16/01/2025

Where are the opportunities for no-alcohol spirits in the US?

IWSR US Navigator data shows no-alcohol spirits are outpacing other no-alcohol alternatives

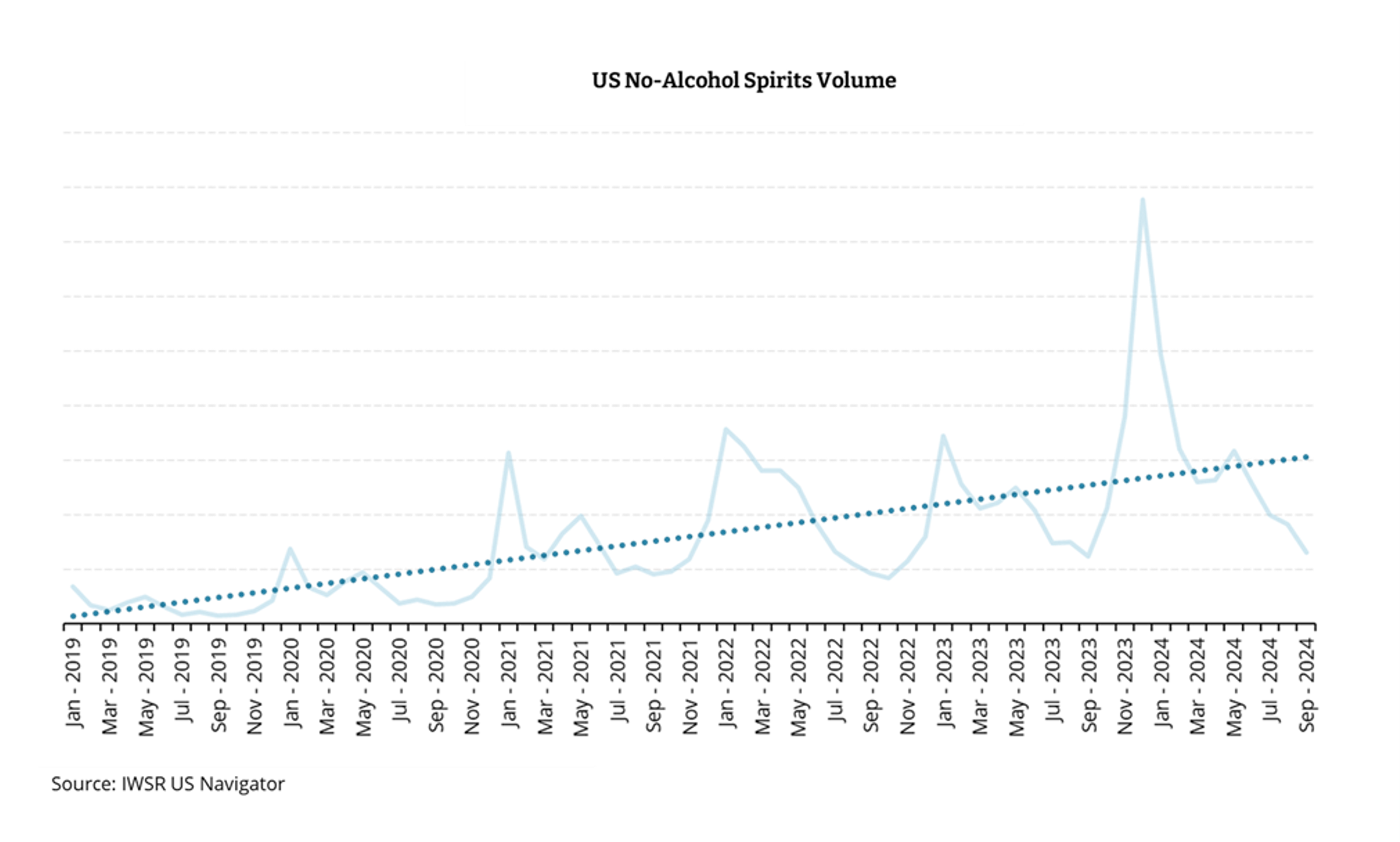

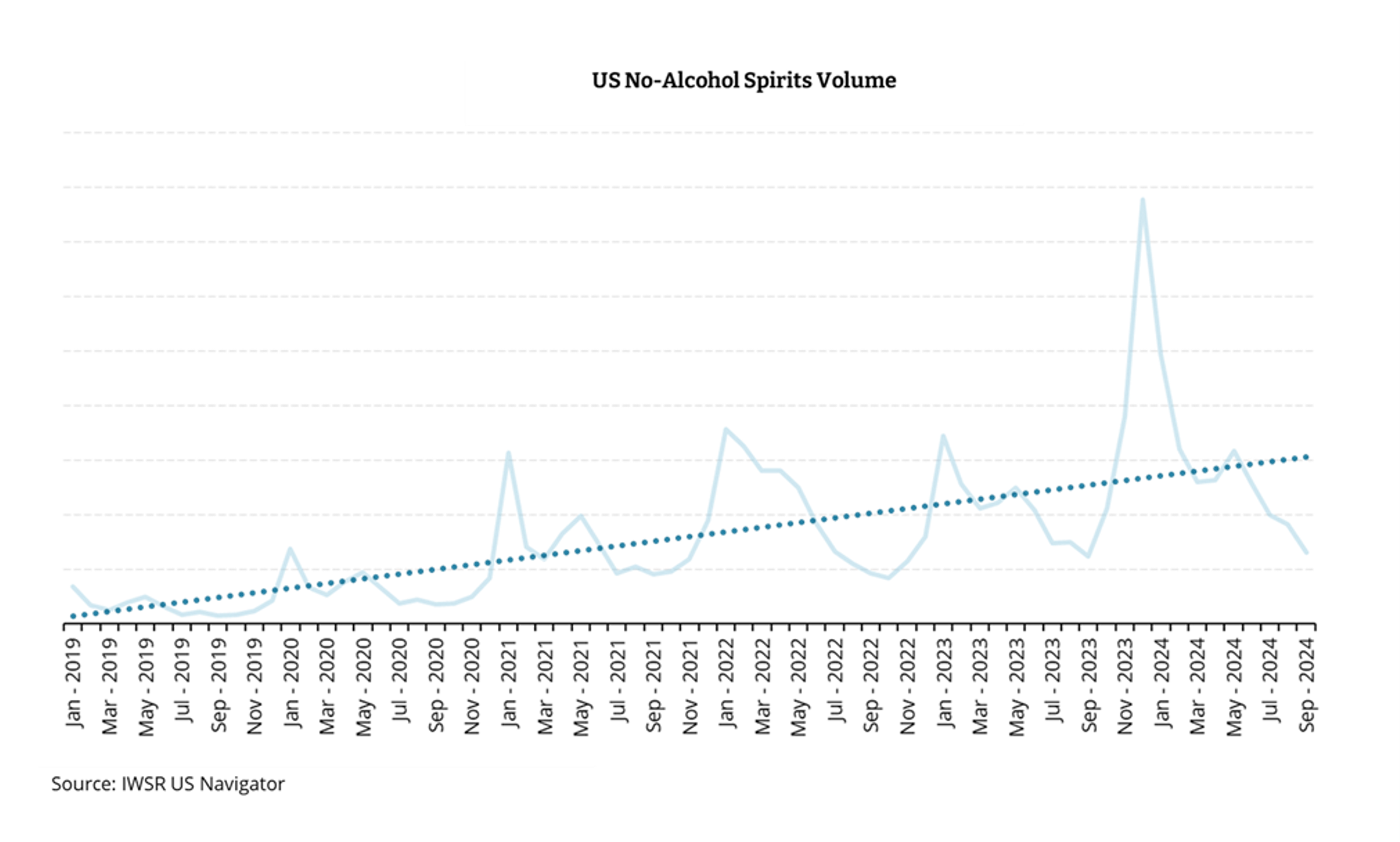

No-alcohol spirits have emerged as the fastest-growing segment within the broader spirits category in the US, boasting a remarkable five-year compound annual growth rate (CAGR) exceeding 60% through 2024.

Despite its smaller overall volume compared to traditional spirits, the segment’s growth trajectory outpaces that of other no-alcohol alternatives, such as beer and wine.

This latest data comes from IWSR US Navigator, the industry’s only trusted source of monthly volume data for the total US beverage alcohol market — across wine, spirits, beer, cider, RTDs and no-alcohol — by price tier, for all 50 states going back to 2019, based on highly accurate local tax office data.

“This growth in no-alcohol spirits is driven by factors such as the sober-curious movement, lifestyle choices, and improved flavor innovations,” comments Koryn Ternes, Consulting Manager – Americas, IWSR. “Premium positioning and shifting social norms have propelled no-alcohol spirits into mainstream drinking culture, offering sophisticated and stigma-free alternatives for a broader audience.”

Seasonal Peaks and Patterns

Seasonality plays a pivotal role in no-alcohol spirits consumption, with January consistently standing out as the strongest month for the category. Volumes in January are more than double the monthly average due to the influence of ‘Dry January’, New Year’s resolutions, and post-holiday consumption trends.

Spring, particularly April and May, marks another period of growth, bolstered by outdoor gatherings, springtime celebrations, and holidays such as Easter, Mother’s Day, and Memorial Day.

In contrast, summer and fall exhibit comparatively lower volumes, suggesting a seasonal shift in consumer preferences toward other beverage categories.

States in the Midwest and Mid-Atlantic regions, including Pennsylvania, Ohio, Virginia, and New York, see heightened demand during January, with CDI (Consumer Demand Index) levels 20% to 50% higher than their yearly averages. This regional boost underscores the importance of targeting consumers during peak periods.

Regional and State-Level Trends

Coastal states dominate the no-alcohol spirits landscape, with California and New York together accounting for over one-third of the segment’s total volume in 2023 and continuing to grow – volumes in California and New York grew at a 47% and 44% CAGR over the past 5 years, respectively. Urban lifestyles and diverse populations in these states have driven category adoption and innovation, solidifying their leadership positions.

Smaller states such as Rhode Island Delaware, and Vermont demonstrate disproportionately high CDI levels, with Rhode Island ranking 1st in CDI across all fifty states, signaling robust demand relative to their size. These regions represent niche opportunities for expansion through targeted marketing and outreach campaigns.

Meanwhile, states like Texas and Florida, despite their large populations, underperform in consumer demand. For instance, Texas ranks among the bottom five states in CDI, highlighting the need for strategic efforts to raise awareness and availability in these high-potential markets. Tactics such as education campaigns and expanded premium product offerings could unlock significant growth in these regions.

Washington D.C. also emerges as a standout market, ranking second in CDI, driven by its younger, urban demographic. As a trendsetter for the category, D.C. offers a blueprint for leveraging innovative marketing strategies to amplify awareness and drive adoption across broader urban centers.

Looking Ahead

The growth of no-alcohol spirits reflects a broader shift toward inclusivity and wellness trends. With a focus on January and springtime events, and strategic investments in both coastal hubs and underserved states, the category is poised for continued expansion. As more consumers embrace these premium, sophisticated alternatives, no-alcohol spirits will remain a key player in the evolving US beverage market.

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: No/Low-Alcohol, Spirits | MARKET: North America | TREND: Moderation |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.