This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

05/09/2024

How impactful are celebrity-backed brands?

IWSR data shows that while celebrity-backed brands tend to outperform their total category, celebrity involvement doesn’t always guarantee success.

The past ten years have seen a ramping up of the relationship between celebrities and beverage alcohol, with a growing number of stars actively involved in creating, marketing – and profiting from – their own drinks brand.

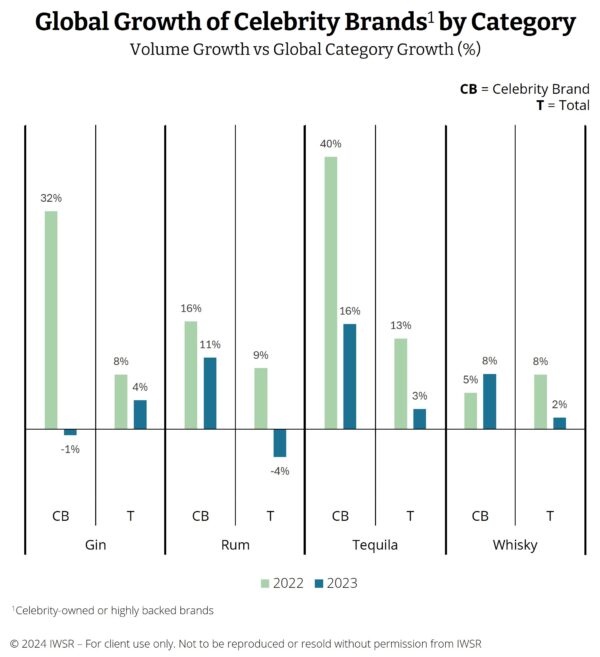

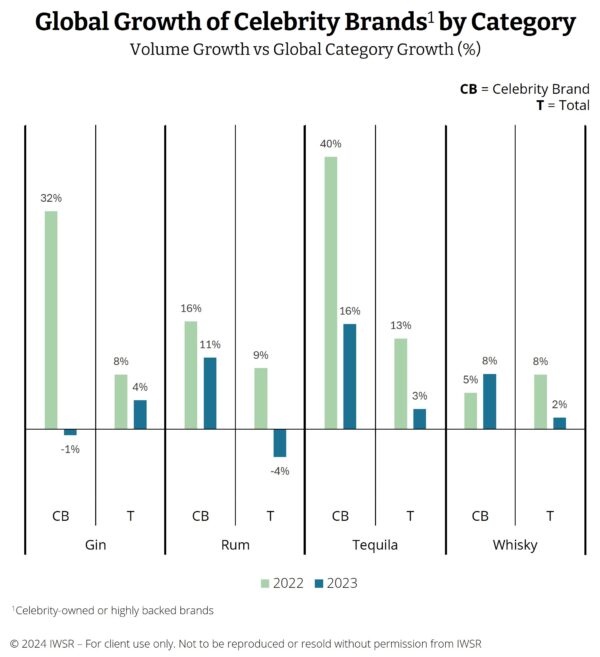

Celebrity brands continue to grow and enter the global market, but the rate has slowed from 2022. Nevertheless, celebrity-backed brands do tend to outperform the overall market.

In 2023, celebrity whiskies grew 8% by volume, compared to 2% for the whisky category as a whole. In the same year, celebrity rums grew 11% – majorly outperforming a category that declined by 4%.

But the category where celebrity drinks appear to have the biggest impact is tequila. In 2022, celebrity tequilas grew at 40% (three times the category growth rate of 13%); last year the figures were 16% for celebrity tequilas against +3% for the category as a whole.

This is partly down to timing. The renaissance of the tequila category has coincided neatly with the rise of celebrity spirits. The category is attracting large numbers of new drinkers who are looking for something premium but reassuring – two things which celebrity endorsement can provide.

But IWSR consumer data also reveals that consumers of tequila and mezcal tend to be discovery oriented. Typically younger LDA drinkers , they are happy to try new brands rather than being sceptical of them. For celebrity drinks with a brand equity measured in social media followers rather than decades of existence, this is a big plus.

A celebrity-backed drink does not always outperform the market, however. In 2023, volumes of celebrity-owned or backed gins actually declined by 1%, against a gin category that grew by 4%.

“When a category is trending, like tequila, you can see celebrity brands outperforming,” says Emily Neill, COO of Market Research, IWSR. “But when a category is beginning to struggle and the boom has ended – like gin – being a celebrity brand doesn’t always insulate you from that downturn.”

Global reach

Over the last decade, celebrity brands have increasingly appeared across beverage alcohol categories and geographies.

In terms of geographies, the US is a key market, also UK, Canada and France when looking at global brands, but there is also a lot of celebrity involvement in local markets. In South Korea, for example, a number of soju brands have engaged K-pop stars to boost awareness of their products. In 2022 K-pop star Jay Park launched his own premium brand, Won Soju. Lisa (from the band Blackpink) created a limited edition Chivas 18 bottle, complete with its own signature Pink Spice cocktail.

Collaborations are evident across all beverage alcohol categories, but especially spirits, where it can be relatively easier to leverage the association for a premium brand positioning. Social media, allowing instant connection between brand, celebrity and followers has played a huge part in this growth.

While celebrity endorsement may be temporary, with the same celebrity putting their face to different brands at different times, celebrity ownership is much more of a commitment, involving significantly more time, effort and, often, financial backing.

For consumers, having a brand directly associated with a celebrity brings several advantages. Firstly, having a favourite celebrity affiliated with a drink allows them to purchase with a degree of trust. This is useful in the complex drinks market – particularly for younger LDA consumers.

Secondly, they are a way of connecting with other fans of that celebrity. And thirdly, drinking what a celebrity does can be an affordable luxury.

For celebrities, having a drinks brand can broaden their fan base, as well as provide extra income from a typically high-margin product.

For the brands themselves, associating with a celebrity brings an instant potential consumer base, who are primed to be inherently receptive to the product and instantly accessible by a (usually significant) social media network. Products can enter the market almost fully-formed.

“With celebrity involvement, a brand immediately has a personality ready-made,” observes Neill. “Non-celebrity brands, by contrast, have to work over a period of time to create their personality and positioning.”

There is always an element of risk, however. Should a celebrity decide to walk away from a brand association (as David Beckham did with Haig Club in 2023) a brand can risk losing a large part of its identity. Additionally, any negative press involving celebrities inevitably attracts significantly more attention across the world’s media than a non-celebrity brand.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All |