This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

23/09/2021

Brewers turn to product diversification to secure long-term growth in the US

IWSR analyses the outlook of the beer industry in the US

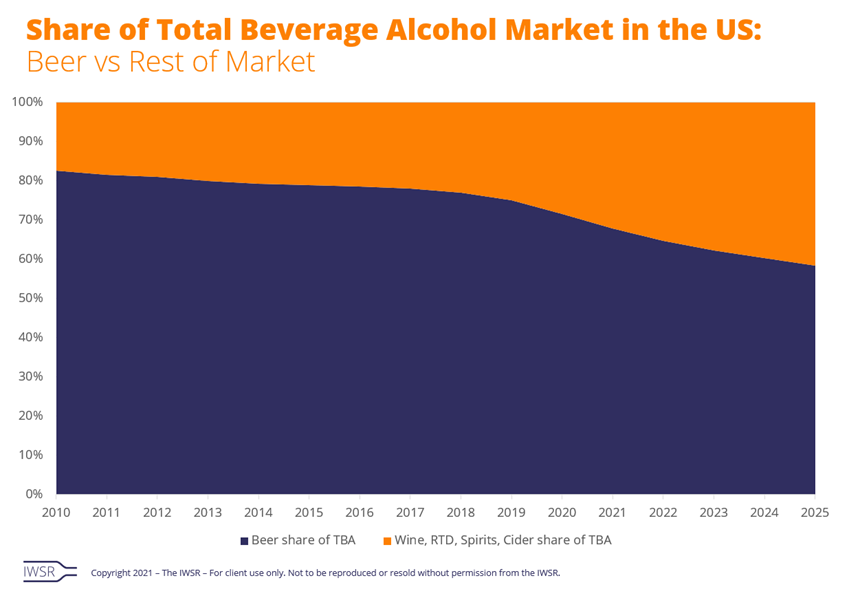

Over the past few decades, beer’s share of total beverage alcohol volume in the US has fallen from 87% in 1990 to 72% in 2020, according to IWSR data. Among the competing factors which explain this decline, the most significant has been the sheer number of beverage alcohol products brought to market.

Consumption occasions and category switching

Brand launches over the past decade have increasingly aligned product attributes and branding with a consumer mindset centred around the drinking occasion. What consumers used to consider a ‘beer occasion’ may now be perceived as much more open to new categories: a hard seltzer on the golf course, beer with lunch, a cocktail before dinner, a glass of red paired with the evening meal, and a whisky before bed, for example.

Recognising that demand has spread into other categories, breweries began moving into this broader consumer consideration at retail. New products have been launched in categories such as hard seltzers; hard teas, kombuchas and coffees; CBD and THC-infused drinks (where legal); spirits innovations in brewstilleries; and new wine and cider beverages.

While volumes of these products are not attributable to beer alone, their contribution to the bottom line is considerable. It follows that breweries will perform better than the beer category overall given their investment in adjacency products that converge existing brands with innovations – primarily in the RTD category. This approach helps drive growth of topline profitability, even as total beer volumes continue to decline. Growth, however, is subjective: from the producer’s perspective, selling more product than last year is ‘growth’ regardless of the categories in which that growth occurs.

Although traditional beer will likely remain the primary focus for the majority of brewers, some have seen that demand for beverages other than beer has driven RTD volumes to outperform their traditional beer offerings.

Industry investment

AB InBev recognised this shift in 2016 when they announced increased investment in their Beyond Beer portfolio. This suite of beverages consists of products such as canned wine, hard seltzers, prepared cocktails and FMBs; for example, AB InBev’s acquisition of Babe Wine, known for their canned rose, Cutwater Spirits known for their spirit-based RTD line and Kombrewcha hard kombucha.

Other large brewing companies have also turned their attentions away from traditional beer. Molson Coors have launched the Coors Whiskey Company, which takes advantage of Coors beer’s malt base. The company has also dropped “Brewing Company” from its corporate name and is now the Molson Coors Beverage Company. Molson Coors has invested in non-alcoholic beverage categories such as Zoa Energy, an energy drink created by a team that includes Dwayne “The Rock” Johnson, as well.

Pabst Brewing have also released various brands under the Pabst label including a whiskey, hard coffee, hard tea and hard seltzer. Boston Beer have launched RTD brands Truly hard seltzer and Twisted Tea.

As beer forges ahead into new territory, incumbent value-priced beer brands – once the mainstay of the beer industry – are under review to assess if there is enough demand to justify their continuation. Molson Coors made the first large-scale move to focus more on streamlining and premiumising their portfolio by discontinuing 11 beer brands which make up 100 SKUs. It is expected that other breweries will follow suit and will discontinue brands no longer in demand to focus on priority brands and investing in further innovation.

Pockets of growth

Even though brewers have pivoted into producing brands in categories other than traditional beer, pockets of growth exist within the beer category. These sub-categories will seed the future growth of the beer industry: sour beer is a nascent development which is being nurtured for robust growth in future years through education and trial. Hops will also increasingly take on a showcasing role in a similar way to how grapes are used in wine varietals. Consumers demanding healthier alternatives are driving the development of the no-alcohol beer movement compounded by newer, more premium offerings that focus on flavour.

In parallel, brewers are releasing lower-ABV versions of their flagship beer brands to provide consumers another ‘better-for-you’ option while staying within the brand family. Hazy IPAs of varying ABVs and full of flavour continue to excite the industry. Some external factors, however, still need to be addressed – hazy brews, for example, are supposed to be consumed as close to the born-on date as possible and kept cold. This is a challenge that breweries have yet to overcome, as is the vast number of similar beers competing for limited refrigerator shelf space.

Compared to other categories such as whisky, gin, tequila and wine, celebrity endorsement and influencers are conspicuous by their absence in beer. It is expected that brewers will recruit well-known celebrities to strengthen the social media bond between the brand and its consumers. The industry has been entertained by successful collaborations between Matthew McConaughey and Wild Turkey; Ryan Reynolds and Aviation; George Clooney and Casamigos; and Sarah Jessica Parker and Invio X wine, to name a few. In addition, since the beer category under-indexes in the ecommerce space, the industry is expected to develop the grocery delivery channel so that beer is delivered cold.

From a local perspective, the beer industry retains a distinct advantage over competing categories through neighborhood brewpubs. These establishments allow not only for the freshest beer on draft, but also offer experiences such as sampling experimental flights, meeting expert brewers, observing the operation of tanks and fermenters, and mixing with fellow brewhounds in a hyper-local setting.

Brewery-produced RTD brands aside, it is expected that the beer category in the US will inevitably achieve balance through the culling of underperforming brands and greater attention on priority brands and innovation.

You may also be interested in reading:

When does celebrity endorsement work in beverage alcohol?

Vodka’s premiumisation challenges and convergence with hard seltzers

Hard seltzers are evolving, not dying

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Beer & Cider | MARKET: All, North America | TREND: All |