15/08/2024

Which markets are driving growth for the beverage alcohol industry?

IWSR data shows that the growth shift from mature to developing alcohol markets is continuing and is, if anything, intensifying

Developing beverage alcohol markets are set to be the major growth engines in value terms for beverage alcohol over the next five years, spearheaded by India, China, Brazil and Mexico. However, gains from mature markets will prove more elusive – the US being a notable exception – with many seeing marginal growth or even contracting.

Following a tough year in 2023, when global TBA (total beverage alcohol) value rose by only +1%, future value gains will be led by India, China and the US, which are expected to add a combined US$30bn in incremental value (at 2023 prices) by 2028. Of this, India and the US will each add incremental value of approximately US$7.6bn.

Meanwhile, the five next most value-adding TBA markets (excluding Russia) are expected to be Brazil, Mexico, South Africa, Vietnam and Nigeria, which will add a combined US$14.4bn by 2028.

“The shift that’s been happening over a fairly long period of time from developed to developing alcohol markets is continuing and is, if anything, intensifying,” comments Emily Neill, COO Market Research, IWSR.

While India and the US are expected to add a similar amount of value in absolute terms between 2023 and 2028, there is a strong contrast in anticipated growth rates. In the US, value is expected to grow at a CAGR of +0.8% between 2023 and 2028, while India’s anticipated CAGR over the same timescale is more than +4%.

“Given that the US beverage alcohol market is four times larger than that of India in volume terms, and almost 6 times larger in value terms, the growth that’s expected to come out of India is quite remarkable,” observes Neill.

A shift to developing markets

Of the other value-adding markets, TBA value in Mexico is expected to grow at a CAGR of +3% between 2023 and 2028, alongside solid value gains for South Africa (+3%) and Brazil (+2%). Meanwhile, China’s anticipated 2023-28 value CAGR of +1% (excluding national spirits) equates to an incremental gain of nearly US$5bn because of the scale of the market.

By contrast, mature alcohol markets are characterised by sluggish value performance: either marginal 2023-28 CAGR increases of +1% or less (the US, Spain, Australia, Italy and the Netherlands); essentially flat performances (France, Poland); or value declines (the UK, Japan, Germany and Canada).

Underlying factors

A number of factors underpin this shift in the anticipated sources of value gains – the most significant being LDA population growth and increases in GDP.

Strong LDA population gains are predicted for most developing alcohol markets (China is an exception), while mature markets are expected to record marginal gains or even reductions. India is expected to add 65m LDA consumers over the next five years.

While the Indian beverage alcohol market is less developed than those of mature nations, the regulatory landscape is becoming less bureaucratic in certain key states, with state governments taking a more pragmatic view on an industry that is often a significant contributor to tax revenues. Combine those two things – population growth and less regulation – and the result is really significant value growth.

In both absolute and percentage GDP growth terms, developing markets are forecast to outperform mature economies – and there is a strong correlation between this and IWSR’s beverage alcohol value growth projections.

“Because of its scale, absolute dollar growth in the US is likely to be high despite a relatively smaller GDP growth rate percentage change,” says Marten Lodewijks, President of IWSR’s US division. “But, on average, the GDP growth rates for the developing markets are 2% or maybe 3% higher than the average across the developed markets.”

He adds: “What this means is that you have a combination of an increasing population, and rising wealth, which translates into volume and value growth in those developing markets.”

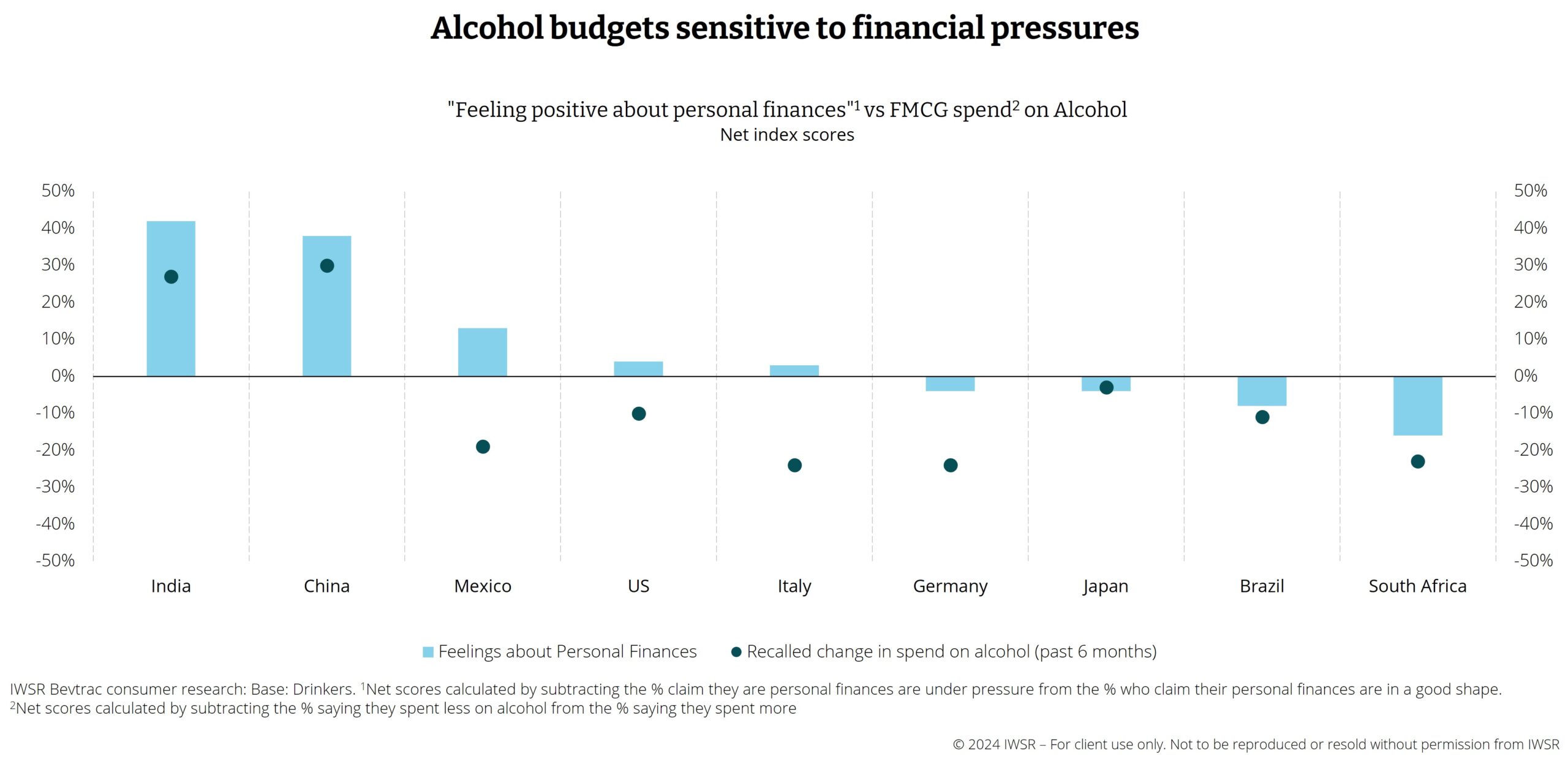

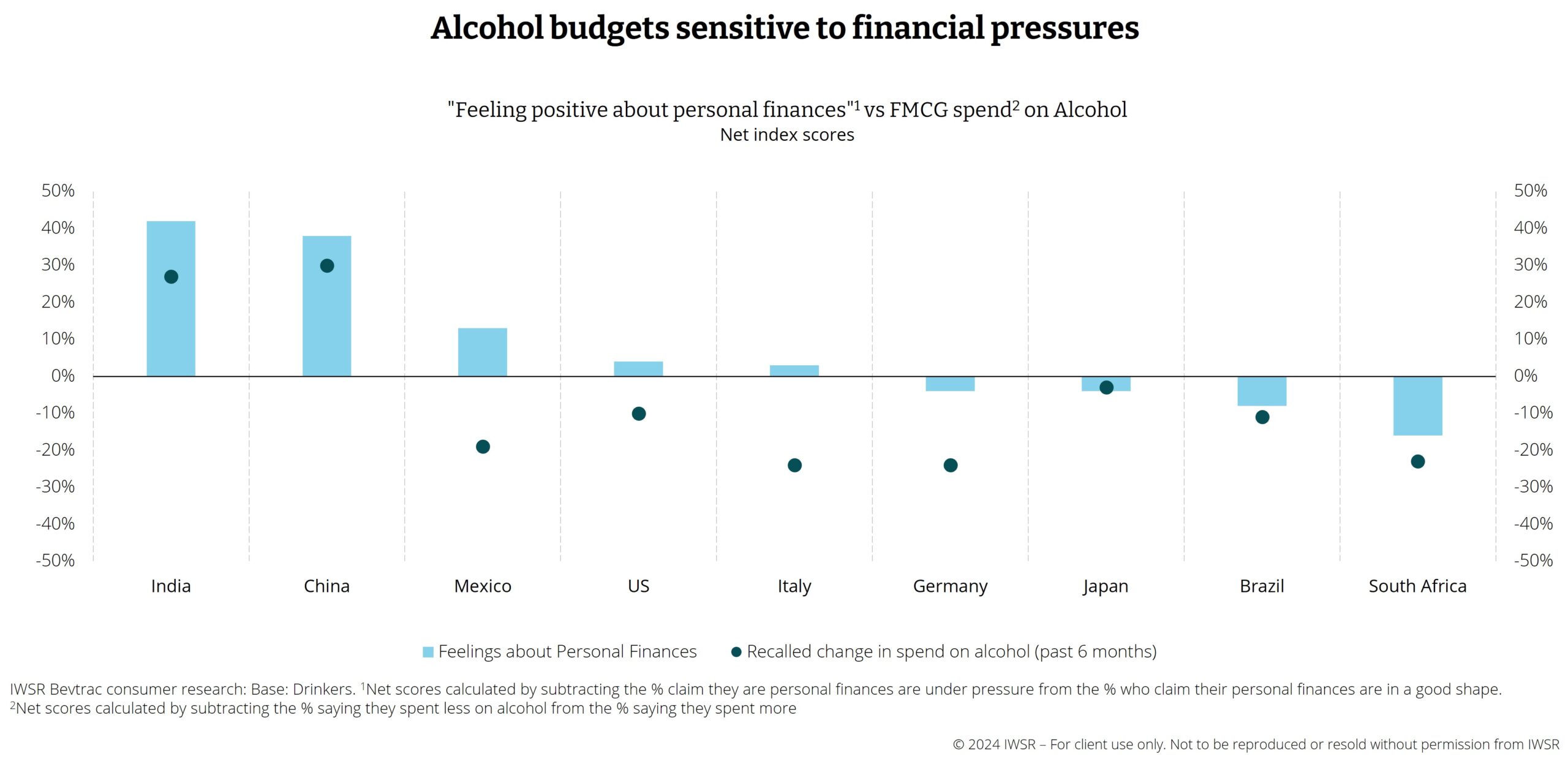

Alcohol budgets sensitive to financial pressures

In the short term, however, consumer spending power on discretionary categories is likely to be constrained by factors including inflation – which has calmed in many markets, but remains high, not least because of geopolitical tensions such as the wars in Ukraine and the Middle East. IWSR forecasts indicate that global TBA value will be essentially flat (+0.5%) in 2024, with recovery coming in 2025.

According to IWSR Bevtrac consumer research undertaken in April 2024, although sentiment about personal finances is starting to show signs of recovery, recalled spend on alcohol in the past six months remains subdued. “There is quite a strong correlation here, particularly for the mature markets,” says Richard Halstead, COO Consumer Research, IWSR. “The data suggests that increased financial control may be a precursor to recovery in alcohol spend.”

The two standouts, however, are India and China, both of which display strong positivity about personal finances, and robust gains in recalled spend on alcohol. There is a caveat, however, that scores from China typically skew strongly positive for cultural reasons. It’s also key to note that China’s recalled spend on alcohol, while still positive, started trending downward in H1 2024, fuelled by growing economic uncertainty.

“At the moment, even in the majority of markets where there is some positivity about personal finances, people are still saying that they’re spending less,” says Halstead.

In Brazil, for example, while there is optimism about future household finances, short-term financial sentiment remains net negative; recalled spend change remains net negative in all categories except whiskies. In Mexico, consumer sentiment is stable and positive, although recalled spend change remains net negative except for a few categories.

“In this context, India is an outlier. It is amongst the key value growth drivers as it is positive in terms of sentiment and intended spend,” notes Halstead.

This contrast reinforces the point that future value gains will be heavily reliant on developing markets, which tend to display higher levels of volatility and risk, and which are typically more complicated and costly for businesses to navigate.

“We are now living in a more complex, uncertain trading environment,” says Neill. “The growth axis has shifted, with value gains now coming more from developing markets, which entails higher levels of business risk. As a result, if brand owners want to orientate to the new growth markets, they will have to find a way to operate with more appetite for risk.”

To learn more about IWSR’s value data and methodology, please contact your account manager or email enquiries@theiwsr.com

The above analysis reflects IWSR data from the 2024 data release. For more in-depth data and current analysis, please get in touch.

CATEGORY: All | MARKET: All |

Interested?

If you’re interested in learning more about our products or solutions, feel free to contact us and a member of our team will get in touch with you.