This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

12/12/2024

Cider sees interesting seasonal variation in the US

Latest IWSR data shows the evolution of cider trends in the US, driven by premiumisation, seasonal demand and regional nuances

Latest data from IWSR US Navigator shows that cider consumption peaks twice a year in the US, with regional trends highlighting a growing demand for the category’s niche and local appeal, as well as its premium offerings.

This latest data comes from IWSR US Navigator, the industry’s only trusted source of monthly volume data for the total US beverage alcohol market — across wine, spirits, beer, cider, RTDs and no-alcohol — by price tier, for all 50 states going back to 2019, based on highly accurate local tax office data.

Seasonal variance

- Cider volumes typically surge during the summer months, particularly from June to August.

- Over the past five years, volumes during the summer have averaged 1.1 times higher than fiscal year averages.

- States like California drive the summer peak, fuelled by outdoor gatherings, tourism, and warmer weather.

An interesting seasonal trend occurs during the late fall and mid-winter.

- According to IWSR’s Consumer Demand Index (CDI) data, per capita cider consumption peaks during late fall (October and November) and in mid-winter (January and February).

- Washington, Vermont, California, the District of Columbia, and New Hampshire lead in per capita demand, with colder states favouring cider for winter gatherings and warm, cider-based beverages.

- This trend suggests a growing niche appeal and a shift toward premium offerings, even amid an 11% decline in overall US cider volume from 2019 to 2023.

Regional nuances

Cider’s popularity varies significantly across the US, with states in the Northeast and Pacific Northwest standing out.

- Washington and Vermont lead in per capita consumption, with CDI levels 7.5 and 4.6 times higher than the national average, respectively.

- Washington’s status as the nation’s largest apple producer and Vermont’s strong local craft scene contribute to their dominance.

In contrast, warmer states like California and Texas drive high total volumes, particularly during the summer, while cooler regions like New England and the Pacific Northwest see demand spike in fall and winter.

- For example, Washington, the second-largest state by cider volume, experiences its highest demand in January, aligning with seasonal preferences.

“Vermont’s unique position as a cider leader, despite being the second-least populous state, underscores the role of local culture and regional brands in shaping cider preferences,” comments Koryn Ternes, Consulting Manager – IWSR Americas.

Premiumisation: a bright spot for cider

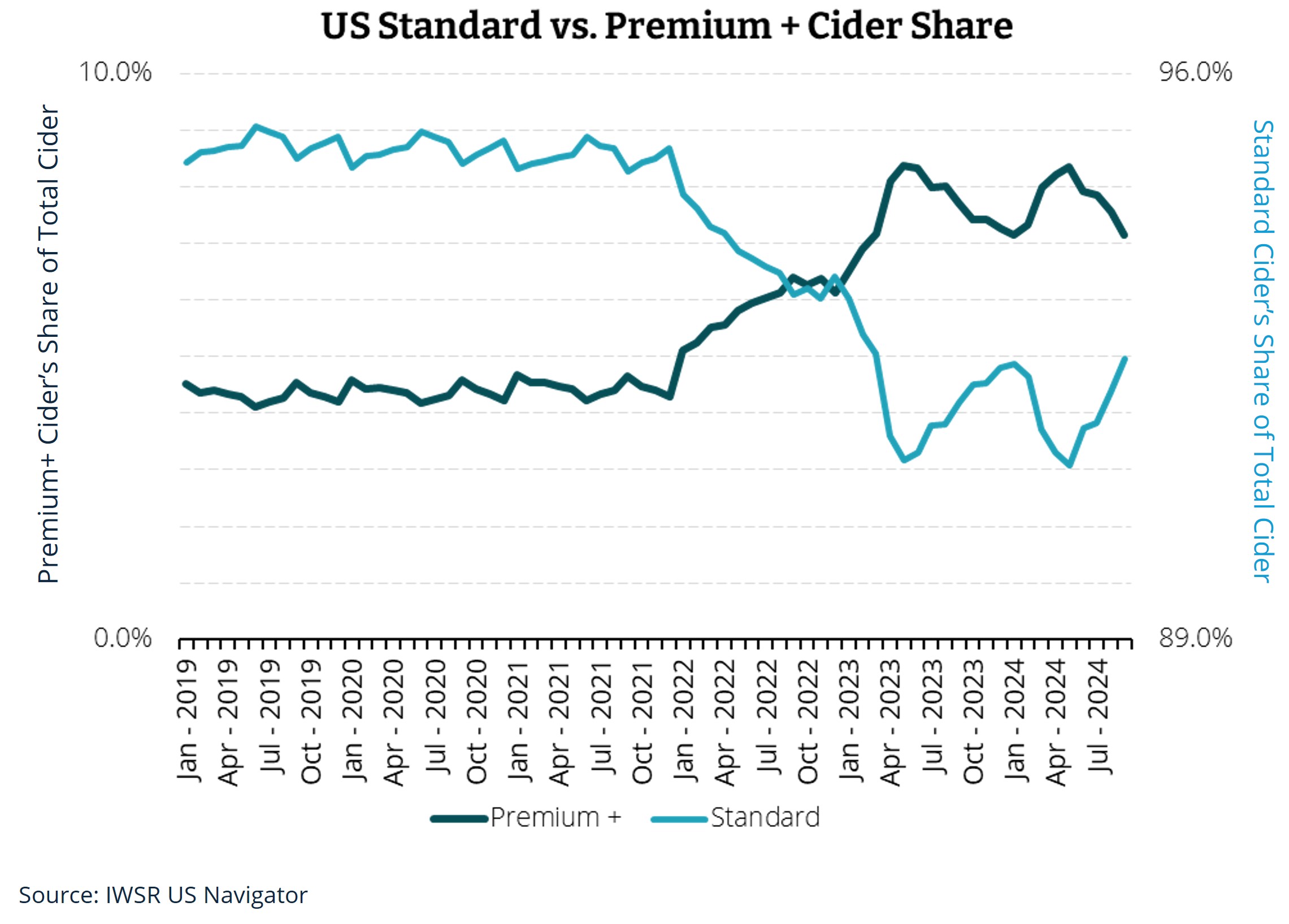

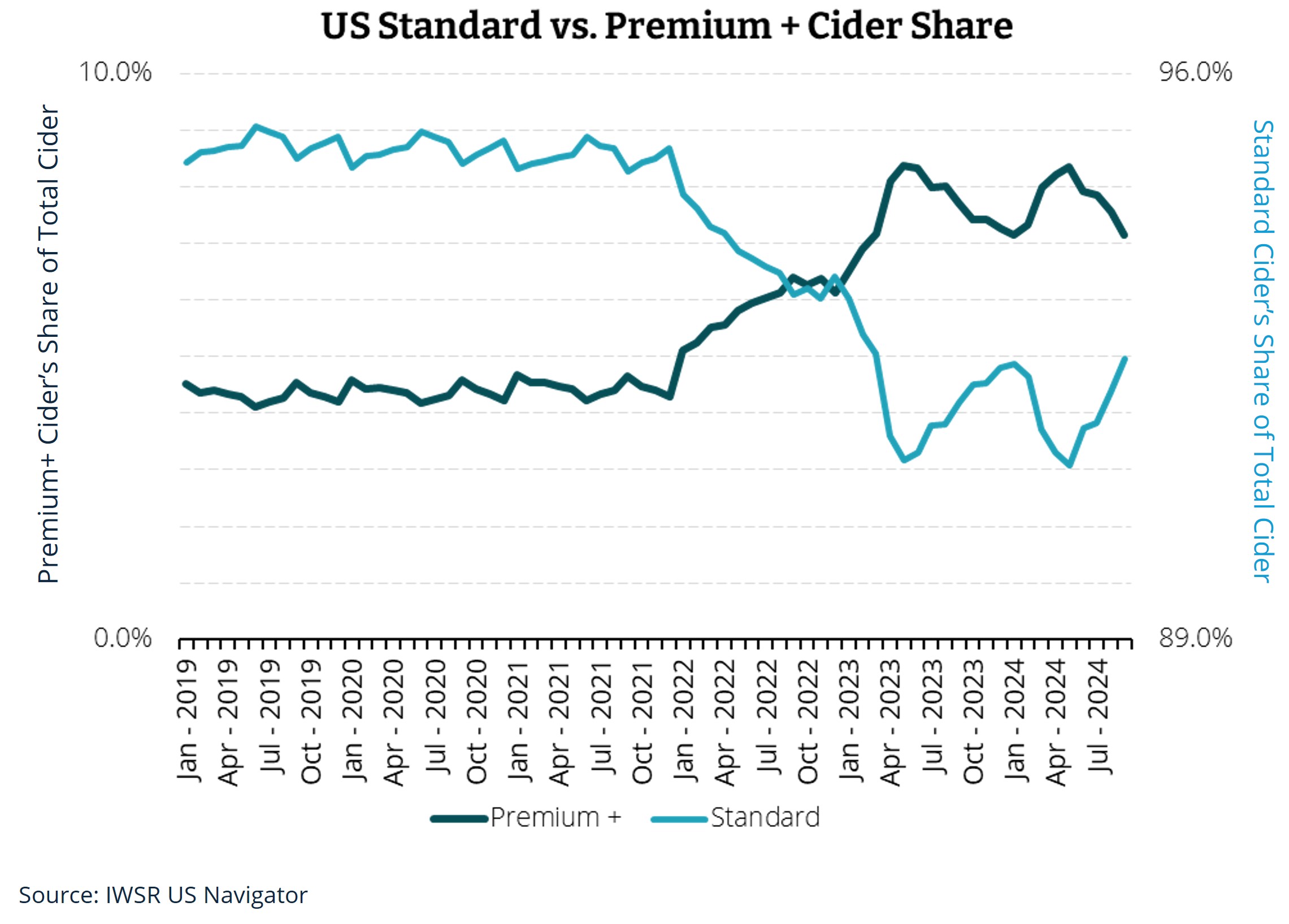

While the Standard price tier continues to dominate US cider volumes, accounting for 92% of sales in 2023 (full year) and 2024 (Jan to Sept), the Premium and Premium+ segments are steadily gaining ground. Since 2022, these higher price tiers have increased their share of the category, particularly in states with a strong cider tradition. Massachusetts (15%), Oregon (12%), and New York (12%) are leaders in Premium+ cider penetration.

Meanwhile, Southern states such as Mississippi, Alabama, and Kentucky show minimal Premium+ market share, remaining focused on Standard and Value categories. However, states like California and Washington, which rank as the top two in overall cider volume, present untapped opportunities for Premium+ growth. Even modest shifts in these large-volume states could significantly impact the premium cider market.

“As the US cider market evolves, seasonal trends, regional nuances, and a push toward premiumisation are shaping its future,” comments Ternes. “With summer and winter providing dual peaks of demand, and certain states leading the charge in premiumisation, cider continues to carve out a unique space in the US beverage market.”

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Beer & Cider | MARKET: North America |