16/10/2024

Northern US states drive biggest gains in no-alcohol beer

IWSR US Navigator data shows no-alcohol beer is less dependent on seasonal shifts in the US

Nationally in the US, no-alcohol beer has gone from strength to strength, growing at a 22% volume CAGR from 2019 to 2023, and in doing so, growing from a 0.5% volume share of total beer to 1.2%. Growth for no-alcohol beer is strongest in the northern states, according to IWSR US Navigator, the industry’s only trusted source of monthly volume data for the total US beverage alcohol market — across wine, spirits, beer, cider, RTDs and no-alcohol — by price tier, for all 50 states going back to 2019, based on highly accurate local tax office data.

North-East and North-West of the US see strongest growth

While every state in the US has seen strong growth in no-alcohol beer (Mississippi saw the smallest growth but still grew 13% volume CAGR from 2019-2023), the biggest share growth has skewed towards the NE and NW of the US:

- Maryland and Massachusetts both went from 1% share of total beer to 4%, growing at 49% and 39% (volume CAGR ’19-’23) respectively.

- Massachusetts is the 22nd biggest beer drinking state in the US but the 3rd biggest no-alcohol beer drinking state, and Maryland the 26th biggest beer state but 8th biggest no-alcohol beer state.

- Connecticut no-alcohol share of beer went from 1% to 3%.

- New Jersey, Washington and Oregon all doubled their no-alcohol beer share going from 1% to 2%.

And in the first seven months of 2024:

- Maryland and Massachusetts no-alcohol beer also grew 34% and 32% respectively, the most of any state in the US, while full-strength beer in those same states saw declines of -5%, slightly worse than the national average. This suggests that some level of switching between the two is happening.

“What is interesting about this regional trend is that as northern states, they have more moderate climates that don’t traditionally lend themselves to over-indexing on beer consumption due to longer cold seasons,” observes Marten Lodewijks, President of IWSR’s US Division. “That would suggest the bigger driver of this growth is underlying consumer preference and not just a switch from full-strength to no-alcohol beer during the hot summer months.”

IWSR Bevtrac consumer data reinforces the lifestyle change

- The population of no-alcohol consumers (across all categories) in the US has doubled between H1 2023 and H1 2024, led by the growth of no-alcohol beer usage. Its consumption frequency and intensity are now approaching that of full-strength beer.

- This popularity is aided by the widening availability of no-alcohol beverages in outlets without a licence to sell alcohol, which serves as a marketing tool to the general public.

No-alcohol beer less dependent on seasonal shifts

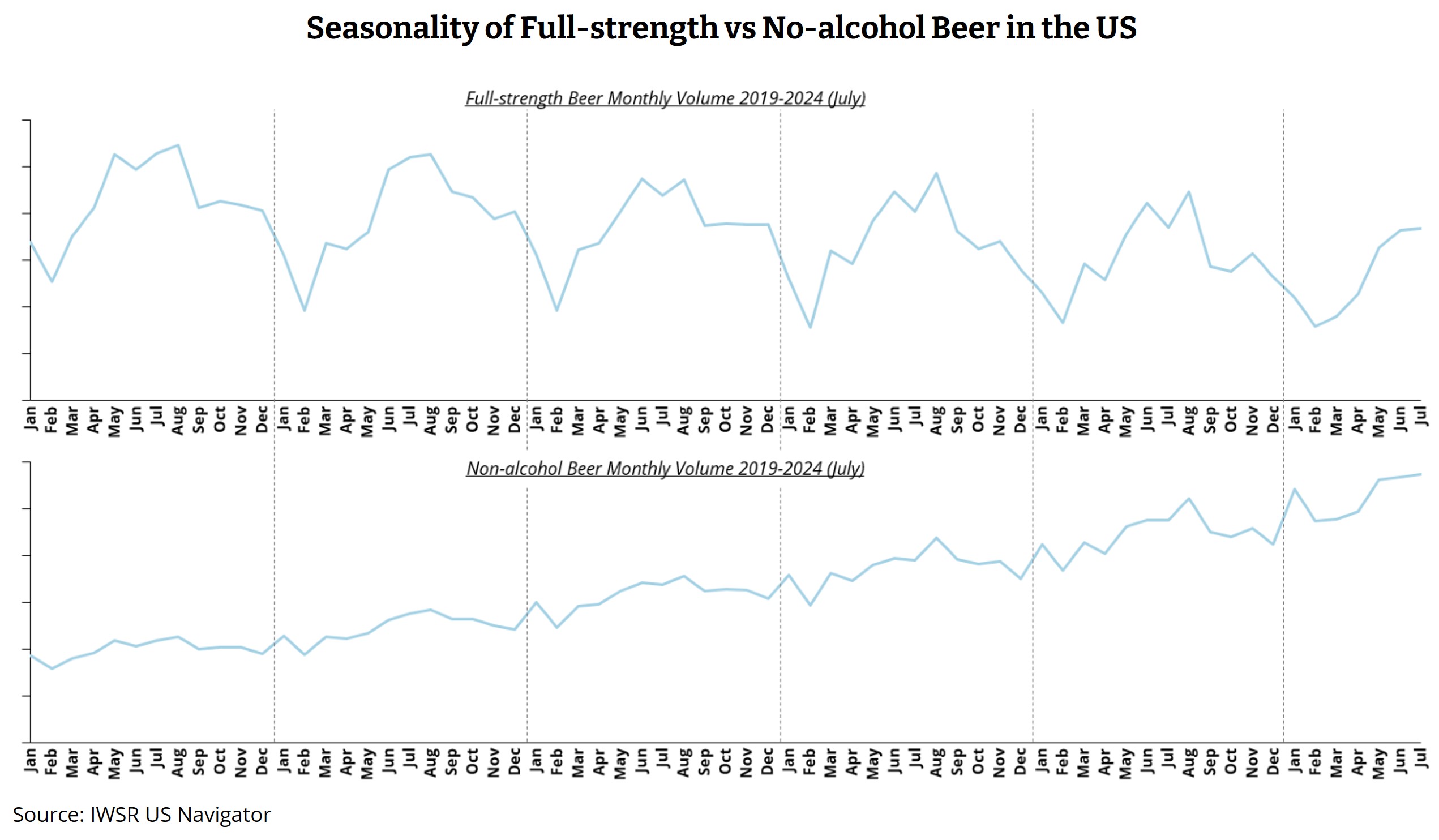

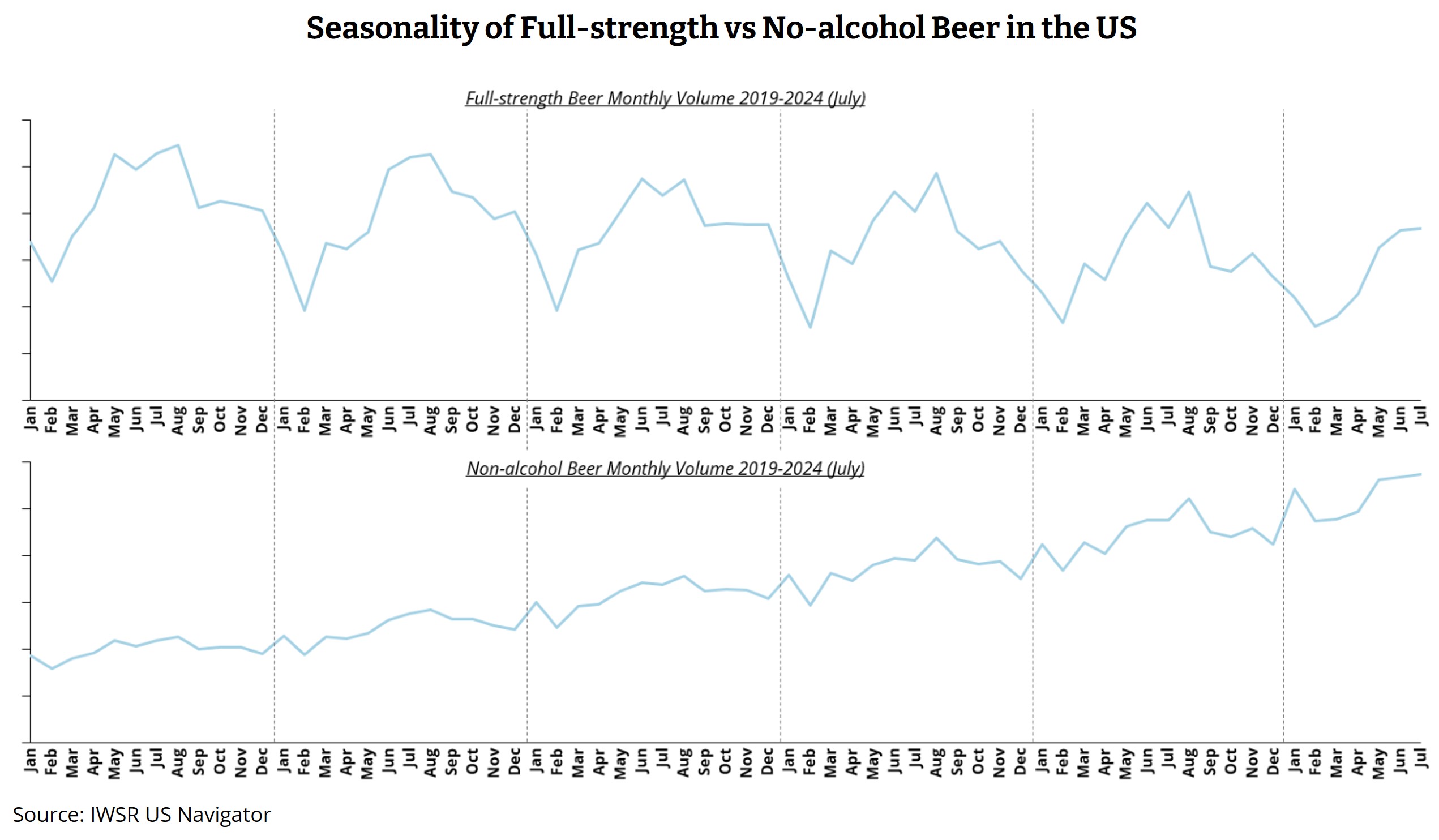

Unlike full-strength beer, no-alcohol beer consumption tends to increase in January, likely driven by consumers in Dry January still wanting to enjoy a beer without compromising on their New Year commitments.

The volatility (i.e. the delta between peaks and trough) of no-alcohol beer consumption also seems much more subdued vs. full-strength beer, suggesting it is consumed more consistently throughout the year, although consumption does still peak over the summer months, as with full-strength beer. See chart below.

IWSR US Navigator is now available to subscribing clients. For further information or to gain access to US Navigator, please email enquiries@theiwsr.com. Current IWSR clients can contact their IWSR Account Manager.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: Beer & Cider, No/Low-Alcohol | MARKET: North America | TREND: Moderation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.