This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

07/09/2022

Economic tensions are high. What does this mean for premium beverage alcohol in the US?

New IWSR analysis shows that despite inflation rising around the world, there could be reasons for optimism among premium alcohol brand owners

Alcohol consumption in the US has been relatively stable over the past 40 years despite economic ups and downs in the country; total beverage alcohol consumption in the US shows a +0.51% volume CAGR, 1980-2020. As we enter a new period of economic instability, what will this mean specifically for premium-and-above alcohol in the US? How will inflation likely impact consumption?

Intuition might suggest that as prices rise, consumers are likely to downgrade their alcohol choices. However, new IWSR findings suggest this may not be the case.

Other external factors also play a role in shaping the future of the industry, as analysis of one key market – the US – illustrates.

The relationship between GDP, inflation and beverage alcohol consumption in the US

Real GDP plays a significant part in beverage alcohol consumption and is the best predictor of TBA volume overall. While disposable income is positively correlated to GDP in the US, the relationship between premium-and-above beverage alcohol consumption and disposable income has weakened in sensitivity over the years. This is largely due to consumers having more choice on where to spend disposable income.

2020 was an exception to this trend, with volume consumption of premium-and-above offerings rising despite negative GDP rates. This can be explained by the Covid-19 lockdowns curtailing spending options, leading to a rise in at-home consumption and the quality of alcohol experiences at home.

How does inflation impact volume consumption of beer, wine and spirits in the US?

The impact of price fluctuations on volume consumption of beer, spirits and wines differs across the individual categories.

Spirits volumes are only mildly impacted by inflation, while wine and beer do not present a reliable pattern of growth or decline due to inflation in the US. As spirits prices rise – shown by an increasing CPI for the category – volume growth can be negatively impacted. This relationship is much stronger for spirits than it is for wine or beer, due to spirits’ wider and higher range of prices. In other words, a 10% rise in beer prices may still be an increase under $1.00, which does not appear to be too detrimental for consumers’ purchasing decisions.

Beer volumes, on the other hand, are less impacted by price movements. Instead, beer appears to be affected by price changes of wine. IWSR analysis shows that beer volumes and wine prices are positively correlated to a certain degree. Additionally, CPI changes in wine impact the volume consumption of beer. Spirits, on the other hand, have proven to be more immune to cross-category competitiveness over the last decade.

Alcohol premiumisation can show resilience during and after recessions

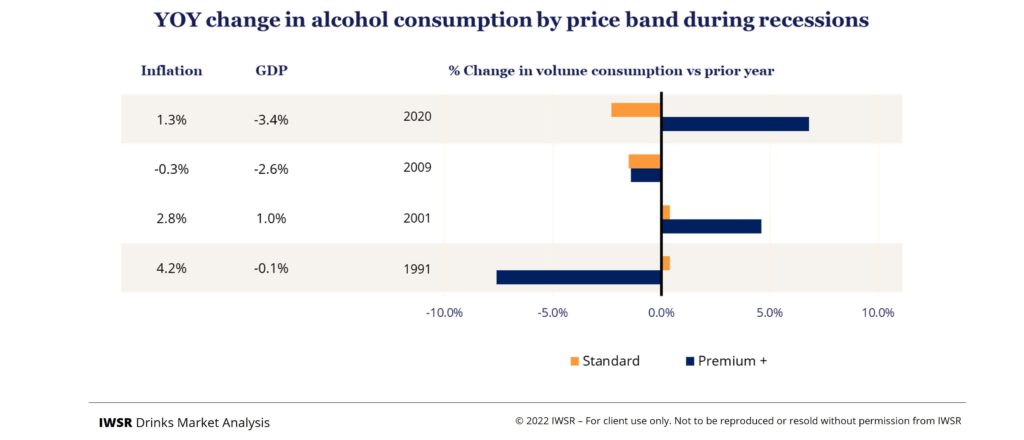

IWSR analysis indicates that there is not a consistent pattern for premium-and-above alcohol consumption during recessionary periods; the market reacted differently to premiumisation during the four most recent recessions (around 1991, 2001, 2008 and 2020).

In 2020, for example, alcohol premiumised even though GDP rates were negative. In 1991, however, volume consumption of premium-and-above alcohol declined against the context of a stagnant economy and fewer options for premium-and-above wines and spirits.

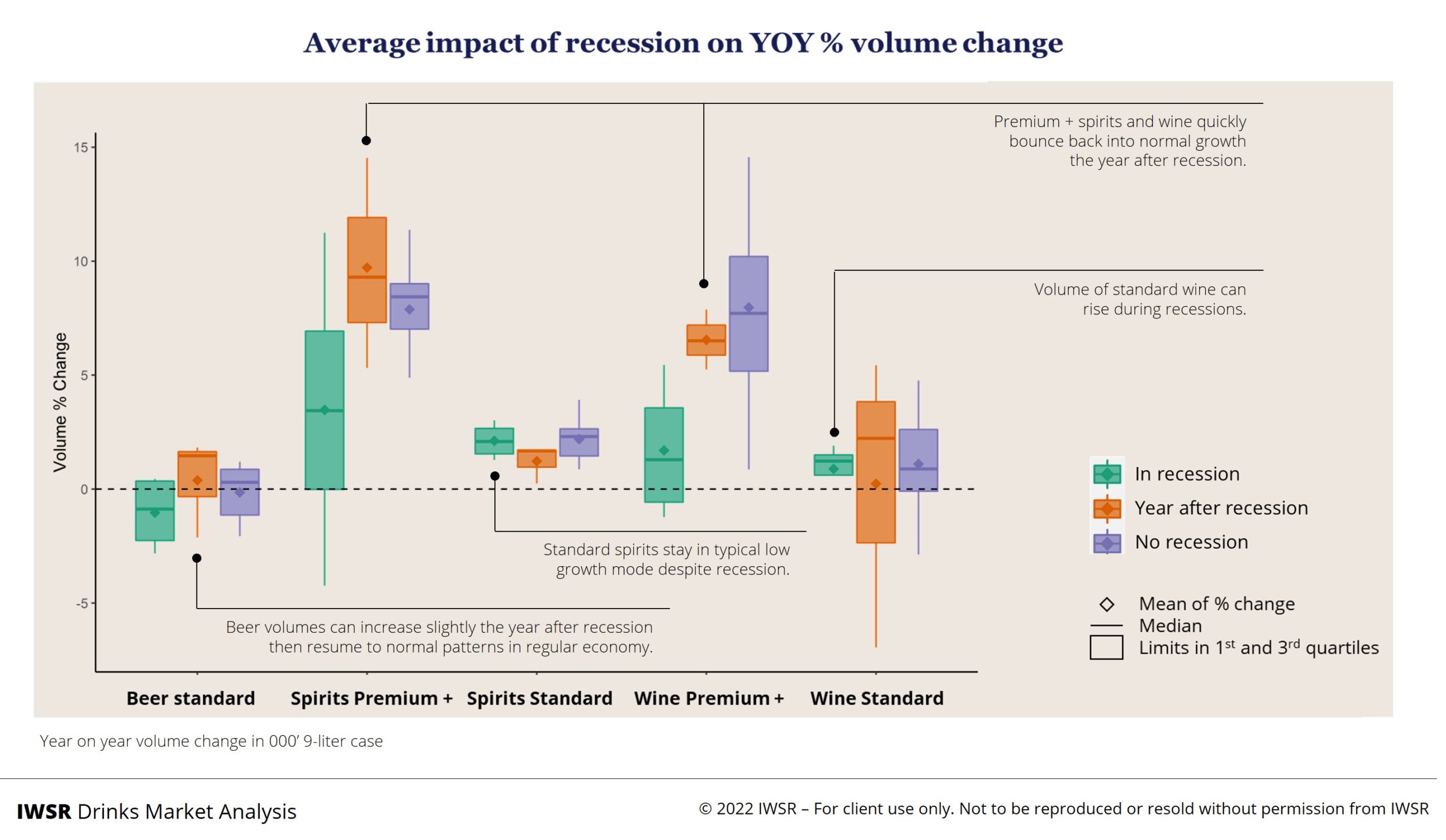

In general, volumes of spirits and wines in the standard-price segment continue to grow during recessions. There is more variation within premium-and-above wines and spirits, however, on average, they tend to stay on slower, but positive, volume growth paths.

In the year after a recession, IWSR analysis shows that premium-and-above wines and spirits tend to resume normal growth trajectories. Beer and standard-priced spirits grow at a similar pace, then return to their distinct growth patterns of non-recessionary periods.

Mitigating risks in the current economic climate

Based on historical trends, consumer interest in premium-and-above alcohol should maintain growth in the years that follow a recession in the US.

At a macro level, one period of comparison is the recession of 2008/9. It had similar conditions of globalisation and competitiveness as today. It was followed by a second period of economic tension in 2011. Similarly, we are experiencing another year of economic tension in 2022, if the IMF’s April forecasts of GDP and inflation are correct.

The good news is that 2011 saw a surge of premiumisation. Even though GDP, at 1.6%, was below inflation at 3.14%, the rate of employment in the US had begun to turn a corner. Interest in premium-and-above spirits, particularly rye-based spirits, 100% agave offerings, US single malt, and high-end bourbon, started to take off.

This premiumisation – or something similar – could happen again. However, as before, external factors will also influence the direction of the market. Alcohol premiumisation could slow down in the short-term while fuel and food prices rise. Other factors related to consumer spending pressure include in-home versus out-of-home consumption of alcohol and price rationalisation.

The dynamics of 2020 and 2021 were also quite different from the conditions in 2022. In 2022, we have seen broader consumer spending on other categories, now that there are fewer restrictions on travel; people going back to the office and to school; and greater socialisation out of the home. Higher interest rates also challenge disposable income.

The current trend towards moderation, and the growing interest in alcohol adjacencies, provides further context. Overall demand for alcohol is not expected to increase significantly in the next few years. Therefore, portfolio diversification and increased investment in spirits categories might represent the most interesting opportunity for alcohol producers. Although this could represent cannibalisation to some extent, it may be a necessary move to maintain consumers’ interest and manage risk.

To read the full analysis, clients of IWSR’s US Beverage Alcohol Review (US BAR) database, can access the findings via the Reports section on the US BAR homepage.

You may also be interested in reading:

Drinks companies diversify as category lines blur

Cocktail culture is driving the evolution of the spirit-based RTD segment in the US

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2022 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All, North America | TREND: All, Premiumisation |