This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

04/12/2023

Is Cognac losing out to tequila in the US?

IWSR analyses the dynamics behind Cognac's recent declines in the US

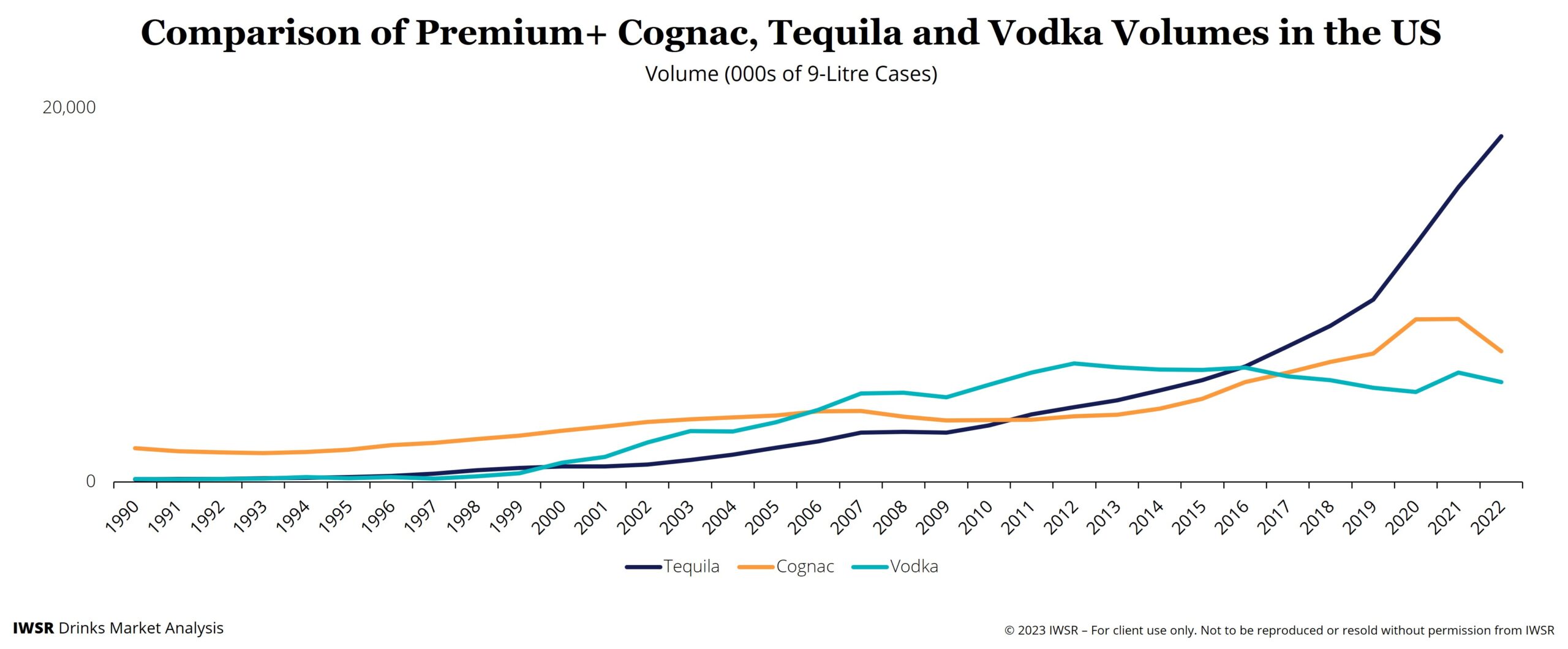

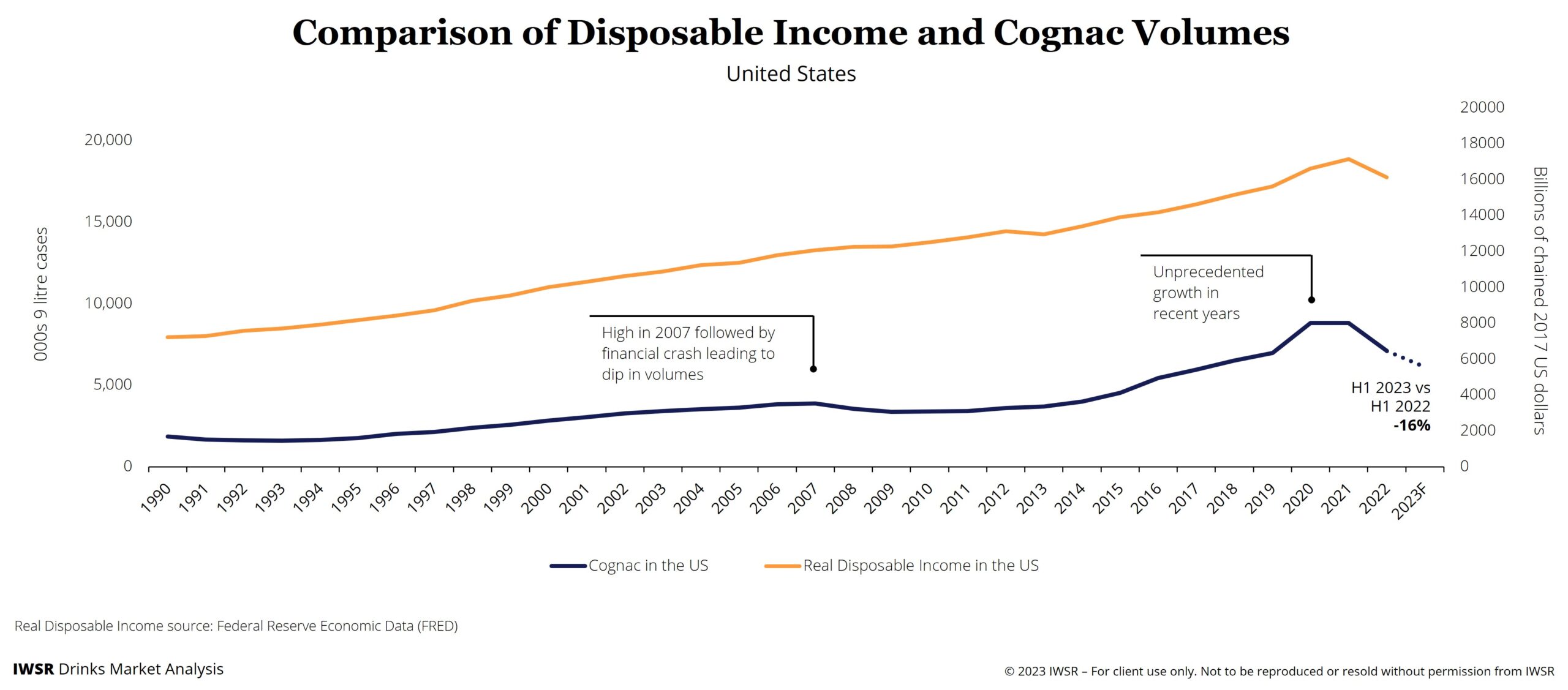

Following years of strong, steady growth, and a massive spike due to Covid-19, Cognac has seen sharp declines in the US – a market that accounts for over 40% of global sales. Cognac volumes in the US grew by +12% CAGR, 2014 to 2019, followed by further growth during the pandemic, before falling by -20% in 2022. Volumes continued to decline (-16%) in the first half of 2023 vs 2022.

Cognac’s steep volume loss in 2022 can partly be explained by supply chain volatility linked to the Covid-19 pandemic, which left brand owners facing a high volume base for prior year comparison in 2021, and a return to more normal consumption patterns. As a result, the supply chain has been working through high levels of Cognac inventory, as noted by IWSR earlier this year.

However, the sharp declines reported by IWSR in the first half of 2023 appear to have more fundamental drivers: the Cognac consumer is feeling the economic pinch, and is reining in their appetite for this high-status, high-priced category in favour of more cost-effective alternatives. Agave-based drinks, especially cocktails, are a convenient, and in some cases lower cost alternative to Cognac, and the two categories have a lot of consumers in common.

The latest analysis from IWSR’s market and consumer data shows that Cognac’s US performance may also be a specific consequence of increased competition from agave-based spirits as tequila cements its status as a luxury drink popular with high-income consumers.

An overlapping consumer base

There is increasing evidence that Cognac and high-end tequila are competing for some of the same consumers. The Cognac consumer can be broken into a twin-track audience: middle income “core” drinkers and higher income urban millennials for whom Cognac is one of many drinks they like.

It is this group of core drinkers that are disproportionately financially vulnerable, making them more likely to drink Cognac less frequently, or trade down to lower-priced categories, as their disposable incomes shrink.

“Our consumer research shows that Cognac drinkers are two times more likely to drink tequila than alcohol drinkers in general,” explains Richard Halstead, COO Insights and Custom Analytics, IWSR. “And both categories generally find themselves in competition at similar consumption opportunities – social, uptempo occasions.

“It’s also important to note that Cognac’s audience is relatively small – less than one-third the size of tequila in the US, with 8% recalled consumption versus 27% – and has more lower- and middle-income drinkers, but fewer high-income drinkers versus tequila: 43% of tequila drinkers say they have an annual income of US$100k+, compared to 27% of Cognac drinkers.”

Category switching as cost of living rises

IWSR consumer research also suggests that Cognac drinkers have one of the broadest drinks repertoires, in terms of the number of categories explored in the past six months, of any category consumption group: more than one-fifth of Cognac drinkers say they consumed a tequila drink on the last consumption occasion.

As a result, “core” Cognac consumers facing a decline in their disposable income are more likely to drink Cognac less often, buy Cognac in smaller quantities, and/or switch to other spirits from their repertoire that are cheaper, but still carry premium cachet – which include tequila, but also premium vodka and cocktails. Higher income consumers are less motivated to switch for economic reasons, but remain discovery-oriented and appear to be switching more out of desire for variety, with cocktails (often involving tequila) also a strong substitution candidate.

“Tequila has a number of inherent advantages over Cognac in terms of its scale, diversity and versatility,” says Jose Luis Hermoso, Research Director, IWSR. “Tequila boasts a wide variety of styles and price points versus the relatively narrow – and expensive – range of products available in Cognac.

“Tequila also has more versatility in terms of consumption occasions, including shots, cocktails and – increasingly, in the upper price tiers – as a sipping spirit. The category has an inbuilt advantage in that it is used in highly popular cocktails, such as the Margarita, the Paloma and Ranch Water.”

This is especially important because Cognac drinkers are significantly more likely to drink cocktails – and IWSR data shows that 50% of Cognac drinkers say they consumed a Margarita in the past six months.

Other category attributes enjoyed by tequila include speed of innovation – lower ageing requirements compared to Cognac allow brand owners to bring new products to market more quickly – and the sheer number of brands on the market, which gives consumers more opportunities for trial and category exploration.

“Tequila is also much more gender-neutral in terms of its consumer appeal in the US,” points out Marten Lodewijks, Consulting Director – US, IWSR. “Both men and women enjoy the spirit more or less equally, whereas Cognac is primarily consumed by men. This increases tequila’s opportunities for consumption.”

Opportunities for Cognac

It’s important to note that Cognac’s decline is likely cyclical – not structural. The category’s current performance is driven by overexposure to economic hardship. Historical trend analysis shows a correlation between disposable income and Cognac volume consumption (see chart below).

As an inherently higher priced category compared to most other beverage alcohol options, and consequently strongly connected with the affluence of its consumer, the long-run data suggests that Cognac tends to do disproportionately well in the good times, and suffers more acutely when the wider economy is struggling.

So, how should Cognac brand owners respond?

“The first task would be to broaden the appeal of Cognac in the US again,” says Lodewijks. “Looking at historical evidence in our research, it seems that Cognac used to have a broader base of consumers, including more people at a higher income level.

“Cognac’s second task would be to broaden its use cases, counteracting tequila’s inherent advantage as a base for hugely popular cocktails. Tequila is also associated with high-tempo events and social gatherings, whereas brandy in general is more skewed to low-tempo, relaxed settings – so this may be an avenue for Cognac to explore in terms of changing the mood.”

Cognac brands are already trying to remain relevant in the US market, aiming to draw in new customers with more inventive marketing strategies that are designed to appeal to the next generation of consumers and relatively untapped demographic groups, such as Hispanic and female consumers. Cognac brands are also seeking to establish more territory in the cocktail space.

You may also be interested in reading:

Home consumption vs the on-trade: have pandemic behaviours become entrenched?

Is the US premium tequila boom over?

The 8 drivers of change for beverage alcohol in 2023 and beyond

The above analysis reflects IWSR data from the 2023 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All, Spirits | MARKET: All, North America | TREND: All, Premiumisation |