This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

16/03/2022

Fewer younger LDA drinkers are entering the wine category – does it matter?

As wine faces increasing competition, brand owners need to engage an evolving audience

A lot of recent media attention has focused on the demographic shifts in the wine category: fewer new drinkers are entering the wine category, particularly from the younger LDA age groups.

Consumer research data from Wine Intelligence, a division of IWSR Group, shows that participation rates in wine (defined as the % of a given age group who say they drink wine at least once a month) among the LDA-34 age group endured a steady slide over the 10-year period from 2010-2020. This was true across a number of markets, in particular the US, UK, Sweden and Japan, whilst noting that there were some exceptions where participation rates rose or remained stable, such as in South Korea and Canada.

The biggest changes can be found in the UK and US: in 2010, around half of UK adults in LDA-34 drank wine once a month, and by 2020 this fell to 26%; in the US, the corresponding fall was 36% to 21%. During the same period, participation rates of wine drinkers among the Boomer generation rose in both markets.

“Many industry stakeholders believe that wine isn’t connecting with the mainstream of younger LDA adult consumers as well as it could, and the pandemic has both accelerated and exposed this,” comments Richard Halstead, COO Wine Intelligence, a division of IWSR Group. “The on-premise was a key channel for consumption of wine at social settings amongst younger LDA consumers prior to Covid. Shutting down the on-premise during lockdowns closed off a key channel for these consumers to encounter wine.”

The moderation trend is also leading to a narrowing of beverage repertoires among wine drinkers. “With consumers not drinking as often, when they do, they tend to choose their favourites over something they rarely drink,” comments Halstead.

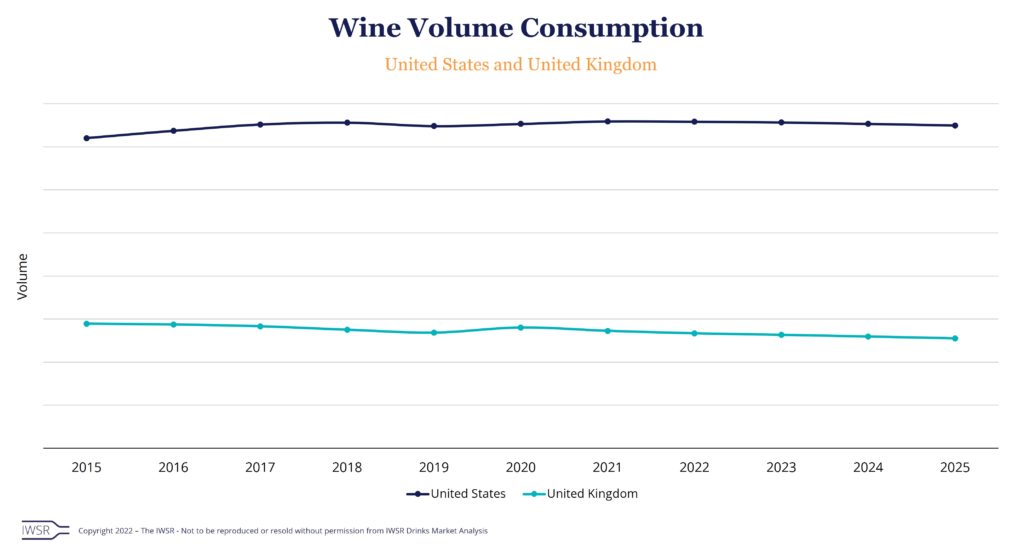

“Wine is facing increased competition from spirits and hard seltzers, especially in the US. Even though the wine category in the US holds an 11% volume share – equal to that of spirits – wine volumes are expected to continue on a downward trajectory,” notes Brandy Rand, COO Americas, IWSR Drinks Market Analysis.

“Recent wine launches, such as Fitvine (Fitvine), Kendall Jackson Avant (Jackson Family Wines), BABE 100 (AB InBev), Bota Box Breeze (Delicato), Cupcake Light Hearted (The Wine Group), and Kim Crawford Illuminate (Constellation), have increasingly focused on health and wellness attributes, as well as more convenient and portable packaging, in order to help generate interest in the wine category,” adds Rand.

Similar factors are influencing the UK wine consumer as well, says Humphrey Serjeantson, Research Director, IWSR Drinks Market Analysis. “In the UK, 2020 saw its first year of growth for still wine volumes in over a decade. However, the still wine category will adjust downwards. Even though the prospects for wine are more positive than they were before the pandemic, recruitment into the category has been a long-term challenge for the UK,” notes Serjeantson. “Competition from other categories is strong, young LDA consumers are more likely to abstain from alcohol entirely or to drink across a wider range of categories than their parents, and the reopening of the on-premise will give more of a boost to other categories as well.”

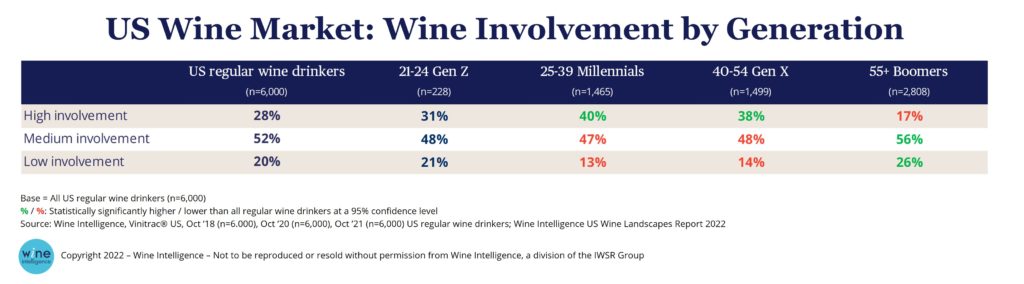

Wine Intelligence insights do however point to a silver lining: those younger LDA adults who are connecting with wine tend to be more engaged, enthusiastic, and above all high-spending, especially compared with older Boomers.

This suggests a future of wine ceding ground to other categories as a mainstream, accessibly-priced beverage, whilst retaining and building its premium consumer base – those who are drinking less, but want to have a special product when they do buy wine.

This view is also reflected in the long-term strategies of some larger wine producers who have shifted focus to the premium-end of their portfolios. In 2019, for example, Constellation Brands announced it would be selling off many of its lower-end wine brands – mostly those that cost under $11 a bottle – to E&J Gallo. In 2021, Delicato Family Wines completed on its purchase of the Francis Ford Coppola winery, and Treasury Wine Estates also announced its acquisition of Napa Valley luxury winery, Frank Family Vineyards.

Although the wine drinking population in the US & UK is skewing older, wine brand owners would be remiss to discount younger LDA consumers entirely. “Many people in these age groups will likely carry on learning, experimenting, discovering and expanding their drinking repertoires over the years,” notes Halstead. Behavioural scientific research reflects this evolution in consumer habits over time as well, as is noted in ‘The 100 Year Life’, published by Linda Grattan and Andrew Scott of London Business School in 2016.

Wine brand owners should look to simplify the wine education process to help engage consumers who are not sure if wine is for them anymore. Similarly, changes in consumer priorities and habits mean that wine brand owners need to re-engage with an audience that’s increasingly older and more affluent, and one that is seeking more premium and interesting wines.

[table id=11 responsive=stack /]

You may also be interested in reading:

Drinks companies diversify as category lines blur

Key trends driving the global beverage alcohol drinks industry in 2022

No- and low-alcohol in key global markets reaches almost US$10 billion in value

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Wine | MARKET: All | TREND: All |