12/09/2024

How is the RTD landscape shifting?

IWSR analysis highlights the key factors shaping the outlook of the RTD category

RTDs are a fast-paced and diverse sector of the beverage alcohol market, wielding growing influence on the shape of the overall industry landscape. They are increasingly taking share from beer and wine, offering consumers a way to discover new brands and enjoy a wider variety of consumption occasions.

The current outlook for the category is being shaped by a number of factors:

• The macro-economic climate, which is impacting consumer spending levels across beverage alcohol

• RTD product fatigue in some key markets, which is affecting consumer purchasing decisions

• Slowing innovation rates, which are impacting how producers need to approach NPD strategies

In light of these developments, here are five key questions that beverage alcohol stakeholders should be asking themselves as they plan their business strategy.

1) How is the macro-economic climate impacting the influence of RTDs on the wider beverage alcohol landscape?

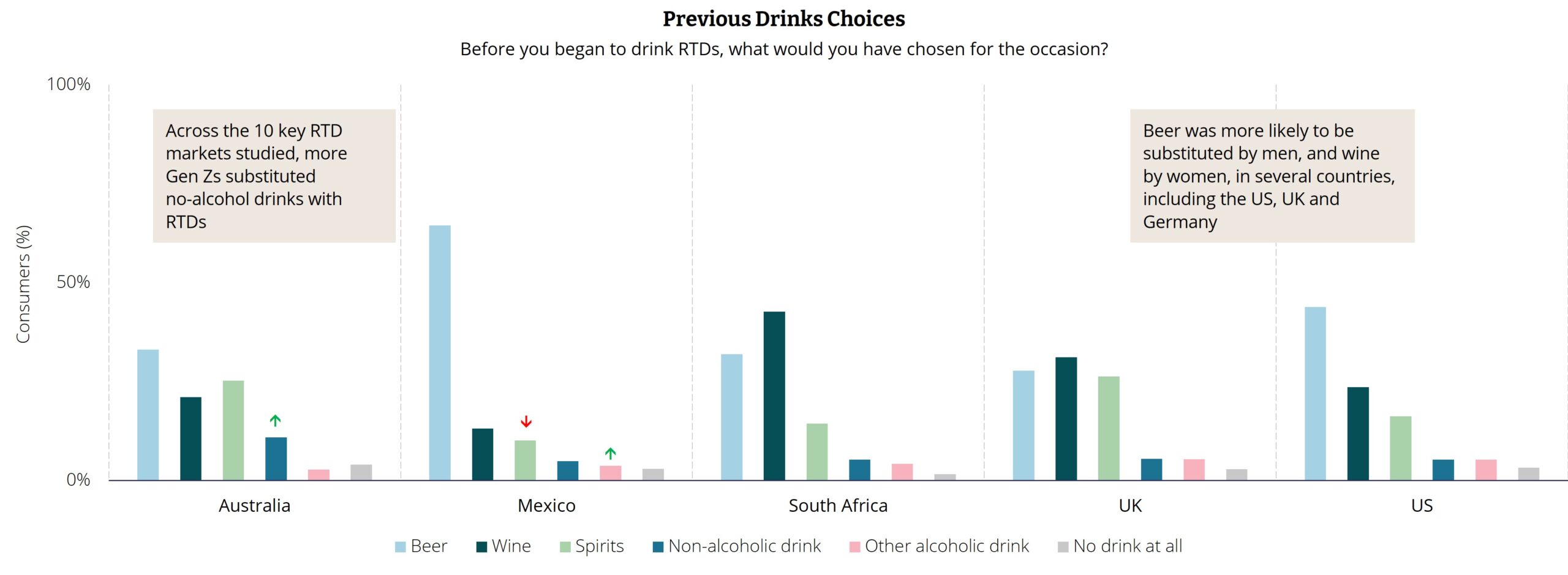

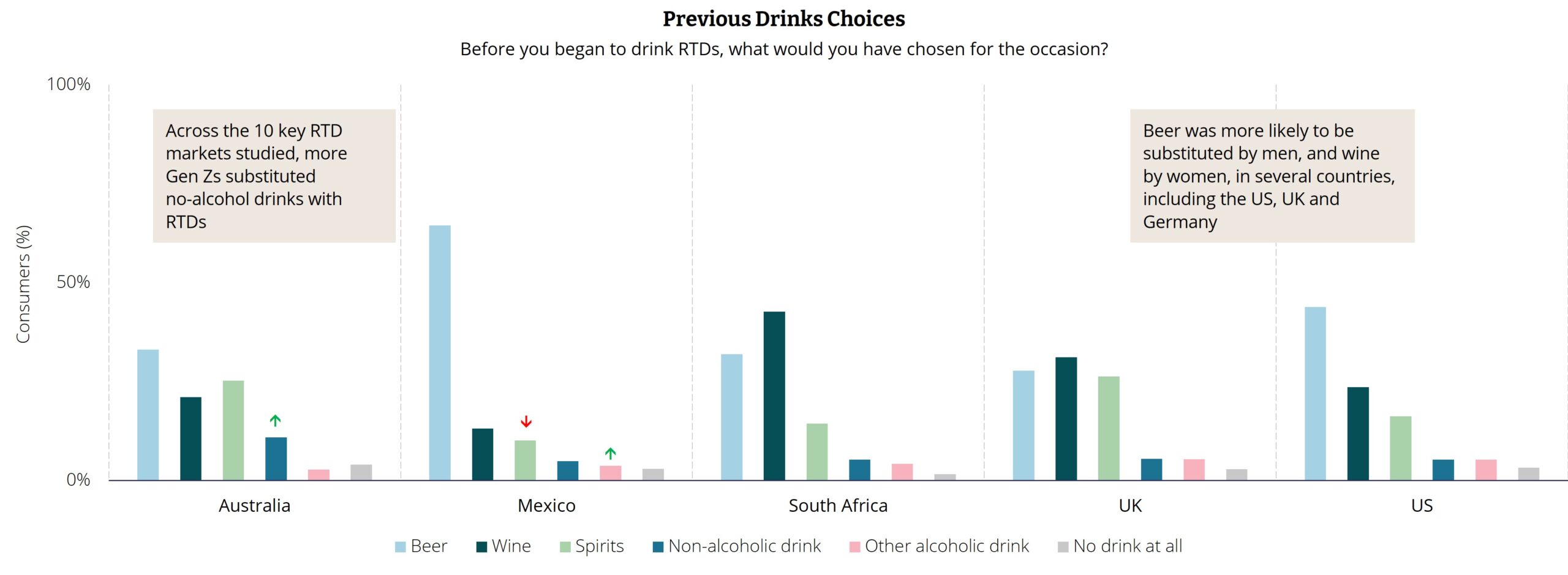

Across 10 key RTD markets last year, 45% of alcohol buyers purchased RTDs; spirits were most often drunk in the same occasion as RTDs; and beer was the most replaced drink. Now, as high inflation and cost-of-living continues to impact spending levels across beverage alcohol, RTDs are also serving as a crucial entry point for consumers who want to enjoy premium spirits at a fraction of the bottle price. Beverage alcohol producers should examine from where RTDs are stealing share in local markets and if this can be leveraged to recruit new consumers or protect share.

2) To what extent are Ready-to-Serve products still relevant?

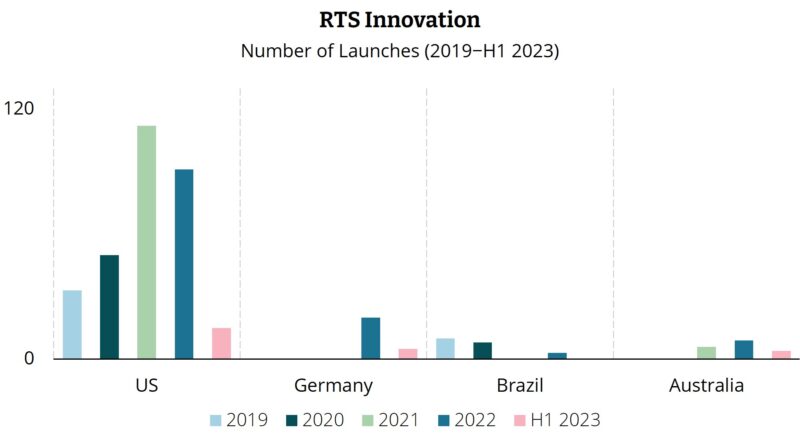

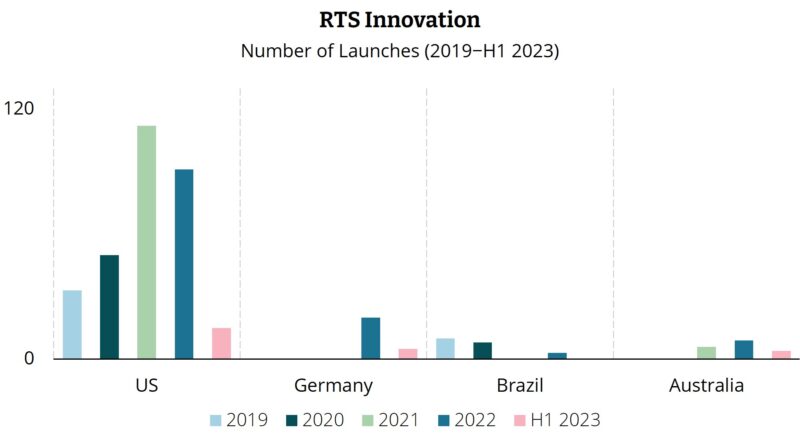

Ready-to-Serve (RTS) products came to market in response to the rise of the at-home cocktail occasion, but product launches have tailed off after a post-pandemic peak. As we see shifts in consumption occasions and the macroeconomic landscape in many markets, what’s the outlook for the segment now, and what types of NPD are driving growth? RTS products have so far been most relevant to the US market – will other countries follow suit?

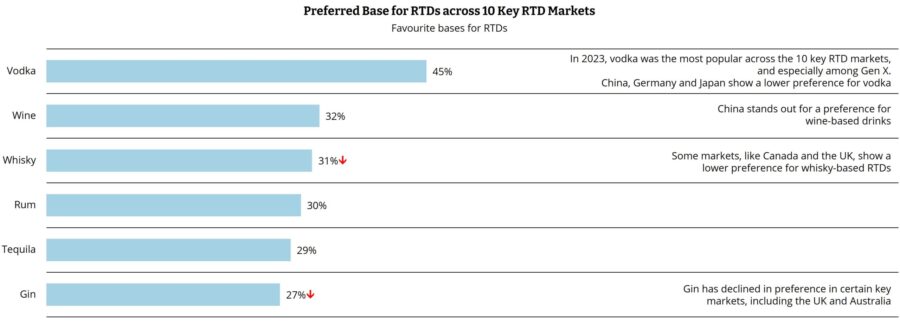

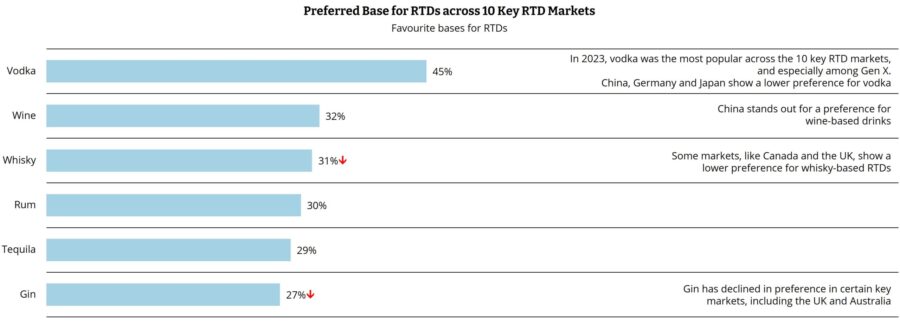

3) Does an RTD’s alcohol base still matter to consumers, and how should it inform product development and branding decisions?

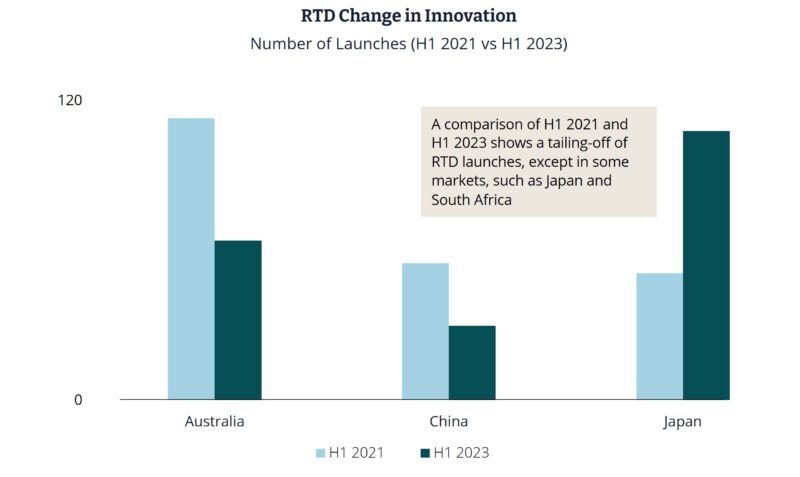

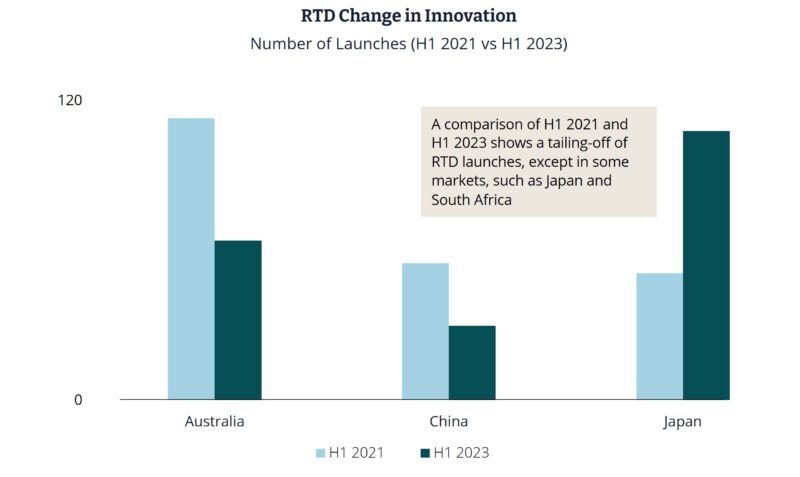

Alcohol base was the joint second most important factor in RTD selection across 10 key RTD markets last year, level with cocktail type and behind flavour, which registered a significant decrease. Malt- and wine-based RTDs showed declines, but spirit-based RTDs outperformed their parent category at the total market level – the only base to do so. Last year, consumers said they were willing to pay more for a spirit-base versus a malt- or wine-base RTD. While vodka was the most popular RTD base globally, tequila has seen the largest increase in innovation focus. How does preference for alcohol base vary across markets, and how important is it to local consumers?

4) Which RTD segments are reaching maturity?

The overall pace of innovation has slowed: having reached a peak in 2021, new product launches across 10 key RTD markets have been declining year-on-year, with the exception of Japan and South Africa. As the RTD category matures in some markets, we will see more product rationalisation to combat consumer fatigue and oversaturation. Producers will need to be more strategic and targeted in their product launches.

5) Is the on-trade the next frontier?

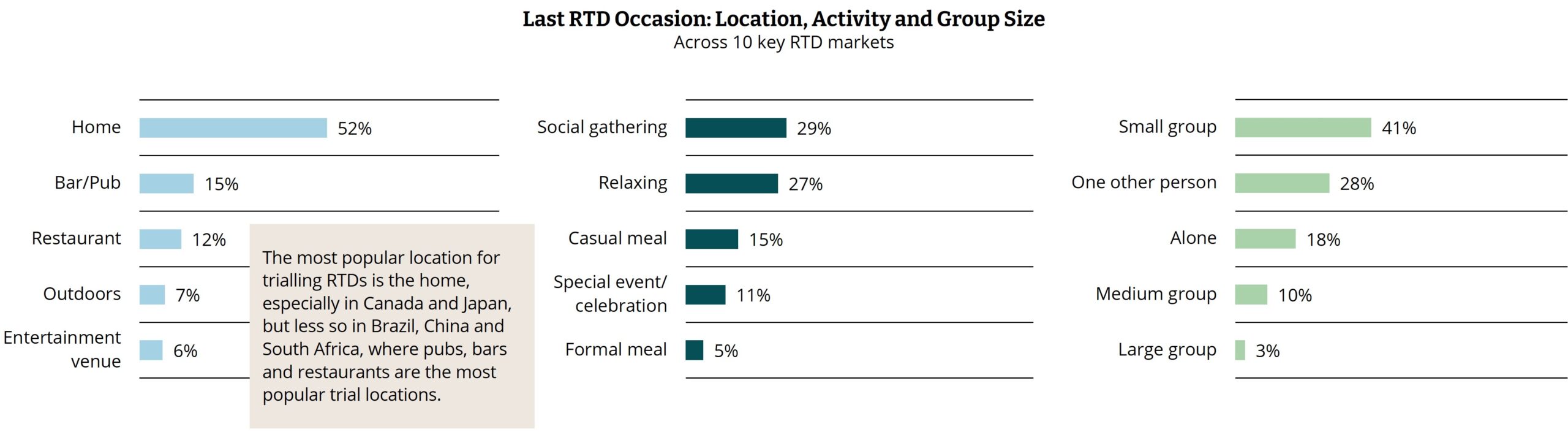

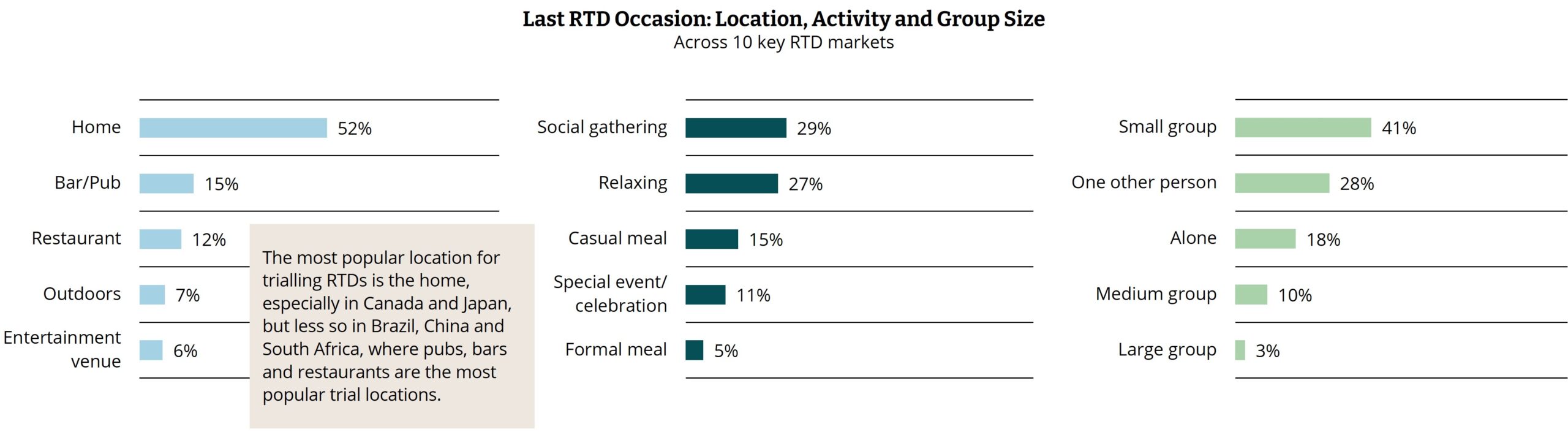

Across the 10 focus RTD countries, the most popular settings for consuming RTDs were at home, in social gatherings or relaxing in small groups or with one other person. However, with 40% of consumers claiming to drink RTDs in a pub more often than the previous year, and many companies targeting the on-trade for growth, this channel could be the next wave of growth and innovation. In 2023, on-trade consumption of RTDs was at or beyond where it was before the pandemic in the US, Canada, Australia and South Africa; and RTD drinkers in Brazil, China and South Africa said they were more likely to drink RTDs in the on-trade.

Planning for the future

To help with strategic decision making, IWSR’s upcoming RTD Strategic Study 2024 will examine the above topics in greater detail, focusing on:

- Replacement of TBA categories with RTDs and the impact of RTD consumption on the wider beverage alcohol landscape

- Occasion analysis by RTD sub-category, and whether certain sub-categories are more likely to be drunk at home or in other occasions than others

- The evolution and innovations driving the Ready-to-Serve space

- Analysis of consumer awareness of RTD alcohol base and to what extent they correctly know the base of the RTDs they drink

- Innovation trends by market and sub-category

To access the upcoming IWSR RTD Strategic Study, please contact your account manager or email enquiries@theiwsr.com

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: RTDs | MARKET: All | TREND: Convenience |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.