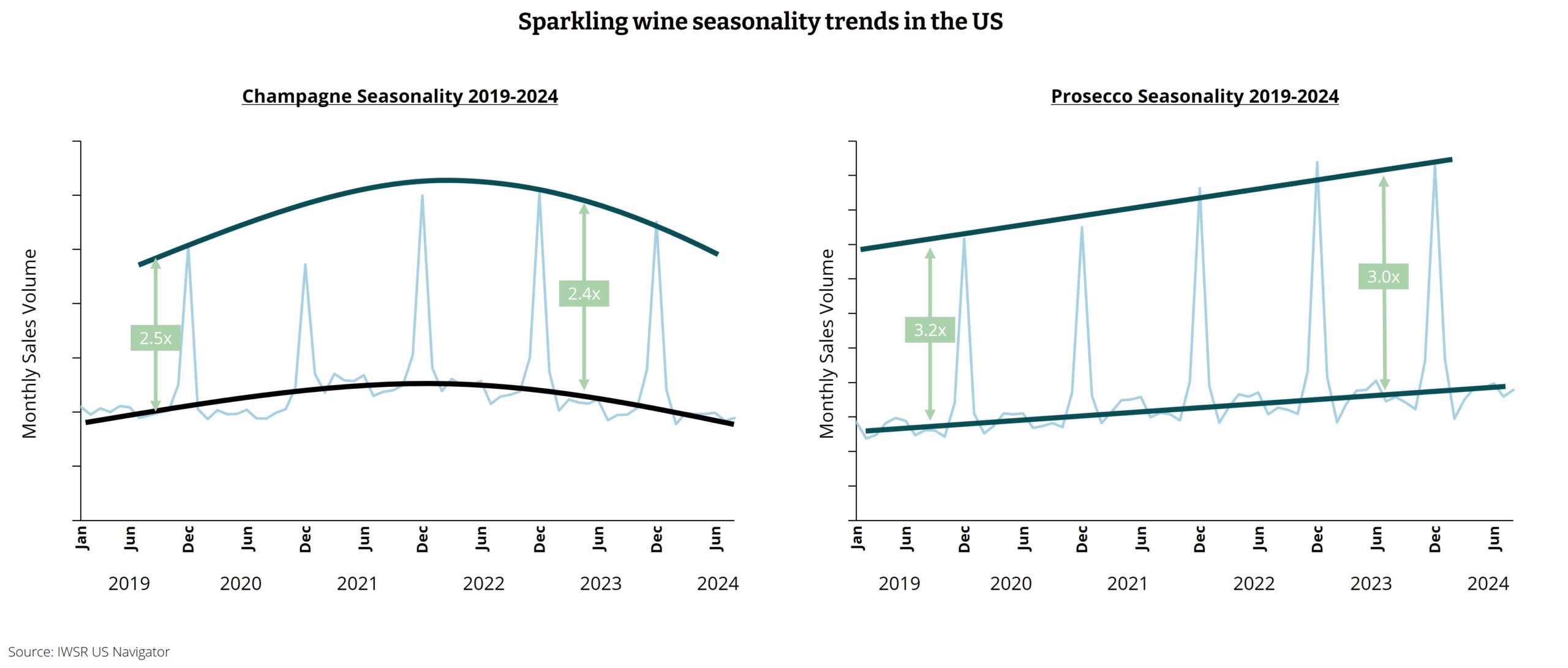

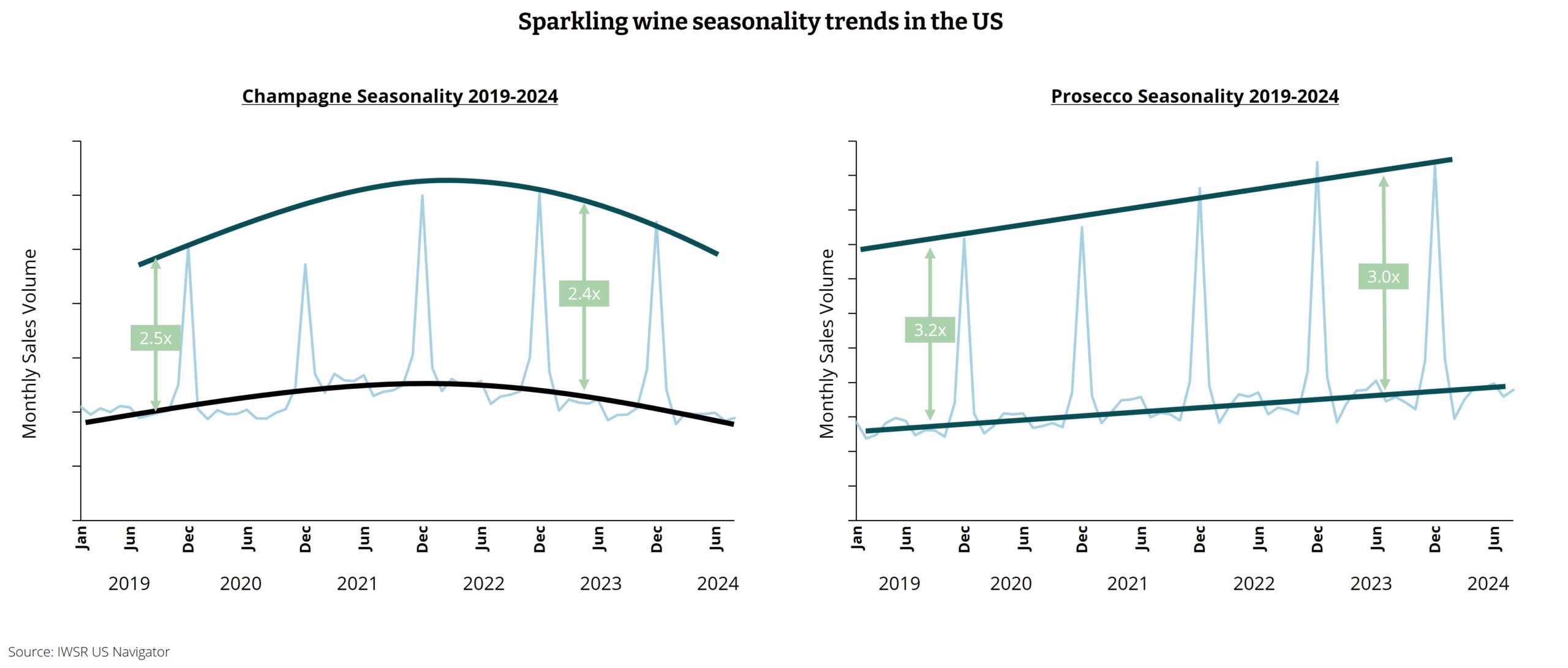

IWSR analysis highlights the seasonality patterns for Prosecco and Champagne in the US

Against a nationwide trend of declining wine volumes (except for no-alcohol wine), total sparkling wine decreased by -7% in Jan-Aug 2024 versus Jan-Aug 2023 in the US. As we approach the holiday season, what can we expect from the sparkling wine category this year?

According to latest data from IWSR US Navigator (the industry’s only trusted source of monthly volume data for the total US beverage alcohol market — across wine, spirits, beer, cider, RTDs and no-alcohol — by price tier, for all 50 states going back to 2019, based on highly accurate local tax office data):

Sparkling wine seasonality

Sparkling wine is a notoriously seasonal category with ~20% of all consumption coming in December each year.

The sales spike in December goes from ~2.5 times the baseline volume for Champagne and over 3 times the baseline volume for Prosecco, in line with expectations as the lower average price point for Prosecco means it shows a greater sales spike over the holiday season than its more expensive cousin, Champagne.

“Prosecco’s acceptance across a broader set of occasions has helped to boost its versatility, comments Marten Lodewijks, President of IWSR’s US Division. “Its affordability compared with Champagne has also helped to propel the segment.”

Champagne vs Prosecco

What’s interesting is the underlying trend we see when looking at the seasonal data.

- Champagne showed significant gains post pandemic with a full year CAGR from 2019-2021 of 11% (vs. a slightly lower 10% for Prosecco).

- The performance of the two categories then decoupled with Champagne declining -7% from 2021-2023 while Prosecco continued to gain +5% over the same period.

This is largely in line with expectations as the inflationary environment in the US put pressure on consumers and de-premiumisation within the broader category ensued, with Prosecco winning out due to its lower average price

Supporting this view that consumers are feeling the cost pressure is the fact that the sales spike in December has been coming down slightly for both categories, with Champagne going from a 2.5x increase over the holidays in 2019 down to 2.4x in 2023 and Prosecco going from 3.2x down to 3.0x, suggesting that, in general, consumers are reducing their consumption of sparkling wine over the peak period.

“Champagne appears to be struggling with increasing switching to Prosecco as consumers continue to feel the pinch of recent price increases,” notes Lodewijks. “Sparkling wine has historically always been a very fungible category with even high-income consumers happy to switch to lower cost options in certain occasions, but this trend seems stronger as consumers grapple with higher prices for virtually all goods.”

The outlook for 2024

Sparkling wine performance so far this year (Jan-Aug) has been mixed:

- Prosecco is a bright spot for the total sparkling wine category. Prosecco has grown in all states YTD, but was not able to offset losses from other sparkling wine sub-categories, such as Champagne. California, Florida and Texas saw the largest volume increases in Prosecco.

- Within Champagne, states that are seeing the fastest declines in Jan-Aug 2024 vs 2023 are Mississippi, Connecticut and New Jersey while the states with the largest absolute volume losses were California, Florida and New York.

“The holiday spike for sparkling wine has historically been evident across many states,” notes Lodewijks, “This year, however, it’s likely that the slowdown in Champagne will drag down any holiday boost for total sparkling wine. It’s more likely that we will see growth for Prosecco, although the relative size of its holiday spike versus its baseline yearly volume is likely to be more subdued than that of previous years.”

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Wine | MARKET: North America | TREND: Premiumisation |