15/06/2023

What are tequila’s prospects outside of the US?

Tequila is poised for growth in markets such as Canada, the UK, Colombia and Australia

The persistent focus on tequila’s dominant market is cemented by current constraints on the supply of agave, with prices remaining high as sales of super-premium-and-above tequila continue to rise in the US.

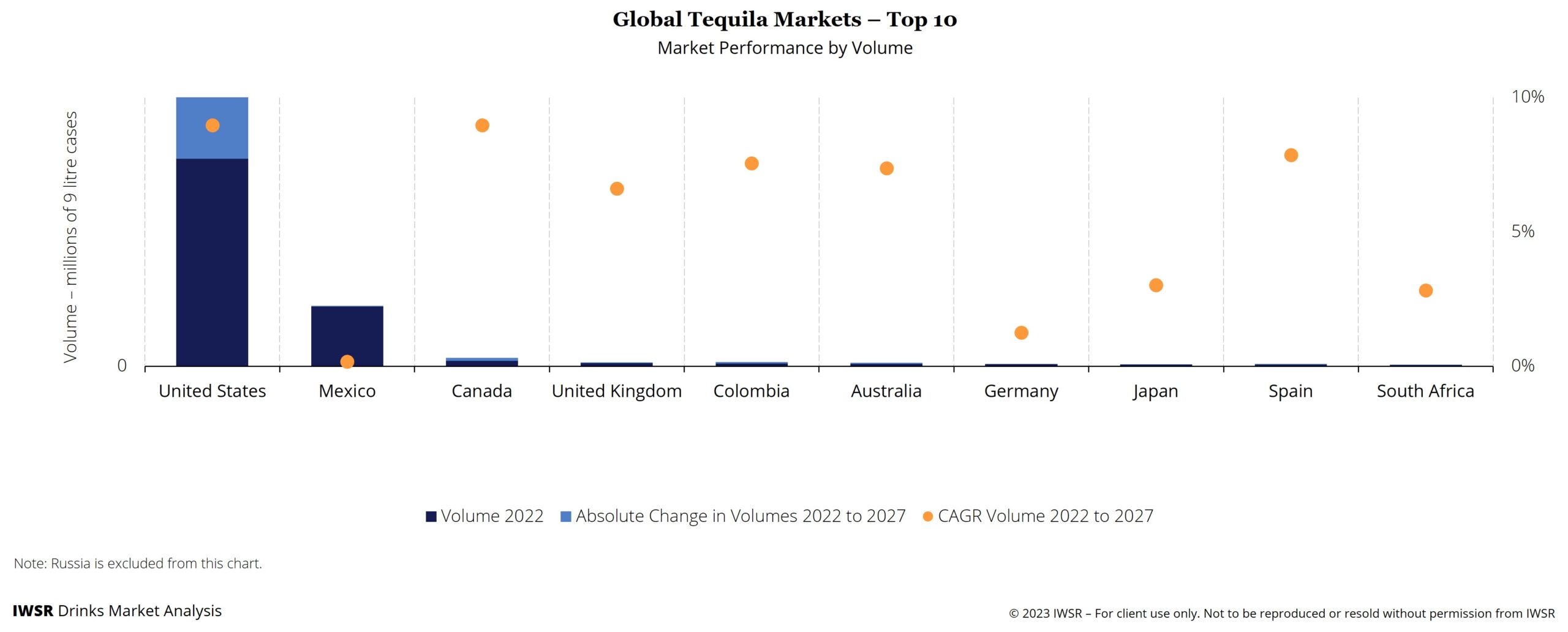

IWSR forecasts that, while international markets such as Canada, the UK, Colombia and Australia are poised for growth in the years ahead, each with expected volume CAGR growth of between 7% and 9%, 2022-27, gains in the US will continue to outstrip overall category expansion.

While global tequila volumes are set to rise at a compound annual growth rate (CAGR) of +7% between 2022 and 2027, the US is poised to grow at a CAGR of +9% over the same period.

Furthermore, 85% of the world’s tequila is consumed in the US and Mexico – although IWSR forecasts a consumption decline in the latter – and, during 2023, tequila is expected to become the most valuable spirits sub-category in the US, overtaking vodka and US whiskey.

“There is no real incentive for brand owners to invest in countries further away if they can make money closer to home,” points out Jose Luis Hermoso, IWSR research director. “While tequila continues to be strong in the US, this market will take priority over anything else – and we have seen this in the last couple of years, with some brands limiting supply to certain markets in order to feed liquid to the US.”

High-end tequila’s continued expansion in the US has confounded brand owner forecasts and frustrated their hopes that agave prices would have softened appreciably by now. As long as consumption continues to grow at this pace, agave supplies will be constrained, inflating prices.

This in turn limits the expansion opportunities of brands into other, developing markets for tequila. “Whilst we are currently constrained on tequila, we are able to support the strong double-digit growth of Espolòn in the US, and look forward to substantial additional capacity coming online in the second half of the year [2023], which would allow us also to support the international expansion of the brand,” explains Campari CEO Bob Kunze-Concewitz.

The industry consensus is that agave prices will gradually begin to soften during 2023 – but any downward trend could be limited if tequila consumption in the US continues to surge, at least in the short term.

“I think we are now on a slight downward trend in terms of the cost of agave,” says Michael Merolli, CEO of Pernod Ricard’s House of Tequila, covering brands such as Olmeca, Altos, Avión and Codigo 1530.

Pernod Ricard and others in the industry have been busy planting their own agave in order to ease future supply volatility; Pernod will start using this for the first time in 2023, says Merolli. “In the coming years, we are quite confident that the [agave] prices are going to come down,” he adds.

However, despite the continued strong focus on the US market, brand owners are keen to expand into other territories when they can. Kunze-Concewitz adds,“Australia is a major growth market, and … we see a lot of positive momentum in Mexico with the development of the cristalino segment for Espolòn.

“This is also why we are accelerating our medium-term capex across the supply chain to overall double capacity for our key categories, including tequila, and to be able to better support all our priorities around the globe.”

At Bacardi-owned Patrón, president and COO Mauricio Vergara Herrera is bullish about the prospects for Australia – another market which the IWSR expects to register consumption growth over the next few years.

“Australia is one of the markets that carries a lot of influence in Asian markets,” he points out. “With tequila becoming more and more popular, together with other global trends, we expect Asia to follow the global and growing popularity of tequila.

“In Asia, the penetration is lower compared to Europe, but nevertheless we also see significant potential that can’t be ignored.” Markets such as China and India are already showing early signs of interest in agave spirits.

Among European markets, Dan Mettyear, IWSR research director EMEA, highlights strong growth for tequila in the UK, as well as in other markets, such as Spain. Standard-and-above tequila in Spain is buoyed by the adoption of the Margarita and the targeting of the bottle serve occasion in high-end venues in Ibiza, Marbella, Madrid and Barcelona – previously the preserve of luxury vodka.

“There has been a real boom in Mexican cuisine and culture in Spain,” Mettyear says. “Tequila has grown alongside this and is premiumising very fast, aided by the top-end trend migrating over from the US. Tequila has gone from a cheap shot to one of the most dynamic categories in the market, with lots of new premium brands coming in.”

However, he advises caution when analysing tequila’s strong volume gains in the region. “Much of the growth we are seeing in European countries such as Spain, France and Germany is made up of bulk exports for the local bottling and re-exporting of inexpensive tequila to Central America, the Caribbean and elsewhere,” he says. “There is also some premium tequila growth in Europe, but off a very small base.”

However promising international markets for tequila may be, for the moment they cannot come close to matching the scale and lucrative lure of the US. Marina Wilson, president of Espanita Tequila Company, points out that tequila’s success Stateside is the result of decades of hard work from trade bodies and brand owners to transform consumer perceptions of the category.

This has created a new level of appreciation for tequila among the American population, Wilson adds. “Until these trends fully develop in other markets, producers will remain largely attuned to supplying the needs of the US market,” she concludes.

You may also be interested in reading:

Global beverage alcohol shows subdued growth 2022-2027, whilst value outlook is more positive

Consumer confidence in the US remains broadly positive

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Spirits | MARKET: All, North America | TREND: All |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.