This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

01/08/2022

A focus on value over volume will drive growth across beverage alcohol

IWSR data shows that pricing strategies by category, demographic and market will be more critical than ever for 1–5-year business growth plans.

In an increasingly complex and nuanced total beverage alcohol (TBA) space, brand owners will need to sharpen their focus on value in order to generate meaningful growth in the future. IWSR data shows that spirits are uniquely well-equipped to drive premiumisation through higher-priced products – but beer and wine brands can also benefit from the ‘drinking less, but better’ trend.

However, trends vary across different categories and regions, making detailed local knowledge of the marketplace increasingly vital – and there is currently a high degree of uncertainty surrounding the effects of rising inflation around the world and its impact on consumer spending power.

According to IWSR data, spirits has been the clear winner when it comes to value generation over the past few years: the average global price per serving for spirits (excluding national spirits such as baijiu) rose at a CAGR of +3.8% between 2016 and 2021, ahead of wine (+3.4%), beer (+2.3%), RTDs (+1.4%) and cider (+1.1%).

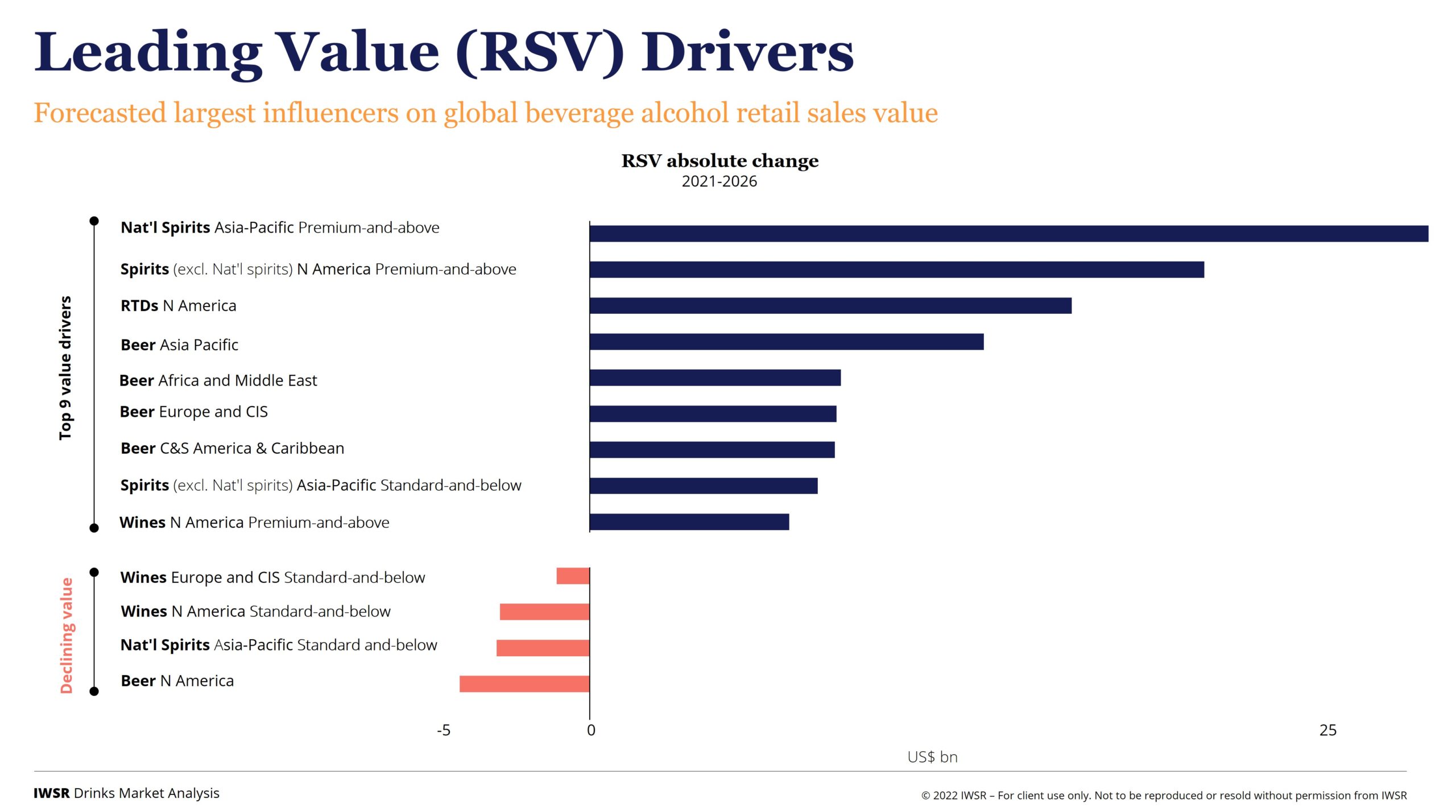

IWSR forecasts suggest that this trend will continue in the years ahead, although the picture is more complex than might first appear. Spirits’ share of the TBA value pool is predicted to rise from 35% in 2021 to 42% in 2026, overtaking beer, wine and RTDs in the process. However, the numbers are skewed by the huge increases in premium-and-above baijiu sales in China. Stripping out national products – most of which is accounted for by baijiu – spirits’ global value share is set to rise from 23% to 27% (2021-26).

Nonetheless, spirits are set to gain value share in every region of the world over the next five years, except for the CIS countries, where the number will remain steady. “One of the advantages enjoyed by spirits is the very wide differential between low-priced and standard products at one end of the pricing spectrum, and super-premium, ultra-premium and above at the other,” observes Emily Neill, IWSR COO research & operations.

“With beer, by contrast, this price differential between standard products and high-value products is smaller. International spirits categories such as whisky, rum, tequila and gin have more of a runway to premiumise.”

However, the signs are more positive for beer when it comes to the future evolution of global servings by category volume – or “share of throat”. Here, IWSR forecasts that equivalent serves of beer will rise at a CAGR of +1.3% between 2021-26 (or +1.6% including cider and RTDs), leading to a change in category share of +0.4% (+1.2% including cider and RTDs). Spirits’ CAGR increase of +1% equates to a category share loss of -0.2%, with wine predicted to decline at a CAGR of -0.2% (category share loss of -0.9%).

This disconnect between value and volume for beer is explained by the fact that category growth is mostly occurring in developing countries across Africa, South America and Southeast Asia, where average prices are lower in US dollar terms. Meanwhile, says Neill, many mature beer markets across North America and Europe – where prices are typically higher – are in decline.

The value share declines for wine – all regions are forecast by IWSR to show wine’s value share shrinking, except for South America and the CIS – disguise an underlying premiumisation trend that has taken root in many markets.

“Wine can premiumise more, and we are indeed seeing a marked ‘less but better’ trend for wine across many regions. However the big volume markets for wine – such as the US, France and Italy – are in decline.”

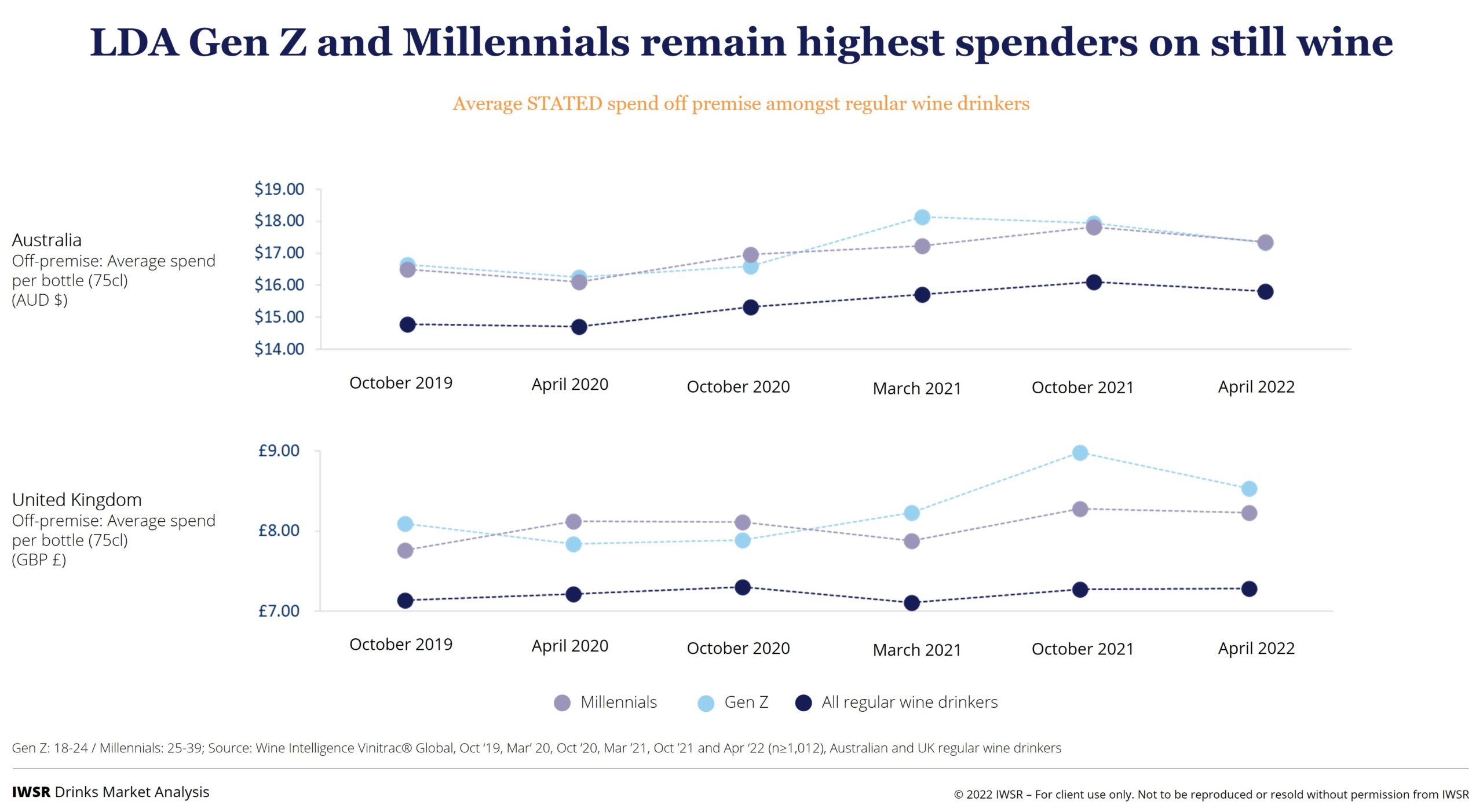

In these markets, a generational shift is reducing routine, everyday consumption of lower-priced wines among older consumers. Younger LDA generations don’t tend to do that, but when they do buy wine, they spend more on a nice bottle.

Consumer research in the UK and Australia shows that millennial and legal-aged Gen Z regular wine drinkers spend more per bottle than older generations on still wine, so the consumption behaviour of younger LDA wine consumers is pushing lower volumes, but higher prices per bottle. However, the steep volume declines are overriding the premiumisation trend in global terms.

At a time of greater economic uncertainty, companies across the beverage alcohol landscape are wrestling with a number of issues, such as inflation, rising costs and persistent supply chain pressures, including shipping delays and price hikes in raw materials and packaging.

“The upward trend for premium-plus spirits in North America has been very significant throughout the Covid-19 pandemic,” says Neill. “Now it’s a question of how long that will continue, depending on the strength of the US economy. There’s quite a lot of uncertainty at the moment, but we are still seeing plenty of demand for products such as high-end tequila and whisky.”

Despite this, the prioritisation of value is likely to remain a dominant trend for beverage alcohol brand owners in the years to come. “A lot of the growth across all TBA will come from premiumisation. Brewers, particularly in mature markets, will get growth by premiumising. With wine, focusing on the more premium end of the market is going to be increasingly important,” says Neill.

“One of the challenges is not to lose sight of this strategy in terms of focusing on premium – and where you do that, given that the on-trade is still quite challenged in many places – while still dealing with difficult operational issues and rising costs.”

Pricing strategies by category, demographic and market will be more critical than ever for 1–5-year business growth plans.

You may also be interested in reading:

Global beverage alcohol rebounds, with value reaching US$1.17 trillion

Key trends driving the global beverage alcohol drinks industry in 2022

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All, Premiumisation |