06/03/2025

Is moderation an existential threat to beverage alcohol?

Across the world’s largest markets, consumers are drinking less alcohol, less often. What’s causing this global moderation trend – and what does it really mean for the industry?

Moderation is a trend that has been discussed in the industry for a few years now and opinions vary from a temporary phenomenon to a worst-case scenario where it’s an existential threat. But what does the data tell us?

According to IWSR market data, overall TBA consumption fell in 2023 at a global level, as growth in developing markets such as Brazil, Mexico and India were outweighed by volume declines in China, the US and Europe.

IWSR forecasts that this trend persists in these large developed markets in 2024 and will carry on doing so. IWSR expects the US alcohol market to be around 9% smaller in 2028 compared to 2019.

Whether it is participating in Dry January, heeding warnings from public health officials, substituting with no-alcohol beverages, or seeking out evening or weekend activities that do not involve buying a drink, consumers from across the age and income spectrum are moderating their intake.

Data from the latest IWSR Bevtrac survey of alcohol drinkers across 15 major consumption markets shows that 48% are “actively choosing to drinking less” in the past six months. This proportion rises to 68% among drinkers of no and low alcohol products, according to IWSR’s recently published No & Low Alcohol Strategic Study.

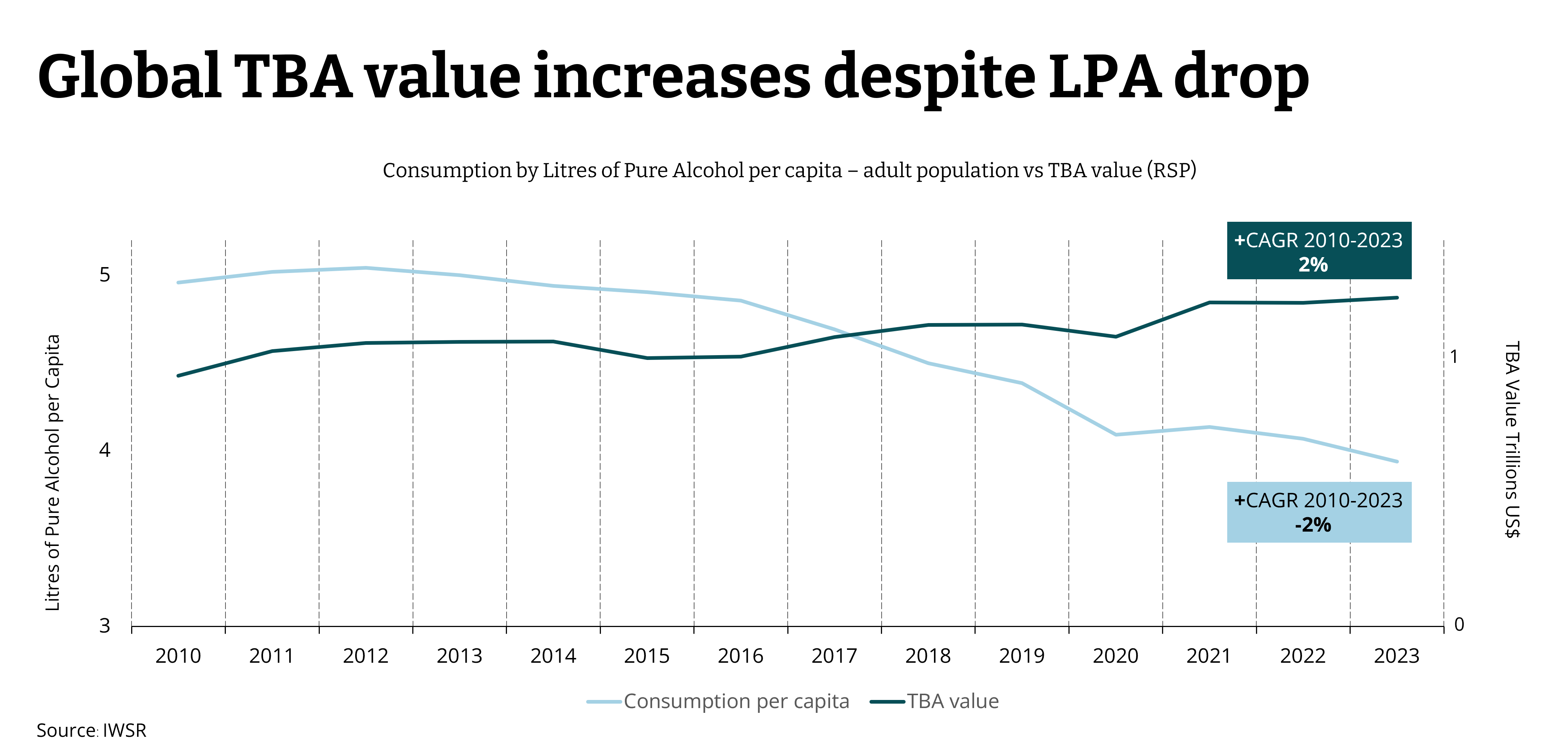

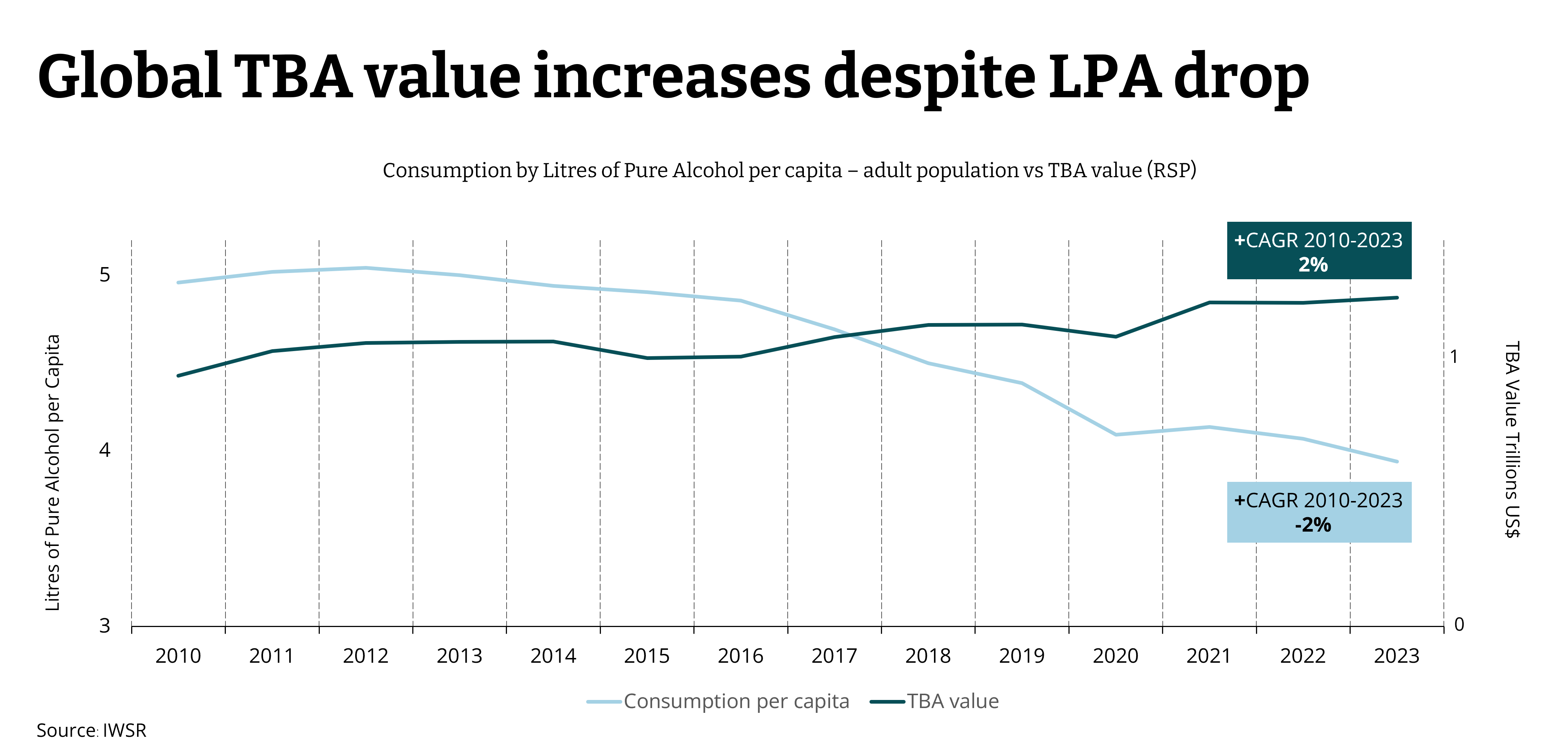

How does the beverage alcohol industry adapt to major changes? Over the past 20 years, the industry has largely been successful in riding the long run trend of volume moderation by switching emphasis from high volume, low cost, low margin products, to a more premium approach where products are lower volume, higher priced, higher quality and higher margin, accompanied by significant investment in marketing.

By following this strategy, the leading players in the global beverage alcohol industry have significantly increased their profits and expanded profit pools for the rest of the supply chain.

The playbook for success for the past 20 years is a combination of brands focusing heavily on their core assets, understanding their consumers’ needs, and creating and positioning products to meet those needs, whilst making them both physically available via distribution and mentally available via heavy marketing investment.

For the remainder of the 2020s, the moderation trend is set to continue, with varying drivers of lifestyle, health, cost of living and the availability of alternatives. For beverage alcohol, the main change will be the intensification of competition at a given occasion as choice widens, and the number of occasions where alcohol consumption is taking place narrows.

This will be particularly acute in mature markets, but increasingly a factor in developing markets as well. Persuading consumers to buy your product rather than someone else’s at that moment – and feel positive about doing so – will become a higher stakes game.

A core element of competitive advantage will be understanding those moments better to build resilient brand strategies and to enable supply chain partners to capture more value with less volume. IWSR’s Bevtrac consumer data provides insights into consumer behaviour, market and substitution patterns that can guide brand strategies.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: Moderation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.