This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

24/06/2021

The ‘inverse-V’ shape of Covid-19

In some markets, Covid-19 prompted an unexpected shift in select spirits & wine categories, either reversing long-term declines or boosting growth paths.

Total beverage alcohol volume decreased by -6.2% globally in 2020, impacted by the near complete shutdown of bars and restaurants around the world. However, in some markets, Covid-19 prompted an unexpected shift within select spirits & wine categories, either reversing long-term declines or boosting growth paths.

In many cases, an ‘inverse-V’ shape was driven by an easy transition to the at-home occasion, but there were other factors at play as well. For example, in markets such as the UK, Canada and Australia, which are traditionally heavy outbound tourism markets, volume consumption took place domestically in 2020 instead of aboard on holiday. The impact of Covid-19 restrictions led to artificial ‘inverse-V’ spikes that are expected to moderate or return to previous long-term trajectories going forward.

IWSR analyses the ‘inverse-V’ shape of Covid-19 in more detail.

The UK

The overall spirits category in the UK saw a spike in 2020, driven by sub-categories such as gin, whisky and liqueurs, which were all fuelled by the shift to the at-home occasion.

For gin, the gin-and-tonic provided consumers with an easy serve for at-home consumption, and offered variety by changing the gin and/or tonic used. Prior to Covid-19, IWSR expected gin volume consumption in the UK to peak in 2019, however, lockdowns boosted the category and gin in the UK performed better than expected – peaking in 2020 instead of 2019. Looking ahead, although traditional gin volumes will start to decline, flavoured gins will resonate with consumers in the UK. Liqueurs also benefited from the category’s strong presence in retail and online marketing, as well as its cues of nostalgia and comfort. Liqueurs returned to growth in 2020 after years of consistent decline (see charts below).

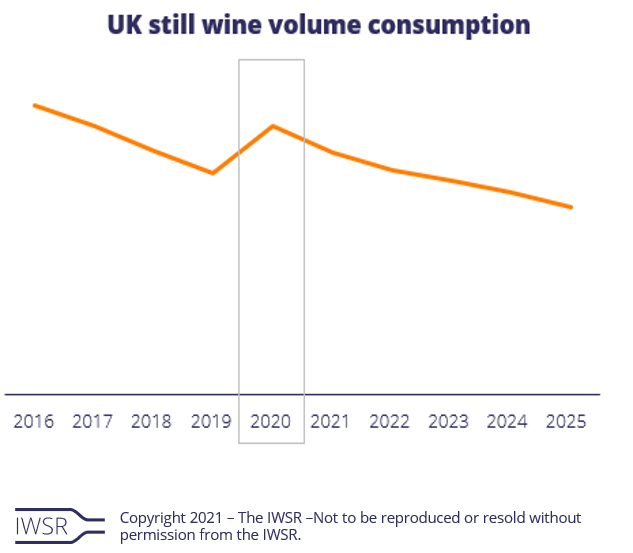

Still wine experienced a boost in 2020 in the UK, as consumers got back into the habit of drinking wine during lockdowns, driven by the category’s suitability to ecommerce and low-tempo occasions. 2020 delivered its first year of still wine volume growth after more than a decade in the UK. Wine will adjust downwards in the short term as the on-trade recovers, but the longer-term prospects for wine are more positive than they were before the pandemic (see chart below).

Australia

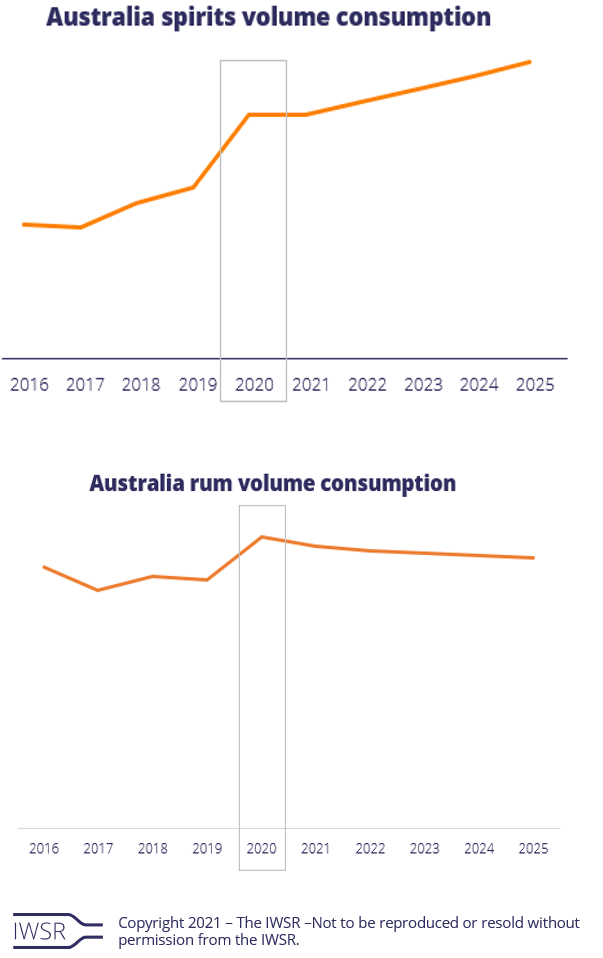

In Australia, the ‘inverse-V’ boost of the overall spirits category was driven by sub-categories such as rum and whisky. Rum made an easy transition to at-home consumption and was up nearly 20% in volume consumption, 2019 to 2020. Consumer familiarity with the category, especially with mainstream brands, and the versatility of the category as a mixer, worked in its favour. Although rum won’t sustain the volumes achieved in 2020, select rum subcategories will grow going forward (see charts below).

Germany

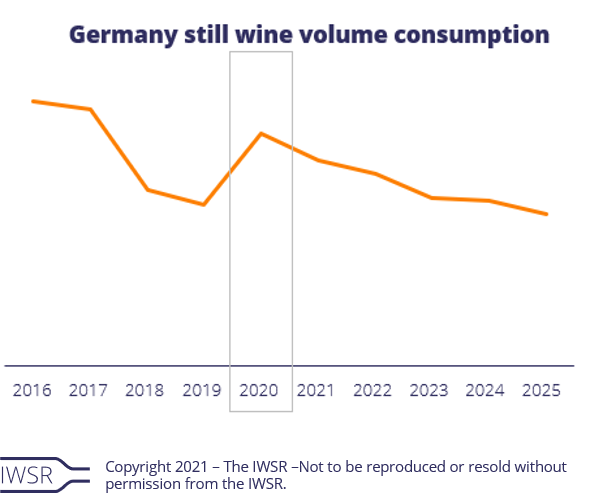

Still wine – which has always been heavily skewed towards the off-trade in Germany – saw volume increases in 2020 as the category resonated with consumers at home during lockdowns. Locally produced wines fared particularly well as the pandemic boosted a trend towards regionality. Despite a good year, wine is likely to return to mild decline again from 2021 as consumers spend progressively less time at home as lockdown restrictions ease off. This is consistent with the long-term trend (see chart below).

Canada

The overall spirits category in Canada saw a spike in 2020, driven by sub-categories including vodka, rum, whisky and flavoured spirits (see charts below).

For example, in 2020, rum saw a reversal of several years of volume declines. The broader market trend for flavours will benefit the spiced and flavoured rum sub-categories going forward. Vodka saw an accelerated boost in 2020, with the general trend around cocktail culture, the growth of at-home bartending kits, and the mixability of vodka bolstering the category’s relevance during 2020, as consumers recreated their on-premise favourites at home.

You may also be interested in reading:

Will the growth of ecommerce cannibalise sales or offer incremental value?

5 key trends that will shape the global beverage alcohol market in 2021

US total beverage alcohol consumption in 2020 was the largest volume gain in nearly 20 years

The above analysis reflects IWSR data from the 2021 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All | TREND: All |