This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

18/11/2024

Beer premiumisation trends in the US

IWSR US Navigator highlights the mixed performance of premium-and-above beer in the US

Beer’s nationwide volume fall of -3.6% (Jan to Aug 2024 vs 2023) is reflected in a fairly consistent picture across the US, with almost all states in decline.

Performance within the biggest beer markets was mixed, with some declining below the national average of -3.6% such as Florida, Texas and New York, while others fared worse, such as California, Ohio and Georgia. Indiana was the only state in the US that saw any growth in ’24 (+0.5% Jan-Aug vs. prior year).

This latest data comes from IWSR US Navigator, the industry’s only trusted source of monthly volume data for the total US beverage alcohol market — across wine, spirits, beer, cider, RTDs and no-alcohol — by price tier, for all 50 states going back to 2019, based on highly accurate local tax office data.

“The challenges facing the beer industry in the U.S. stem from a number of factors. While no single factor stands out as the primary cause, most of them have generally pushed the category in a negative direction,” comments Marten Lodewijks, President of IWSR’s US Division.

“It’s challenging to make definitive conclusions about beer performance at the state level, as each state has unique dynamics. However, in general, states that performed better tended to experience stronger growth within higher price tiers.”

Super-Premium beer stands out

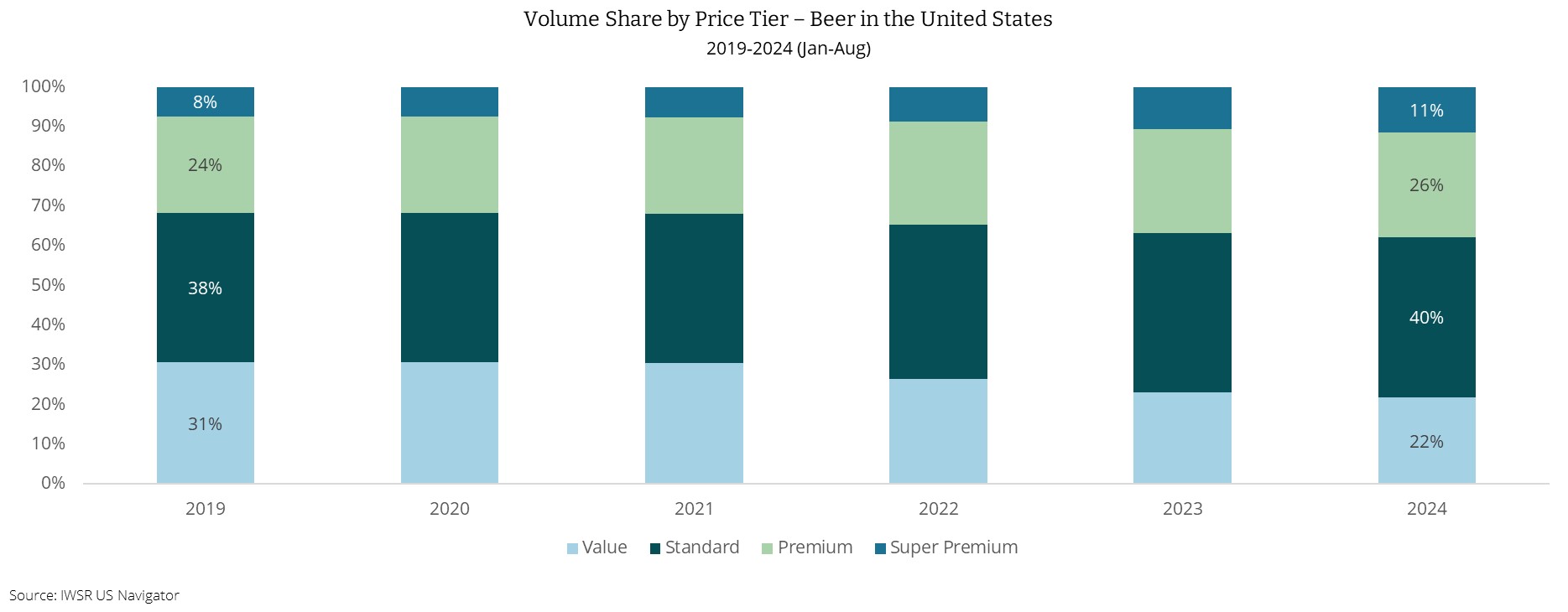

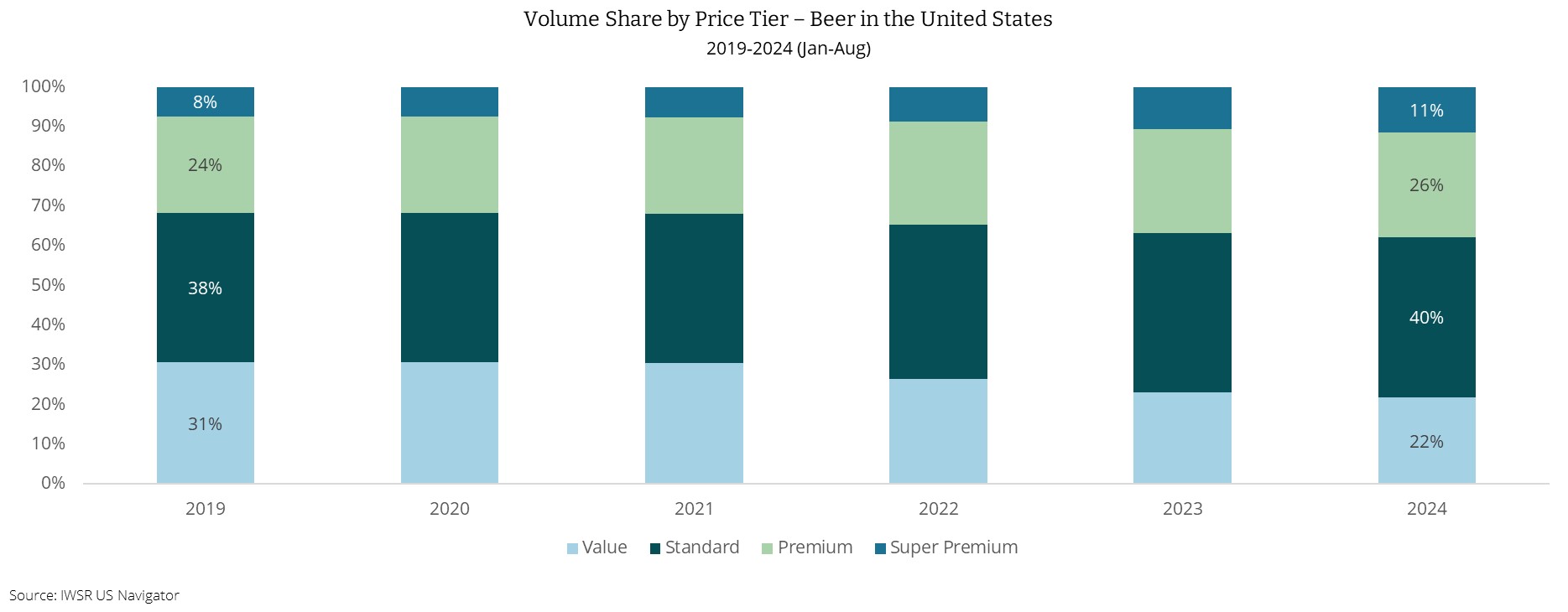

Although Premium-and-above beer shows declines of -1% (Jan to Aug), the Super-premium segment is growing by +4%.

Super-premium beer has been growing by high single digits in the US’s top 5 beer markets of California, Texas, Florida, New York and Illinois, and is helping to soften some of the declines in Standard beer. Double digit growth was seen in many states including Nevada, Indiana, Texas and Maryland.

The relatively more positive performance of Premium+ beers is largely being driven by the affordability trend, as consumer occasions evolve and consumers seek cheaper alternatives to spirits or other drinks categories. This trend will likely continue into the year ahead.

“Consumers still get a sense of premiumisation while spending less out-of-pocket for a premium beer vs. a premium wine or spirit,” comments Lodewjiks.

Growth of imported products (mainly from Mexico but not exclusively), is also taking share from domestic products. Imported brands tend to also skew towards Super-premium.

Losses in Value segments drag down overall beer market

Growth in Premium+ tiers is coming at the cost of all lower price segments, driving down total beer volumes.

Most major states are seeing significant declines in the Value price tier. California, Illinois, Florida and Wisconsin are amongst the largest markets that saw double digit volume declines in the Value segment.

The key difference between California, which experienced a larger overall loss, and states like Florida and Texas, with smaller losses, is that Florida and Texas also saw growth in the Premium price tier, which California did not. This growth in Premium-and-above beer helped Florida and Texas offset losses from their rapidly declining Standard and Value segments.

Part of this is due to ongoing premiumisation, not just within beer but across beverage alcohol, and is also likely driven by consumers downtrading from more expensive categories into beer.

“Going forward, as long as consumers feel pressured by prices both within and beyond the beverage alcohol sector, it’s likely that premium beer will keep performing well due to its lower out-of-pocket cost compared to other categories,” comments Lodewijks. “The underlying consumer demand for more premium offerings will always be relevant.”

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Beer & Cider | MARKET: North America | TREND: Premiumisation |