This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

28/07/2021

Consumer curiosity underpins ecommerce evolution

Specialist drinks ecommerce platforms have seen a notable shift in the reach and scope of their businesses. IWSR speaks with UK-based drinks ecommerce platform, Master of Malt, about how online shopping is evolving

Specialist drinks ecommerce platforms have seen a notable shift in the reach and scope of their businesses as a result of the Covid-19 pandemic, attracting a broader audience and sharpening their focus on customer engagement, a personalised service, and limited-edition products.

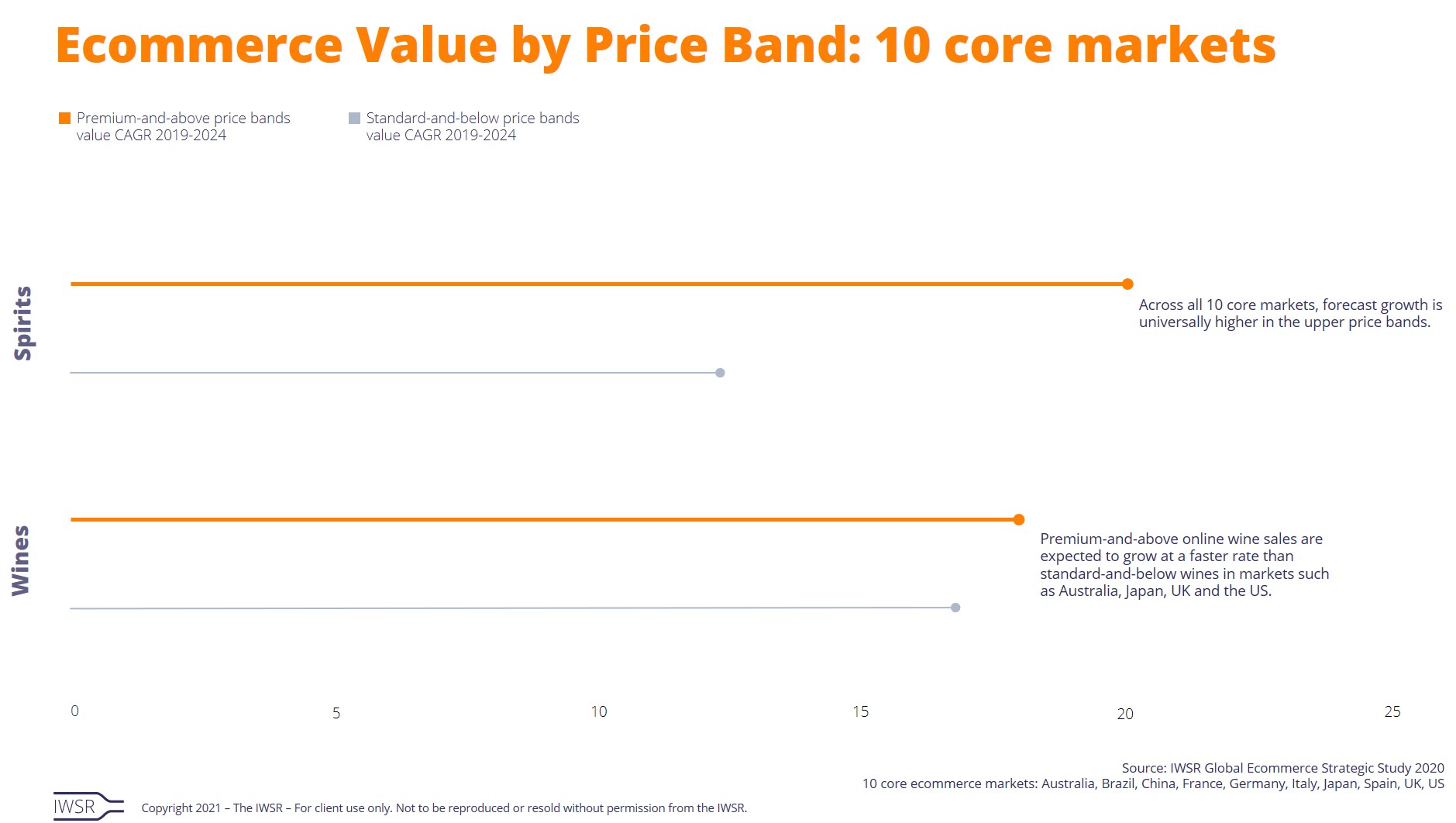

“As locked down consumers grew more accustomed to buying alcohol online, they became increasingly willing to experiment with their product choices, ordering more frequently and trading up to more expensive and limited-edition products,” remarks Guy Wolfe, strategic insights manager, IWSR Drinks Market Analysis.

According to Master of Malt, the UK-based drinks ecommerce platform that is part of Anheuser-Busch InBev-owned Atom Group, the early months of 2020 lockdown saw an expansion of the mainstream side of the business and an acceleration of the pre-existing trend of smaller but more frequent orders.

“We witnessed a widening of our customer base to those who previously included alcohol in their weekly grocery shop, those who generally pursued lower-cost products, resulting in significant growth in the sub-£30 range across the board,” says Sam Simmons, head of spirits at Master of Malt.

As sales and order numbers experienced triple-digit growth, another phenomenon began to emerge: the desire of consumers to find out more about the products they were buying.

“What is interesting is the trend towards valuing being educated about new products or whole sectors of drink,” says Simmons. “Analytics show that engine searches for ‘cheapest’ have been dropping, while those for ‘best’ have been growing over the same period, reflecting a trend toward ‘affordable luxuries’ through quality-led, more educated customer decisions; less but better.”

Rising levels of consumer curiosity tended to benefit what Simmons calls “information-led products” – categories such as whisky and agave spirits where some level of knowledge and discernment helps with the navigation of product choices, comparing prices, and tasting notes, and measuring quality cues such as heritage and provenance.

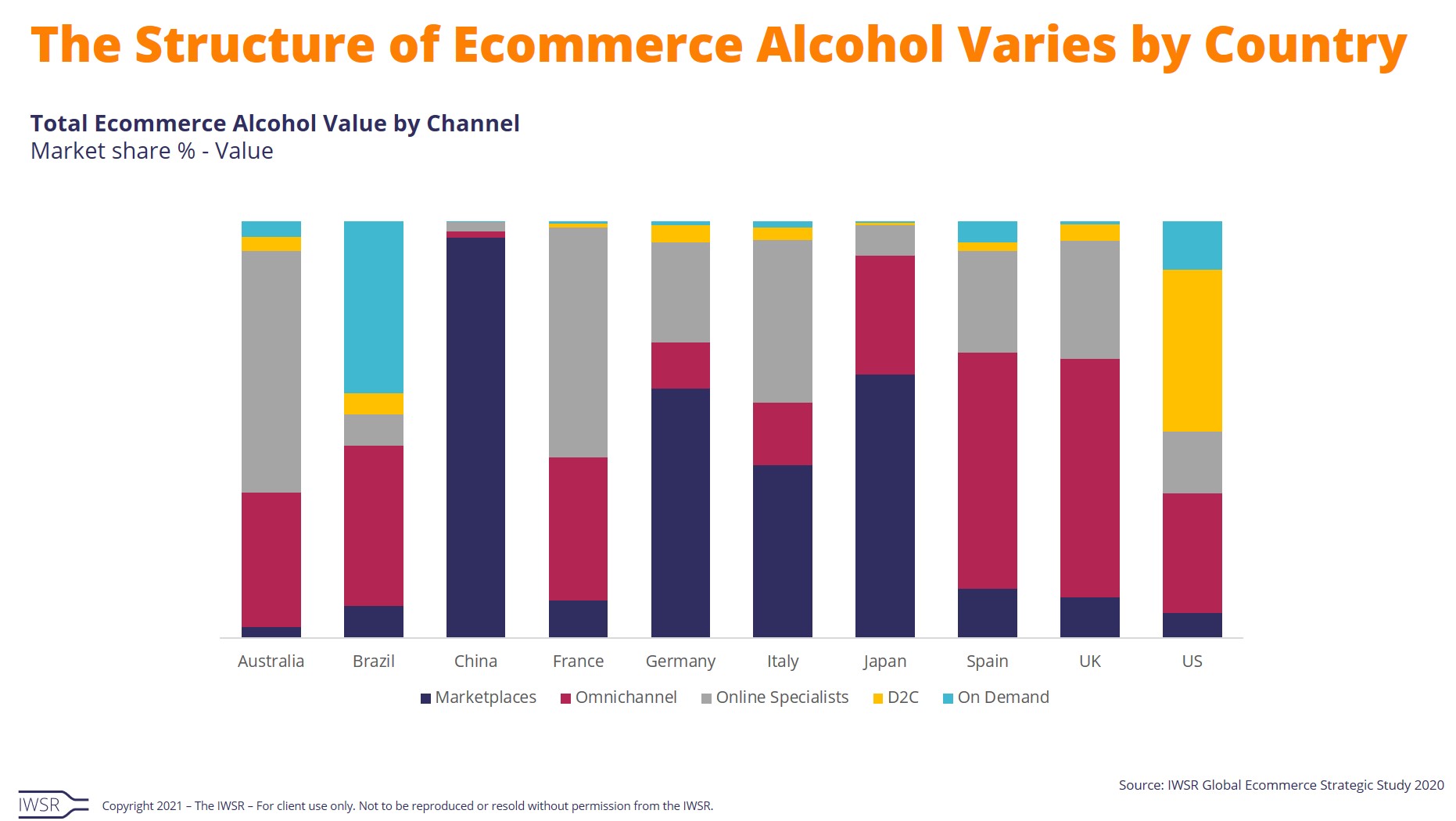

Many ecommerce platforms are now evolving from specialists in one narrow category (whisky, for example) into generalists that have branched out from spirits into wine, beer, RTDs, pre-mixed cocktails, and mixers. Unlike bricks-and-mortar retailers, they are not constrained by the physical limits of shelf space into only stocking a strictly limited selection of products.

“This point of difference is also illustrated by the strong presence in online specialists of exclusive products, limited editions, and hard-to-find expressions that are subject to strict allocations from brand owners,” remarks Wolfe.

“The specialist consumer seeks out niche and new brands that never get to supermarket shelves,” says Simmons. “A huge chain tends to curate spirit categories, almost choosing for consumers. We’d rather provide all the choices we can for the purchase decisions to be made by each individual.”

Catering to the specific needs of that individual customer is another strength of well-run alcohol ecommerce platforms – whether it is offering small tasting samples so people can “try before they buy”, or having an increasingly broad range of bespoke services and gifting options, such as bottle engraving, tasting events, subscription programmes, and the opportunity for people to blend their own whisky or cask-age their cocktail.

As with the breadth of product offer and the availability of limited edition or exclusive bottlings, these personalised services play a crucial role in helping specialist ecommerce platforms to develop a clear point of difference versus alternatives such as online grocers or marketplaces. A broad programme of consumer engagement is also vital in terms of attracting and retaining new customers.

“The opportunity we have in the digital space to introduce niche and new products into the market and to use our social media and video/content tools to do so, is our ‘superpower’ as consumers increasingly demand products that speak to them in clever and engaging ways,” says Simmons.

“Being online, there can be no real-world parallel. We are a ‘shelfless’ platform, meaning we are not limited by space in a given bricks-and-mortar retailer, which enables us to give an enormous amount of choice to consumers and speak to them in depth about each product.”

The reopening of the on-trade and the return to something approaching pre-pandemic normality is bringing some degree of correction back towards the trends of 2019 – which raises the question of how many of the consumers who have discovered specialist alcohol ecommerce platforms over the course of multiple lockdowns will remain loyal to them in the longer term.

“Whether it is gifting or breadth of range or the spirit of discovery, ecommerce has displayed its value to consumers over this past 18 months, and the learnings from those benefits will not fade fast,” argues Simmons.

“The future of drinks ecommerce is all about consumer experience, engaging them with brands, and joining them on a flavour journey as peers.”

[table id=10 responsive=stack /]

You may also be interested in reading:

The US and China offer resilience and opportunity for drinks groups

5 key trends that will shape the global beverage alcohol market in 2021

New technology drives ecommerce innovation in the US

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Digitalisation |