This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

14/07/2021

IWSR predicts material opportunities for increased premiumisation of beverage alcohol consumption in key markets & categories post-Covid-19

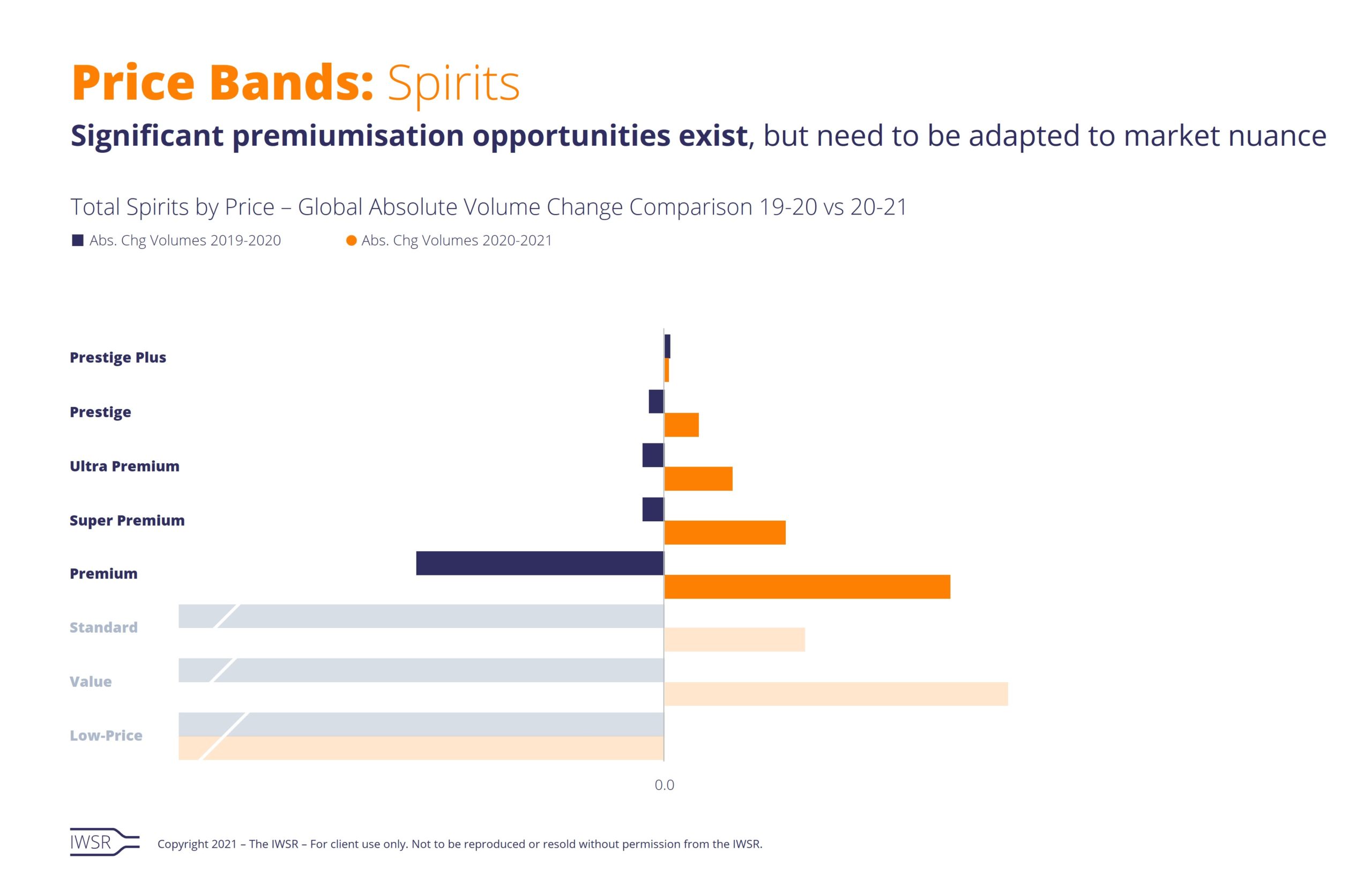

Significant premiumisation opportunities exist, but need to be adapted to market nuance

Significant premiumisation opportunities exist, but brand owners should plan for a two-speed recovery in key markets post-Covid. Markets with high vaccination rates and substantial financial support structures will thrive in the short to medium term, however IWSR expects to see significant downtrading in less protected markets and regions.

Lockdown savings

The premium-and-above beverage-alcohol market stalled amid lengthy periods of lockdown during 2020, but with opportunities to spend severely curtailed, consumers in developed economies accumulated extraordinarily high levels of savings.

In the UK, the household savings ratio hit 25.9% in the second quarter of 2020 – the highest figure since tracking began in 1987. In France, the figure was 27.4%, and in April 2020 in the US, the personal savings rate hit 33%, according to government reports.

“Covid restrictions have led consumers to appreciate the value of at-home treating through the purchase of premium products. The pandemic has put a lot of things into perspective, and ‘carpe diem’ is back on the agenda,” says IWSR research director Jose Luis Hermoso.

Many brand owners responded to this pent-up consumer demand, moving promotional spend to targeting consumers at home, and becoming more creative in terms of at-home packaging and experiences.

Premium gains: markets

IWSR expects premium-and-above price bands for spirits to more than regain 2020’s volume losses during 2021, reflecting the fact that alcohol remains an affordable luxury for those willing and able to spend.

However, less developed nations will be impacted harder and for longer by the effects of Covid-19. “In many developing countries, mainstream premiumisation – trading up from local spirits to imported, for example, or from value to standard price bands – has suffered a blow and will take time to resume,” says Hermoso. “But even in these economies, there is a small segment of the population less affected by economic hardship through Covid-19 who could embrace the very high end at even a faster pace than before,” he adds.

Detailed trends will vary by market, including the following:

• China saw an approximate -4% dip in volumes for premium-and-above spirits during 2020, driven by severe lockdowns and the market’s dependence on the on-premise, with baijiu and, to a lesser extent, Cognac and whisky suffering the greatest impact. However, all three categories are expected to return to growth, with the premium-and-above spirits market expected to bounce back with an approximate +11% volume gain in 2021.

• By contrast, the US recorded close to +10% volume gain in premium-and-above spirits in 2020, which is expected to moderate closer to a +7% gain in 2021. Here – as in other developed markets such as the UK and France – brands successfully adapted to at-home consumption trends.

In the US, consumers are responding to the more varied offer in premium-plus spirits, the buzz around celebrity endorsements and more interest in flavoured drinks.

• After an almost static year for premium-and-above spirits in the UK during 2020, volumes are expected to increase by close to 6% in 2021. Premium no-alcohol spirits performed particularly well in 2020, driven by new product launches, shifting consumer attitudes and Covid-fuelled concerns over health and wellness.

Premium gains: categories

Malt Scotch whisky and Cognac remain best placed to benefit from a greater appetite for high-end products, but this segment of the market is changing fast, and a rising number of categories and brands have it in their sights, says IWSR director Alastair Smith.

“Scotch and Cognac have been the prime drivers of international premium-plus consumption for years, but this has changed now, and that change will accelerate as many more whiskies – Irish, US and international – focus on the premium-plus space,” he adds.

This phenomenon extends beyond whisky. “On-trend categories such as tequila and mezcal could be the ones to watch,” says Hermoso. “Agave-based spirits have trebled in volume in the prestige-and-above segments in the past five years, and we forecast them to grow at a CAGR of close to +40% over the next five years.

“Rum also has potential – a lot of work is going into establishing dedicated high-end rum brands without lower-priced brand line extensions.”

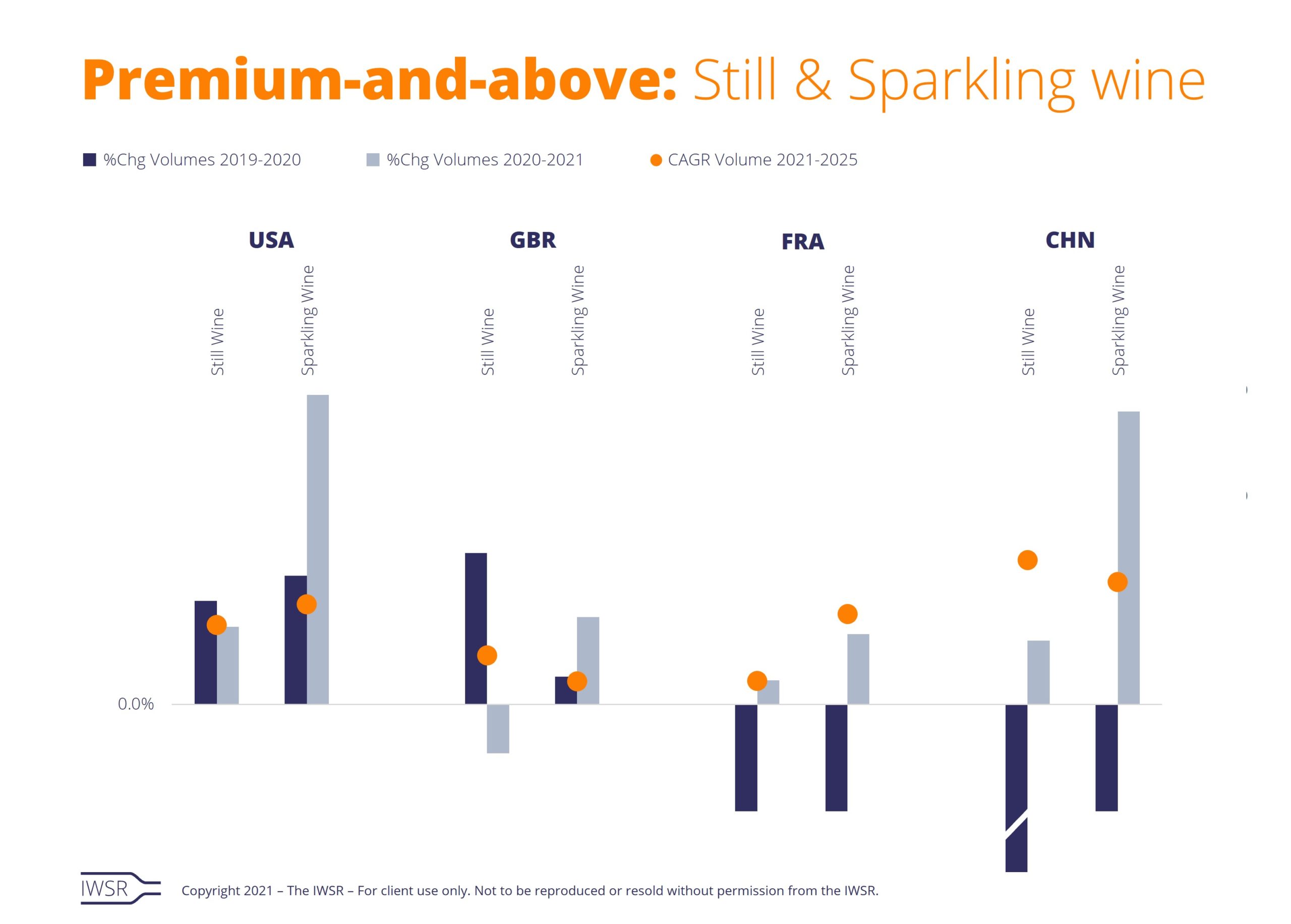

In wine, consumption of premium-and-above products is not predicted to return to 2019 levels until 2022. The premium wine trend was interrupted in France and China, both of which are more dependent on the on-premise, but still wine benefitted from the switch to at-home consumption in the UK.

Premium sparkling wines are expected to see long-term recovery and growth as the on-premise re-opens and large-scale celebrations and weddings return. Premium Prosecco proved resilient in 2020 thanks to its reputation as an affordable luxury – and Champagne’s allure remains intact in key markets such as the US, with rosé Champagne increasingly in vogue.

Purchase drivers and channels

As the premium-plus marketplace becomes more crowded and competitive, consumer engagement is vital to brands finding an audience. “Luxury consumers are becoming more discerning about what is in the bottle, and how the liquid justifies its price,” points out Hermoso. “Fancy, expensive packaging is no longer enough.”

The pandemic has given brands a new set of tools to reach customers virtually. After discovering the huge potential of ecommerce, digital communication and social media during lockdown, many companies now have dedicated budgets and teams working in this space.

However, they are also having to cope with ongoing supply-chain issues as a result of the pandemic, including worker shortages, shipping delays and rising raw materials costs. Some importers in the US, for example, have already seen their costs increase – for some, the cost to bring one container on a barge into the US has increased 60-75% between 2019 and 2021. These changes in the supply chain will leave brand owners facing a choice between putting up their prices or eroding profitability. IWSR predicts that many brand owners will look at increasing prices in the next 12 months, and there is increasing evidence that consumers will – within reason – accept price increases; however, this hypothesis is finely balanced and caution is required.

Brands will also have to deal with the long-term damage inflicted on the travel retail channel – the ninth-largest global market for premium-plus products in 2019. Recovery is however expected here, and IWSR foresees a scenario in which this channel could see a real shift in increased premiumisation, especially at the ultra-high end of the market. The number of SKUs in this channel is expected to decrease materially in the middle-market segment, with consumers focused at opposite ends of the market – at the very high end and in value-for-money brands.

A resurgent on-trade will also be vital to the recovery of higher price segments in the world’s top 10 markets, which together account for more than 80% of global premium-and-above sales. Covid-19 will have a severe long-term impact here, with many venues permanently closed or struggling to survive.

Extended periods of on-trade inactivity may also have had a psychological impact on consumers, notes Hermoso. “There is a belief that, during lockdown, they may have learned not to pay hospitality prices,” he says.

“As the on-trade returns in 2021, consumers may prefer to drink a premium product at home (at retail cost), rather than a more standard product in a restaurant (at on-premise margins).”

Covid-19 has created a notable shift in the channel balance for premium-and-above beverage alcohol, with ecommerce now a significant feature of the trading landscape and at-home consumption likely to remain dominant – in the short term at least.

But, as Hermoso notes, this last point should be viewed with a degree of optimism. “The desire of consumers to go out and enjoy concerts, night entertainment and festivals should not be underestimated,” he says.

“Nor should we forget the crucial role of the on-trade as a brand-builder. Grey Goose, Patrón and Diplomático rum in France – all of these were built in the on-premise before making the leap into retail.

“This is why multinationals have continued – and will continue – to support the on-premise throughout the crisis, regardless of how investment levels in each channel might change post-Covid.”

You may also be interested in reading:

Global beverage alcohol expected to gain +3% volume in 2021

5 key trends that will shape the global beverage alcohol market in 2021

US total beverage alcohol consumption in 2020 was the largest volume gain in nearly 20 years

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Premiumisation |