This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

01/11/2024

Florida shows largest gains in rum premiumisation in the US

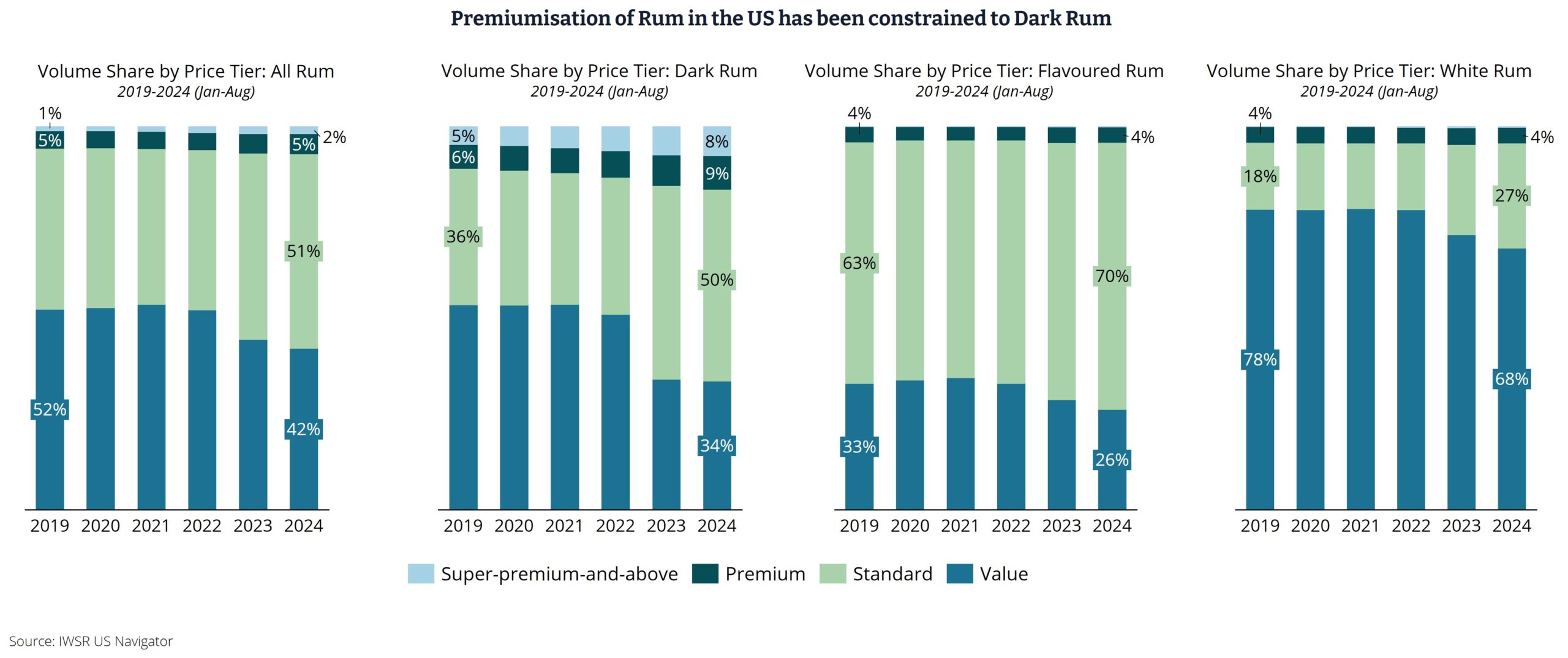

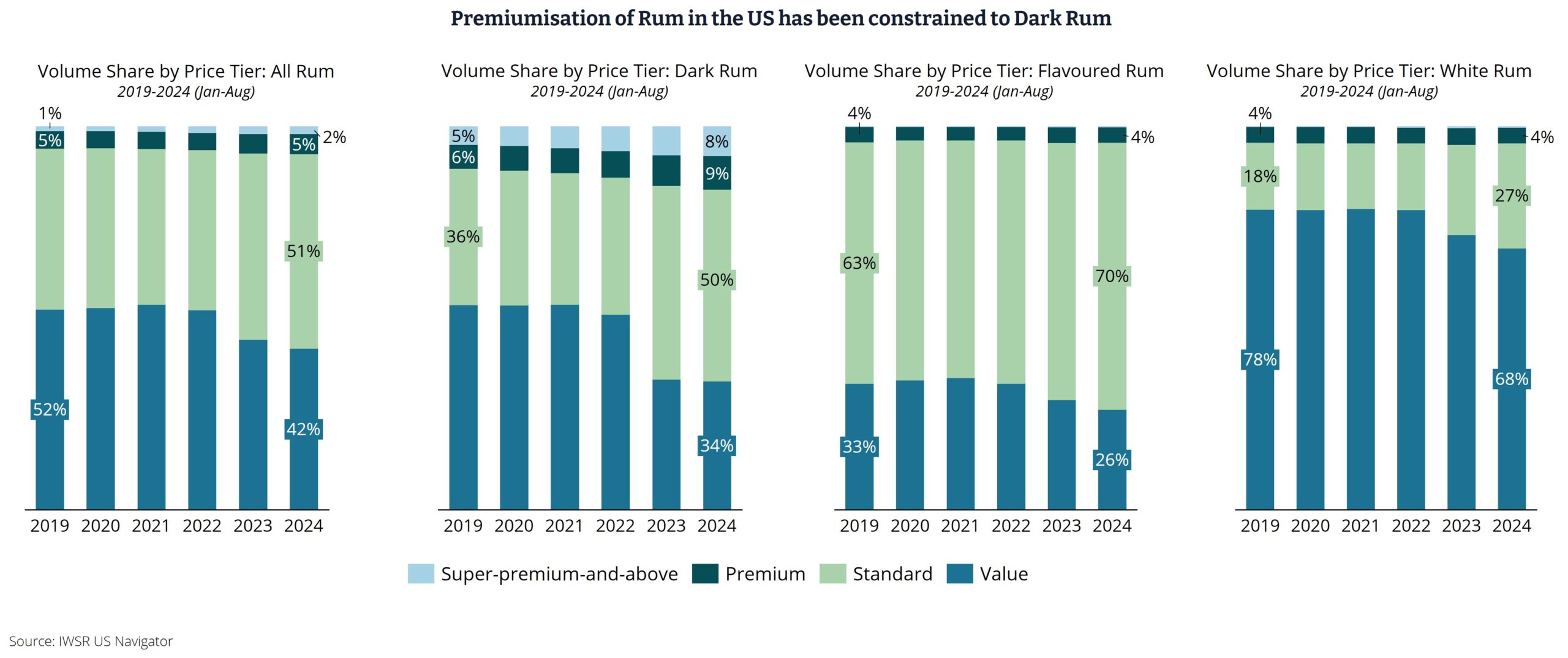

IWSR US Navigator data shows nationwide rum premiumisation trend is constrained to dark rum

Rum has seen mixed, but generally underwhelming, performance over the past few years in the US.

When looking at Jan-Aug performance in previous years: The pandemic ‘bump’ that the category received was a modest +4% 2019-2020 and +2% 2020-2021 (compared to total spirits which saw 5% growth for both years). Rum then slipped into decline from 2022 to YTD.

This downward volume trend for rum holds broadly true for all its sub-categories — dark rum, white rum and flavoured. Declines have been slightly worse for flavoured rum, which is the largest sub-category, accounting for 43% of total rum volumes in the US.

This latest data comes from IWSR US Navigator, the industry’s only trusted source of monthly volume data for the total US beverage alcohol market — across wine, spirits, beer, cider, RTDs and no-alcohol — by price tier, for all 50 states going back to 2019, based on highly accurate local tax office data.

Rum’s largest domestic markets:

At the State-level, the top 8 States account for 50% of the volume share of rum, with Florida the clear number 1, accounting for 15% of the total rum consumed in 2024, up from 12% in 2019. This is followed by New York at 8%, California at 7%, Texas at 6%, and Pennsylvania, Michigan, Illinois and Wisconsin each holding a 4% share of the market.

Looking at Jan-Aug performance:

- All states have seen a decline from rum’s peak in 2021, with Florida seeing a -3% decline, New York a modest -1% and California a large -7% decline.

- Only New Jersey, Massachusetts, Georgia, Maryland, Louisiana, Connecticut, Hawaii and Rhode Island have seen bigger declines than California’s, all down -8% from the peak in 2021.

Premiumisation opportunities by state:

Premiumisation in Florida has been impressive, with the Standard price tier jumping from 15% share of the rum market in Florida in 2019, to 43% in 2024, while Value went from 80% to 51% over the same time period.

This is in contrast to New York, where both Standard and Value price bands lost share to Premium-and-above which gained 5pts of share to represent 12% of the market in 2024, the largest gain of any of the top 8 states.

Premiumisation opportunities by rum segment:

Premiumisation within rum has been robust, but happening at lower price tiers than what we have seen for more premium categories like whiskey and tequila.

The vast majority of premiumisation has been evident between Value and Standard price tiers.

- The Value price tier for rum between 2019 and 2024 has declined from 52% to 42% in volume share, while Standard has gone from 42% to 51%, and Premium-and-above has gained a single point of share, going from 6% to 7%. See chart below.

This looks a bit different for dark rum:

- Premium-and-above dark rum has gone from 11% market share in 2019 to 17% share in 2024.

- White and flavoured rum have not found the recipe for premiumising their respective sub-categories beyond Standard, and the Premium-and-above segment languishes at 4% market share.

The outlook for rum:

“The lack of a standardised framework for rum production makes it harder for brands to convey a quality ladder across rum products,” notes Marten Lodewijks, President of IWSR’s US Division.

“High-end rums, however, are relatively more affordable than high-end products in competing categories,” he notes. “Brands could lean into this, especially in the current economic climate.”

Despite frequent introductions of line extensions by major brands, there is a shortage of completely new brands entering the market. This has led to lower consumer excitement, particularly compared to categories such as tequila and American whiskey.

An increased focus on rum-based RTDs may help drive excitement in the category – such as the launch of Captain Morgan & Vita Coco coconut water.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Spirits | MARKET: North America | TREND: Premiumisation |